As the Australian market shows resilience with the ASX200 closing up 0.24% at 8,145 points, sectors like IT and Real Estate are leading the charge with notable gains. In this dynamic environment, identifying hidden stock gems requires a keen eye for companies that not only demonstrate strong growth potential but also align well with current sector trends and economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

GenusPlus Group (ASX:GNP)

Simply Wall St Value Rating: ★★★★★★

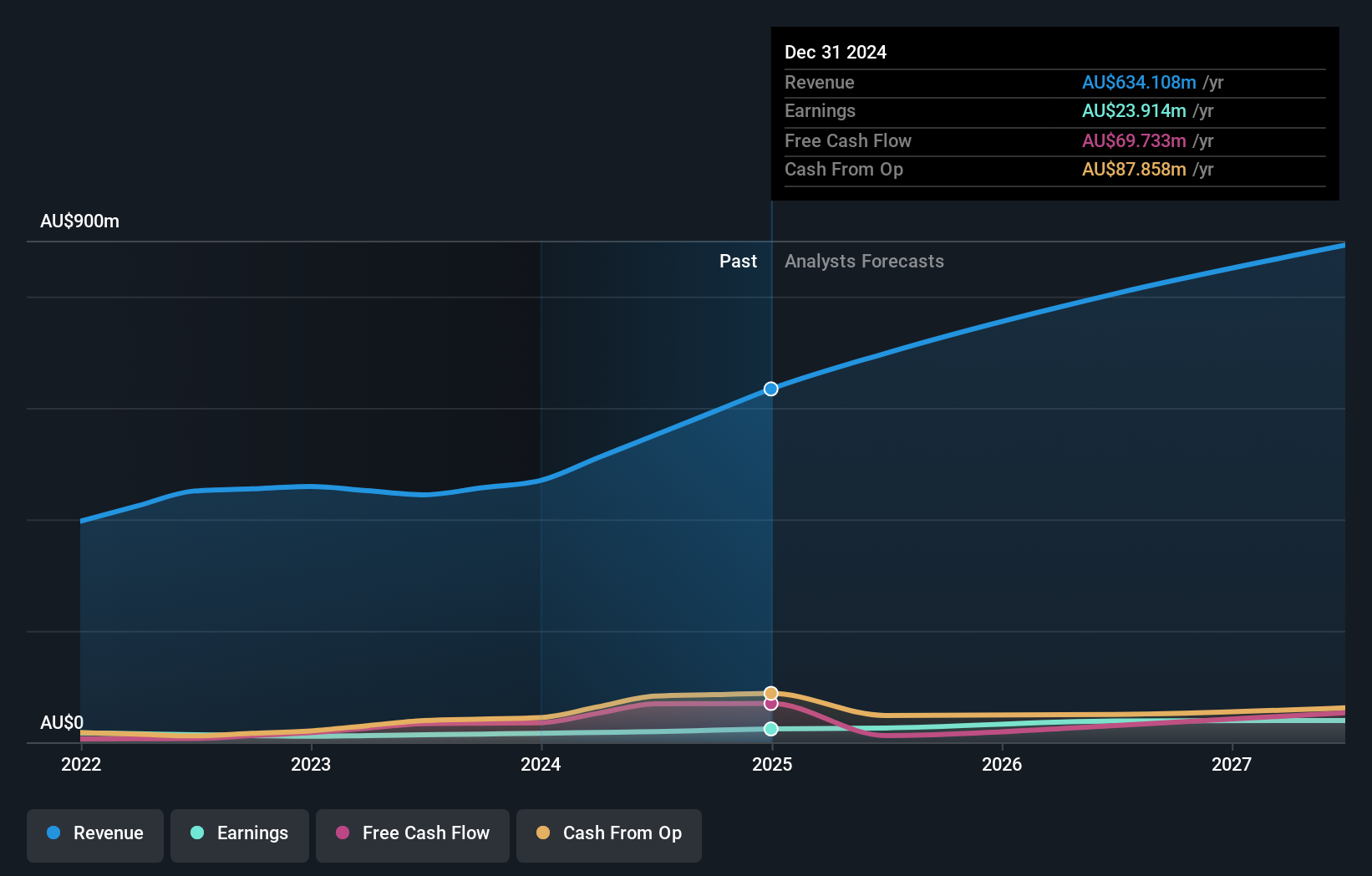

Overview: GenusPlus Group Ltd specializes in the installation, construction, and maintenance of power and communication systems across Australia with a market capitalization of A$500.92 million.

Operations: GenusPlus Group Ltd generates revenue primarily from its Infrastructure segment at A$372.42 million, followed by the Industrial and Communication segments contributing A$187.56 million and A$86.02 million, respectively.

GenusPlus Group, a dynamic player in the Australian market, has seen its debt to equity ratio drop from 10.3% to 2.6% over five years, showcasing effective financial management. The company's earnings surged by 48.7% last year, outpacing the construction sector's growth of 28.7%, hinting at strong operational performance and market positioning. Despite significant insider selling recently, GenusPlus is trading at a notable discount of 26.3% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in this space. With high-quality earnings and free cash flow positivity, it seems well-positioned for future growth prospects.

- Click to explore a detailed breakdown of our findings in GenusPlus Group's health report.

Explore historical data to track GenusPlus Group's performance over time in our Past section.

Qualitas (ASX:QAL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qualitas is a real estate investment firm specializing in direct investments across various real estate classes and geographies, distressed debt restructuring, third-party capital raisings, and consulting services, with a market cap of A$727.78 million.

Operations: Qualitas generates revenue primarily from direct lending, contributing A$23.03 million, and funds management, adding A$21.46 million.

Qualitas, a nimble player in the real estate investment space, has seen its fee-earning funds under management jump by 41%, which is likely to boost management fee revenue. With a debt-to-equity ratio now at 10.7% from over 1000% five years ago, it shows improved financial health. The company's EBIT covers interest payments comfortably at 3.5 times, indicating robust earnings quality. While earnings have grown annually by about 21.6% over five years, competition and reliance on the residential sector—85% of deployment—pose risks despite projected profit margin growth from 27.6% to an expected 35.3%.

Tuas (ASX:TUA)

Simply Wall St Value Rating: ★★★★★★

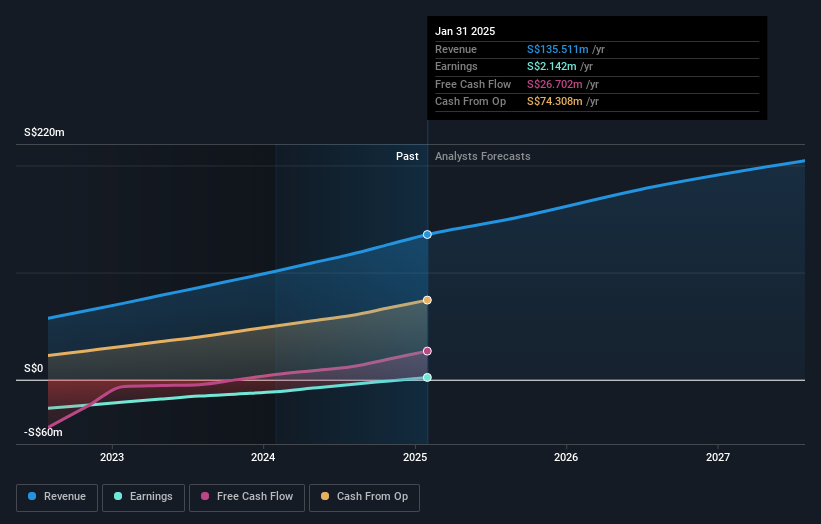

Overview: Tuas Limited owns and operates a mobile network in Singapore with a market capitalization of A$2.63 billion.

Operations: The company generates revenue primarily from its mobile operations, amounting to SGD 135.51 million.

Tuas has shown promising strides, achieving profitability with net income of SGD 3.02 million for the half-year ending January 2025, a significant turnaround from a SGD 3.5 million loss previously. The telecom player reported sales of SGD 73.16 million, up from SGD 54.72 million year-on-year, indicating robust growth in operations. Free cash flow turned positive at A$19.35 million as of October 2024, reflecting improved financial health without debt concerns clouding its horizon. With revenue forecasted to grow by over 16% annually and high-quality earnings on record, Tuas seems poised for further expansion in the competitive telecom industry landscape.

- Delve into the full analysis health report here for a deeper understanding of Tuas.

Gain insights into Tuas' historical performance by reviewing our past performance report.

Where To Now?

- Get an in-depth perspective on all 51 ASX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tuas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TUA

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives