Capital Injection and BNY Mellon's Larger Stake Could Be a Game Changer for NOVONIX (ASX:NVX)

Reviewed by Sasha Jovanovic

- Earlier this week, NOVONIX Limited announced the issuance of 48,044,482 new shares on the Australian Securities Exchange after the conversion of convertible debentures to strengthen its capital structure and position in the battery materials sector.

- BNY Mellon’s recent move to increase its holding in NOVONIX from 8% to 10% illustrates growing international institutional interest, especially from US investors using the ADR system.

- We'll explore how BNY Mellon's heightened stake and the share issuance influence NOVONIX's investment narrative and global investor appeal.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is NOVONIX's Investment Narrative?

For anyone following NOVONIX, the big-picture story has always centered on its ambition to supply the growing lithium-ion battery market, especially with key offtake and supply agreements targeting North American manufacturers. The recent share issuance after debenture conversion was a move to reinforce its balance sheet, addressing concerns about financial sustainability in light of prior losses and a recent auditor note on going concern risks. BNY Mellon's increased stake, meanwhile, is a signal that global institutional players are paying attention, although the 22% share price drop suggests that liquidity and short-term profit-taking remain top of mind for many shareholders. Looking ahead, immediate catalysts like ramping commercial supply for Panasonic and Stellantis and advancing US manufacturing plans remain in focus, but any dilution and ongoing losses could temper these positives if financial pressures persist. Much of this recent news doesn’t immediately shift the key risks or near-term catalysts, but it does prompt a closer look at how capital structure and market volatility might influence NOVONIX's ability to execute its strategy.

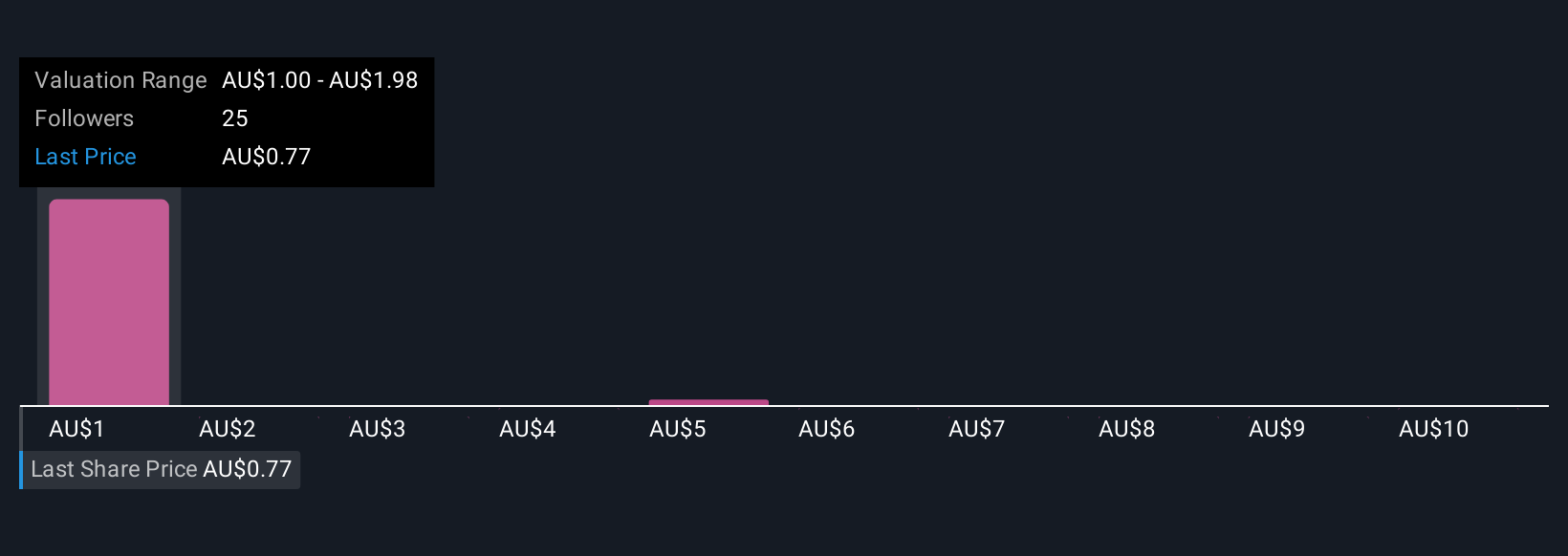

But while expansion plans are promising, recent dilution is a risk every investor should consider. Our valuation report here indicates NOVONIX may be overvalued.Exploring Other Perspectives

Explore 8 other fair value estimates on NOVONIX - why the stock might be worth just A$1.00!

Build Your Own NOVONIX Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NOVONIX research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NOVONIX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NOVONIX's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NOVONIX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NVX

NOVONIX

A battery technology and materials company, provides products and mission critical services in North America, Asia, Australia, and Europe.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion