Elsight (ASX:ELS): Assessing Valuation After Record Revenue and First-Ever Profitability Announcement

Reviewed by Simply Wall St

Elsight (ASX:ELS) has just announced its highest-ever quarterly revenue and, for the first time, achieved profitability. This milestone follows growth in both the defense and commercial segments, as well as increased visibility from key index inclusion.

See our latest analysis for Elsight.

Elsight’s latest record results have caught the market’s attention, reflected in a sharp 13.94% share price gain in one day. While the stock is off its recent highs, the impressive 276% year-to-date price return and 177% total shareholder return in the past year point to building momentum and renewed optimism for both short-term and long-term investors.

If you’re watching this surge and wondering what other high-potential tech names are out there, the logical next move is to check See the full list for free..

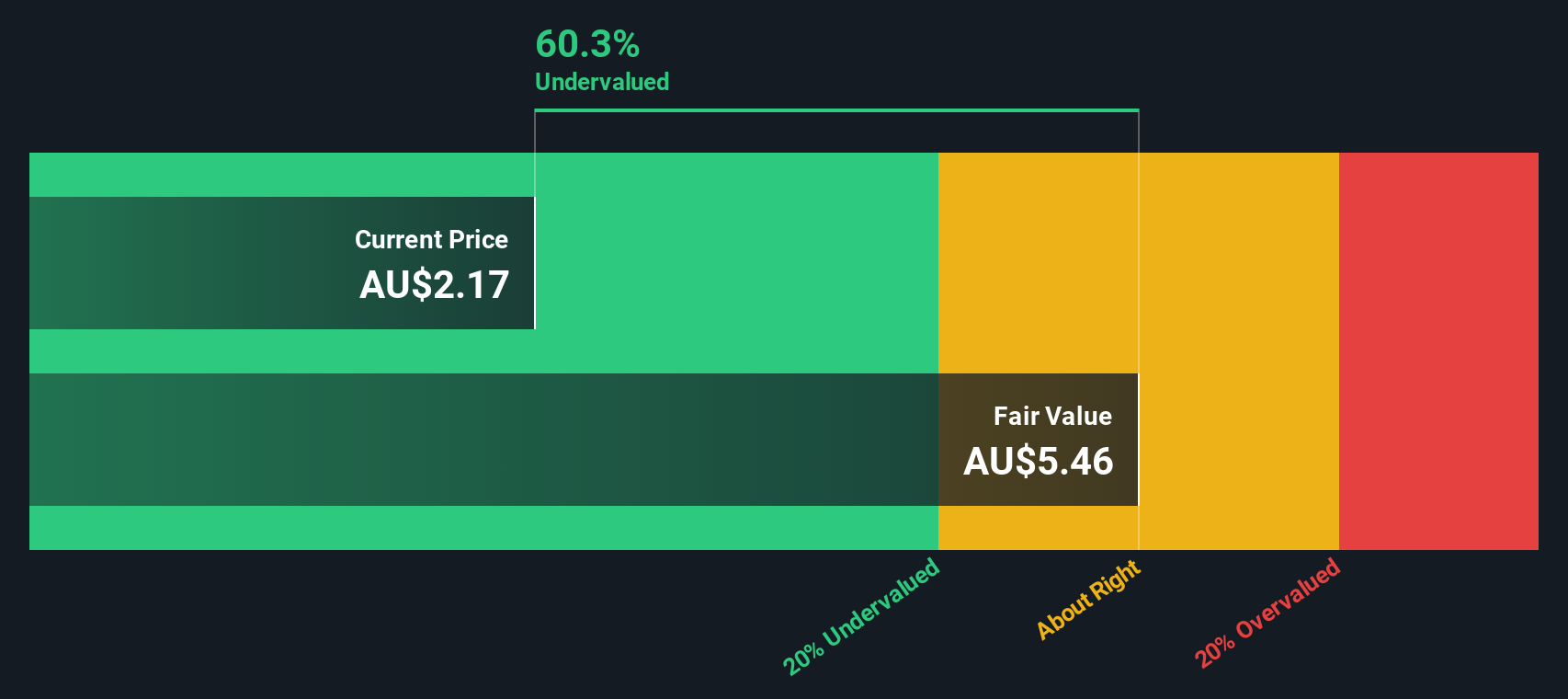

With such standout financials and rapid gains, the big question is whether Elsight’s current share price still undervalues its recent achievements, or if investors have already factored in all the future growth. Could there be further upside, or is the opportunity already passed?

Price-to-Sales of 35.4x: Is it justified?

Elsight’s current price-to-sales ratio stands at 35.4x, substantially above both the global electronics industry average and its direct peers. Despite recent financial milestones, the market is attributing a hefty premium compared to similar companies.

The price-to-sales (P/S) ratio measures how much investors are paying for each dollar of sales. This can be especially useful for growth firms that may not yet be profitable but are rapidly expanding their top line. In sectors like technology, high P/S multiples can hint at optimism about future growth or, conversely, raise the possibility of over-exuberance.

At 35.4x, Elsight trades at nearly twenty times the industry average P/S of 1.8x and more than double its peer average. This level suggests the market is pricing in continued explosive growth, but it also exposes investors to the risk of sharp corrections if expectations are not met. Compared to an estimated fair P/S ratio of 20x, the current multiple looks stretched and vulnerable to revision if momentum fades.

Explore the SWS fair ratio for Elsight

Result: Price-to-Sales of 35.4x (OVERVALUED)

However, rapid sales growth could slow or profit momentum could falter, prompting investors to quickly reassess Elsight’s premium valuation.

Find out about the key risks to this Elsight narrative.

Another View: What Does the SWS DCF Model Say?

While the market’s sky-high price-to-sales ratio suggests enthusiasm may have run ahead of fundamentals, our DCF model presents a different perspective. According to the SWS DCF analysis, Elsight is trading well above its estimated fair value of A$0.89, making the current price appear overvalued on a discounted cash flow basis. Does this challenge the optimistic growth outlook, or is there more to the story that numbers alone cannot capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elsight for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elsight Narrative

If you have your own perspective, want to dig deeper, or simply enjoy hands-on analysis, it's quick and easy to craft your own take. Do it your way.

A great starting point for your Elsight research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock the full power of Simply Wall Street's Screener to spot companies the market often overlooks. Miss these opportunities today and someone else will seize them tomorrow.

- Boost your passive income by checking out these 19 dividend stocks with yields > 3% offering strong yields and reliability above 3%.

- Ride the next tech wave when you tap into these 27 AI penny stocks which are poised to disrupt industries with artificial intelligence.

- Uncover hidden bargains now by reviewing these 874 undervalued stocks based on cash flows that stand out for exceptional value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elsight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELS

Elsight

Provides connectivity solutions in Israel, the United States, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)