Will a Major Equity Raise and Shareholder Dilution Change Tuas' (ASX:TUA) Growth Narrative?

Reviewed by Simply Wall St

- Tuas Limited recently completed a follow-on equity offering, raising approximately A$385.17 million through the issuance of 69,903,780 new ordinary shares at A$5.51 each.

- This sizeable capital raise introduces significant shareholder dilution, signaling both expanded funding potential and shifting investor considerations for the company.

- We'll explore how the substantial capital influx shapes Tuas Limited's investment narrative, particularly in light of increased shareholder dilution.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Tuas' Investment Narrative?

For anyone considering Tuas Limited, the latest capital raise can’t be ignored. With A$385.17 million now in hand after the follow-on equity offering, Tuas has boosted its funding options in a significant way. For investors, the big-picture belief hinges on whether this cash injection accelerates Tuas’s ability to grow revenue faster than the Australian market, or is simply a buffer for operational needs. The influx might strengthen short-term catalysts like network expansion or support moves ahead of the next earnings report, but it does also bring increased shareholder dilution into focus. Risks now shift: with new equity issued at a price well below recent highs, questions may arise over valuation and future returns for both new and existing investors. Short-term price action suggests mixed market sentiment, meaning risk and reward could be recalibrated in the wake of this dilutive funding round.

Yet, the sharp impact of dilution on future per-share earnings is a possibility worth watching.

Exploring Other Perspectives

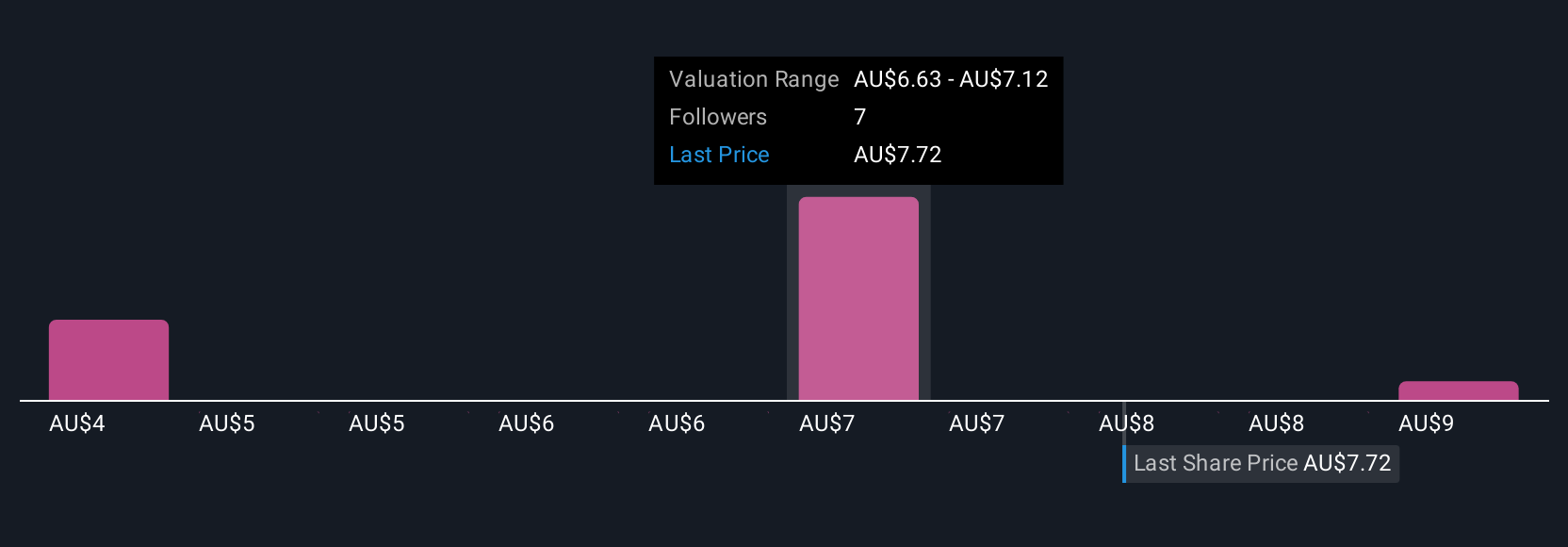

Explore 3 other fair value estimates on Tuas - why the stock might be worth 46% less than the current price!

Build Your Own Tuas Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tuas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tuas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tuas' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tuas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TUA

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives