- Australia

- /

- Infrastructure

- /

- ASX:ALX

How Atlas Arteria’s Executive Streamlining Could Reshape Cost Efficiency and Accountability (ASX:ALX)

Reviewed by Sasha Jovanovic

- Atlas Arteria has announced a significant restructuring of its executive team, reducing its size to four members and broadening the responsibilities of key leaders, with Vincent Portal-Barrault set to become CFO and Amanda Baxter appointed Chief Commercial Officer, both effective November 10, 2025.

- This overhaul is designed to streamline leadership, cut corporate costs, and strengthen accountability across the company’s four value-creation pillars as part of its strategy to deliver premium road infrastructure solutions.

- We'll explore how the streamlined executive structure could impact Atlas Arteria's investment narrative, especially relating to cost efficiency and accountability.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Atlas Arteria's Investment Narrative?

For Atlas Arteria shareholders, the big picture rests on long-term demand for road infrastructure and the business’s ability to consistently convert traffic growth into cash flows and distributions. With the executive overhaul now reducing the team to four, each with broader roles, Atlas Arteria is aiming for sharper cost discipline and accountability, a direct response to rising scrutiny over costs and a relatively inexperienced board. This change fits squarely into the company’s focus on efficiency, addressing one of the biggest short-term catalysts: restoring profit momentum after last year’s earnings decline. While the company recently reaffirmed its dividend guidance and reported higher revenues, profit margins have slipped and legal uncertainties in the US remain a risk. The news of a streamlined executive team could help address some cost and governance challenges, but it does not immediately resolve Atlas Arteria’s biggest risk: execution delays or regulatory setbacks affecting toll income, especially as the leadership transition unfolds.

But don’t ignore the potential impact of unresolved US legal issues on future returns.

Exploring Other Perspectives

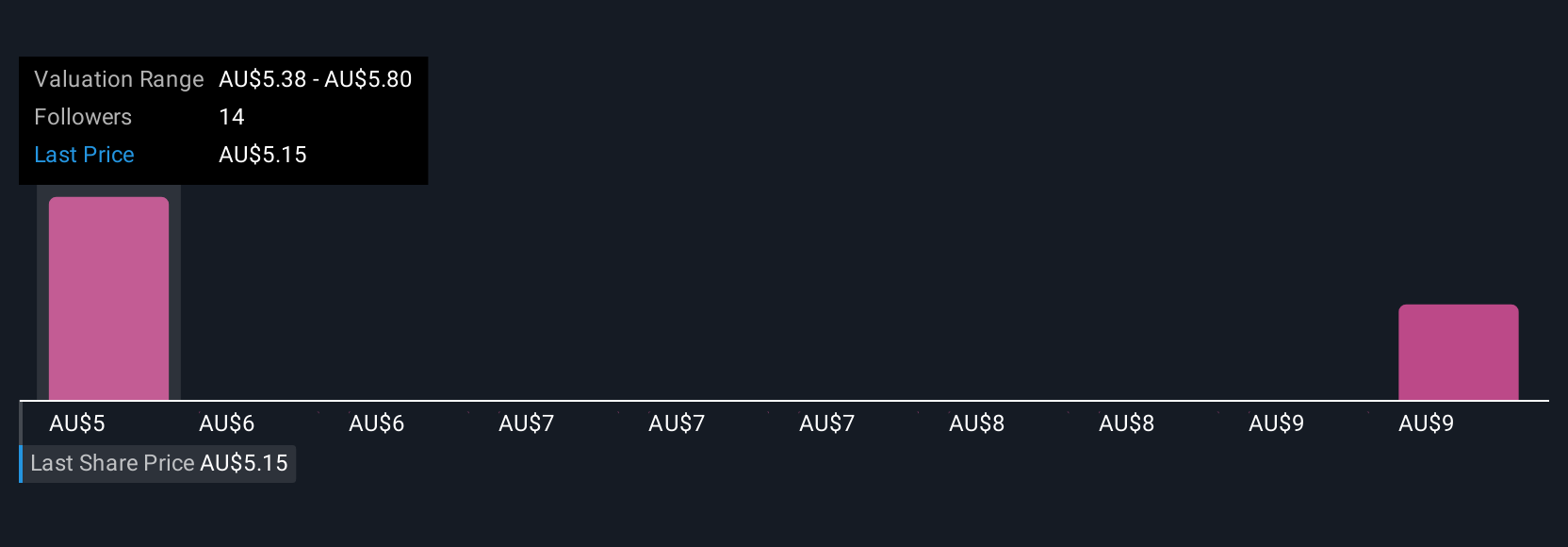

Explore 2 other fair value estimates on Atlas Arteria - why the stock might be worth over 2x more than the current price!

Build Your Own Atlas Arteria Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlas Arteria research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Atlas Arteria research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlas Arteria's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALX

Atlas Arteria

Owns, develops, and operates toll roads in France, Germany, and the United States.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion