Top Undervalued Small Caps With Insider Action For August 2024

Reviewed by Simply Wall St

The Australian market has climbed 2.1% in the last 7 days, with a gain of 2.4%, and is up 11% over the last 12 months, with earnings forecast to grow by 13% annually. In this favorable environment, identifying small-cap stocks that show significant insider action can be a promising strategy for investors seeking undervalued opportunities.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Growthpoint Properties Australia | NA | 5.5x | 27.62% | ★★★★★☆ |

| Servcorp | 12.1x | 1.5x | 6.42% | ★★★★☆☆ |

| Eagers Automotive | 9.7x | 0.3x | 44.03% | ★★★★☆☆ |

| MFF Capital Investments | 5.0x | 3.4x | 45.37% | ★★★★☆☆ |

| Elders | 22.7x | 0.5x | 49.59% | ★★★★☆☆ |

| Neuren Pharmaceuticals | 12.4x | 8.4x | -46.80% | ★★★★☆☆ |

| Codan | 32.1x | 4.7x | 22.56% | ★★★★☆☆ |

| Dicker Data | 23.0x | 0.8x | 6.92% | ★★★☆☆☆ |

| Coventry Group | 244.6x | 0.4x | -18.80% | ★★★☆☆☆ |

| RAM Essential Services Property Fund | NA | 6.0x | 42.69% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is an Australian company specializing in the design and manufacture of communications, metal detection, and mining technology solutions with a market cap of approximately A$1.08 billion.

Operations: Codan generates revenue primarily from product sales, with notable figures including A$510.57 million in the latest period. The company's gross profit margin has shown variability, reaching 54.42% recently. Operating expenses and non-operating expenses are significant cost components, impacting net income margins which have been around 14.67%.

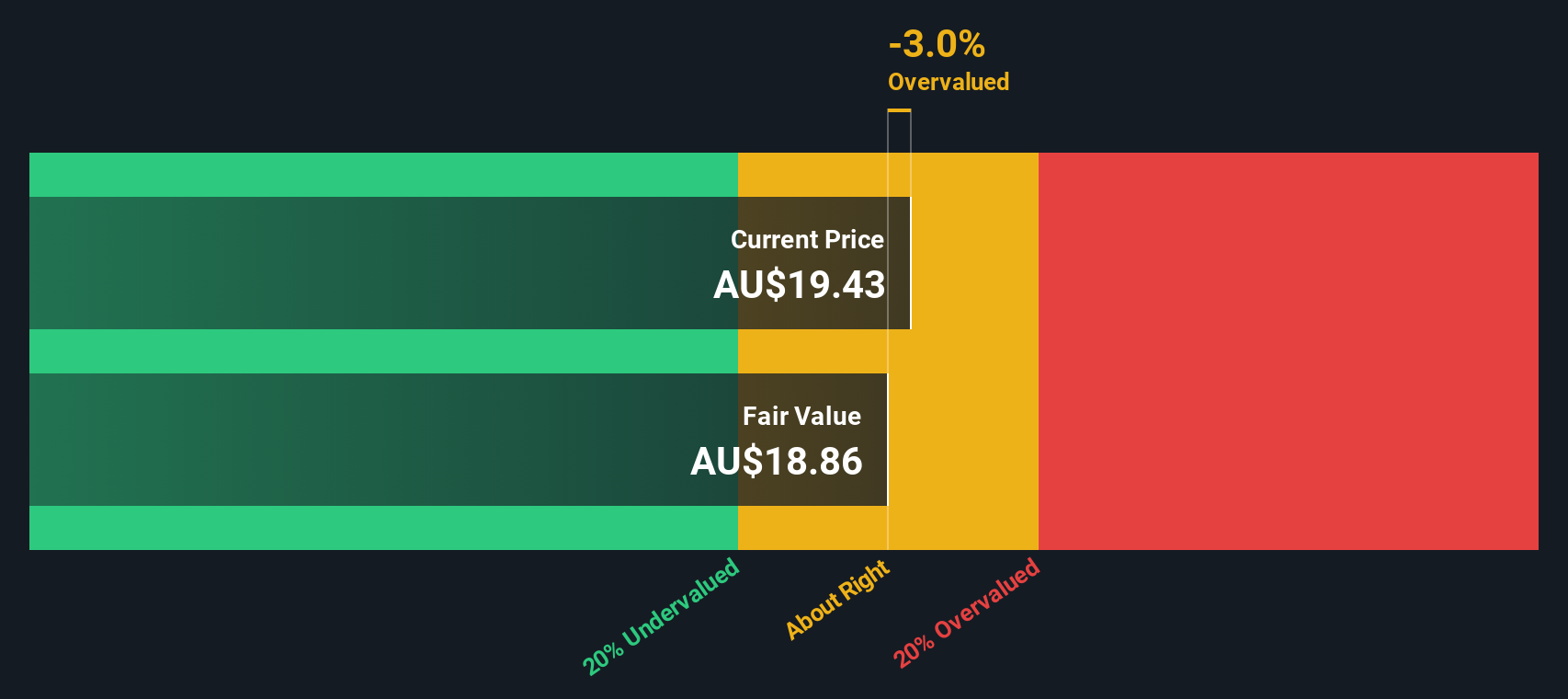

PE: 32.1x

Codan, a small cap in Australia, reported full-year 2024 earnings with sales of A$550.5 million, up from A$456.5 million the previous year, and net income rising to A$81.3 million from A$67.7 million. This growth reflects strong operational performance despite higher risk funding through external borrowing. Insider confidence is evident with recent share purchases by executives in July 2024. With earnings forecasted to grow by 15.1% annually, Codan shows promising potential for investors seeking undervalued opportunities in the market.

- Unlock comprehensive insights into our analysis of Codan stock in this valuation report.

Gain insights into Codan's historical performance by reviewing our past performance report.

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is an Australian wholesale distributor specializing in computer peripherals, with a market cap of approximately A$1.91 billion.

Operations: The company generates revenue primarily from wholesale computer peripherals, with recent figures reaching A$2.27 billion. The cost of goods sold (COGS) was A$1.94 billion, resulting in a gross profit of A$322.61 million and a gross profit margin of 14.23%. Operating expenses stood at A$186.77 million, while net income was recorded at A$82.15 million with a net income margin of 3.62%.

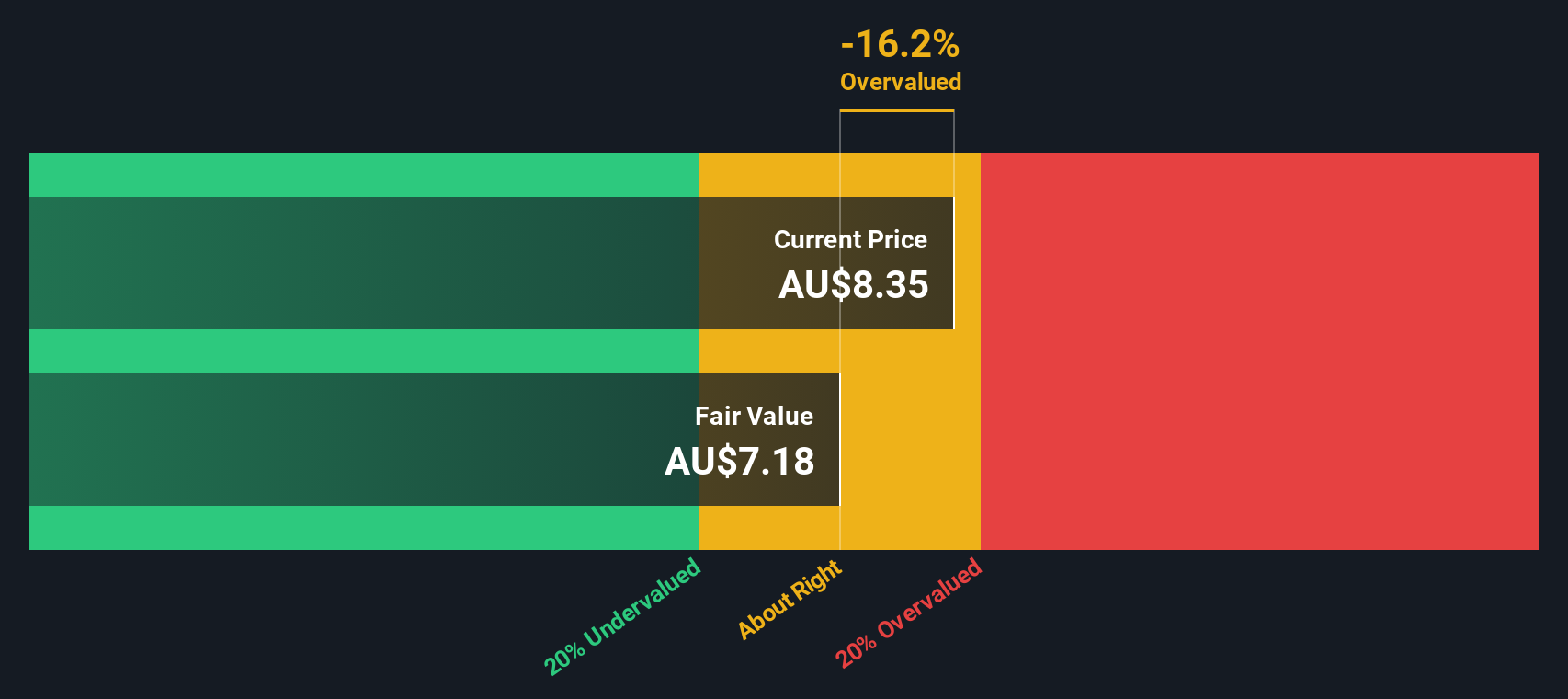

PE: 23.0x

Dicker Data, a small Australian tech distributor, recently declared a fully franked dividend of A$0.11 per share for Q2 2024, with an ex-div date of August 15. Insider confidence is evident as key individuals have been purchasing shares throughout the past year. Despite higher risk due to reliance on external borrowing, the company is in a solid financial position and forecasts earnings growth of 7.83% annually, suggesting potential for future value appreciation.

- Get an in-depth perspective on Dicker Data's performance by reading our valuation report here.

Understand Dicker Data's track record by examining our Past report.

Growthpoint Properties Australia (ASX:GOZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Growthpoint Properties Australia is a real estate investment trust that owns and manages a diversified portfolio of industrial and office properties across Australia with a market cap of approximately A$3.20 billion.

Operations: The company's primary revenue stream is derived from its operations, with significant gross profit margins observed over the periods. Gross profit margin has ranged between 83.39% and 87.51%. Operating expenses and non-operating expenses are notable cost components impacting net income, with recent periods showing substantial non-operating expenses leading to negative net income margins.

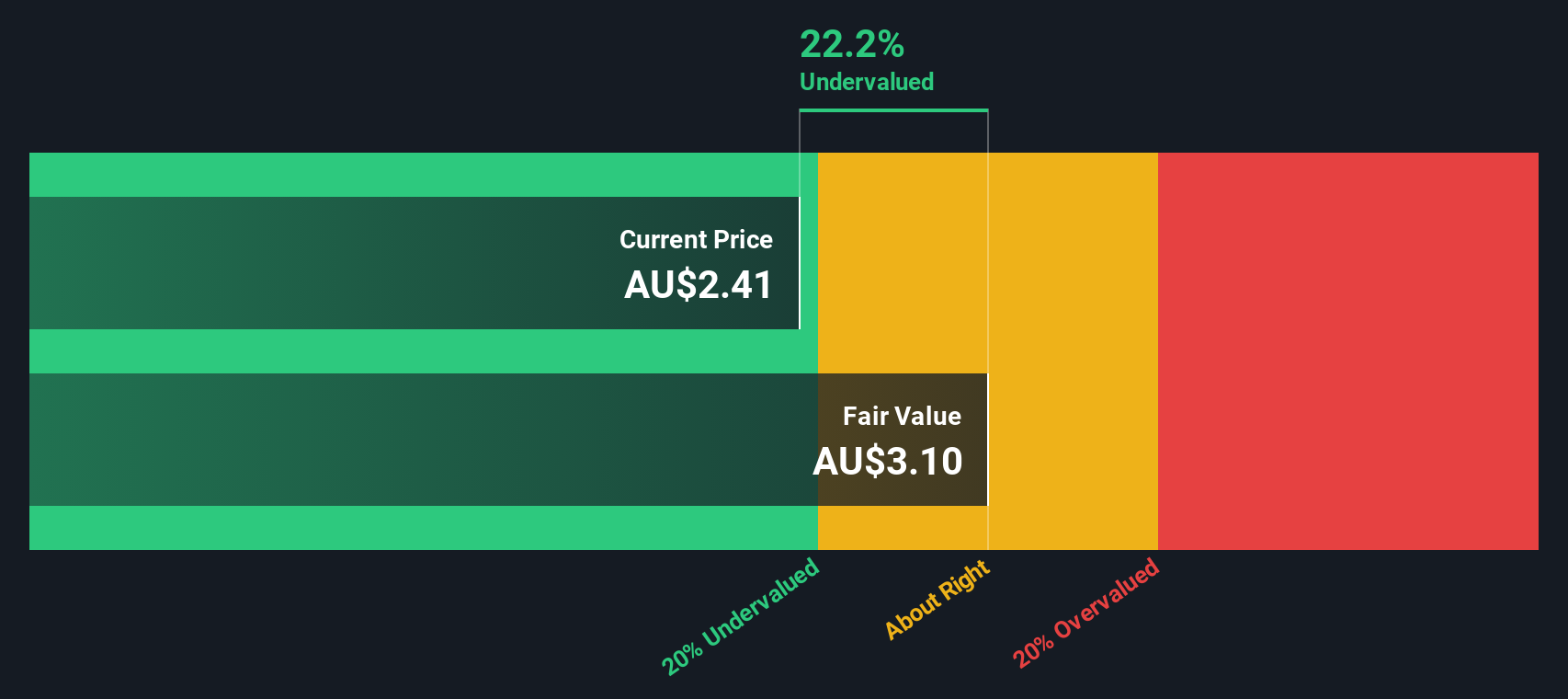

PE: -6.1x

Growthpoint Properties Australia, a smaller player in the Australian market, recently reported earnings for the year ending June 30, 2024. Sales were A$313.7 million, slightly down from A$325.3 million the previous year. Revenue also dipped to A$332.4 million from A$342.7 million, while net loss widened to A$298.2 million compared to last year's A$245.6 million loss. Despite these figures, insider confidence remains strong with notable purchases by executives in recent months indicating potential future growth and value realization.

Taking Advantage

- Delve into our full catalog of 14 Undervalued ASX Small Caps With Insider Buying here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GOZ

Growthpoint Properties Australia

Growthpoint provides space for you and your business to thrive.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives