Investors Holding Back On Field Solutions Holdings Limited (ASX:FSG)

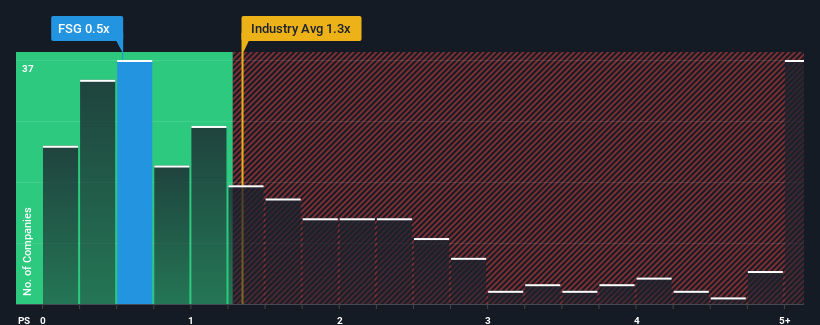

Field Solutions Holdings Limited's (ASX:FSG) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Telecom industry in Australia have P/S ratios greater than 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Field Solutions Holdings

What Does Field Solutions Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Field Solutions Holdings has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Field Solutions Holdings will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Field Solutions Holdings?

The only time you'd be truly comfortable seeing a P/S as low as Field Solutions Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 24% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 6.4%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Field Solutions Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Field Solutions Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Field Solutions Holdings you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FSG

Field Solutions Holdings

A telecommunications carrier and technology company, provides connectivity and business solutions for rural, regional, and remote areas in Australia.

Undervalued moderate.