Why NOVONIX (ASX:NVX) Is Up 62.1% After Delivering First Mass Production Synthetic Graphite Sample

Reviewed by Sasha Jovanovic

- In late September 2025, NOVONIX Limited announced the delivery of its first mass production, commercial-grade synthetic graphite sample for industrial applications to a leading North American carbon processor for final qualification.

- This milestone showcases NOVONIX’s ability to enter the industrial-grade synthetic graphite market quickly, offering a shorter qualification timeline than for battery-grade products.

- We’ll explore how NOVONIX’s rapid move into industrial-grade synthetic graphite shapes its broader investment narrative and market positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is NOVONIX's Investment Narrative?

For anyone weighing an investment in NOVONIX, the broader belief hinges on whether the company can successfully move from R&D and pilot production into sustained, profitable large-scale manufacturing amid the rapidly evolving synthetic graphite market. The recent delivery of its first commercial-grade, industrial synthetic graphite sample stands out as a real-world step toward that goal and could accelerate key short-term catalysts, most notably, the timeline for securing new supply agreements and hitting annual production targets at the new Riverside facility. After months of share price underperformance, this progress has given the stock a strong boost and has the potential to reshape perceptions about near-term growth prospects. However, it’s important to acknowledge that NOVONIX remains unprofitable and dilute for current shareholders, with its ambitious scale-up still facing execution, qualification, and funding risks. The headline success doesn’t erase those underlying challenges, but it does shorten the path to meaningful revenues and addresses some investor concerns around viability and market timing.

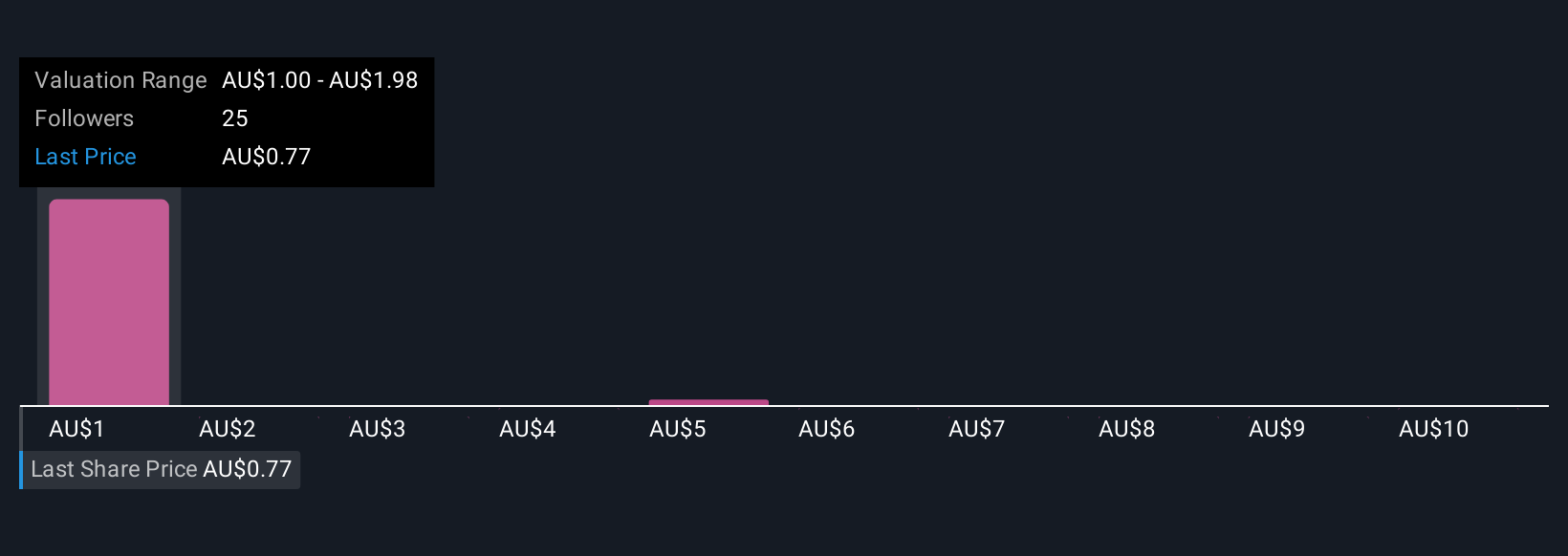

But against all this optimism, there’s still the question of whether NOVONIX can achieve consistent profitability soon enough to justify its current valuation. Our comprehensive valuation report raises the possibility that NOVONIX is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 8 other fair value estimates on NOVONIX - why the stock might be a potential multi-bagger!

Build Your Own NOVONIX Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NOVONIX research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NOVONIX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NOVONIX's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NOVONIX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NVX

NOVONIX

A battery technology and materials company, provides products and mission critical services in North America, Asia, Australia, and Europe.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)