Xero (ASX:XRO) Sees Revenue Growth with Syft Analytics Acquisition and U.K. Regulatory Tailwinds

Reviewed by Simply Wall St

Xero (ASX:XRO) continues to demonstrate its strong market position with a 25% increase in revenue to $996 million and a 52% rise in adjusted EBITDA, driven by significant growth in Australia and the U.K. The recent acquisition of Syft Analytics and expansion in payments highlight Xero's strategic focus on innovation and diversification, despite challenges such as a low ROE and high valuation concerns. This report explores Xero's competitive advantages, vulnerabilities, emerging market opportunities, and regulatory challenges, offering a comprehensive analysis of its current and future prospects.

Unlock comprehensive insights into our analysis of Xero stock here.

Competitive Advantages That Elevate Xero

With a forecasted revenue growth of 14.4% annually, Xero is outpacing the Australian market average of 5.8%, underscoring its strong market position. The company's recent financial performance, highlighted by a 25% increase in revenue to $996 million and a 52% rise in adjusted EBITDA to $312 million, demonstrates solid profitability. This financial health is further supported by a Rule of 40 outcome of 43.9%, showcasing operational efficiency. Sukhinder Singh Cassidy, CEO, emphasized that regions like Australia and the U.K. have contributed significantly, with revenue growth of 27% and 26% respectively, indicating Xero's ability to capture growth across various markets. The strategic focus on product innovation, as seen in the successful launch of new features at Xerocon events, continues to bolster its competitive edge.

Vulnerabilities Impacting Xero

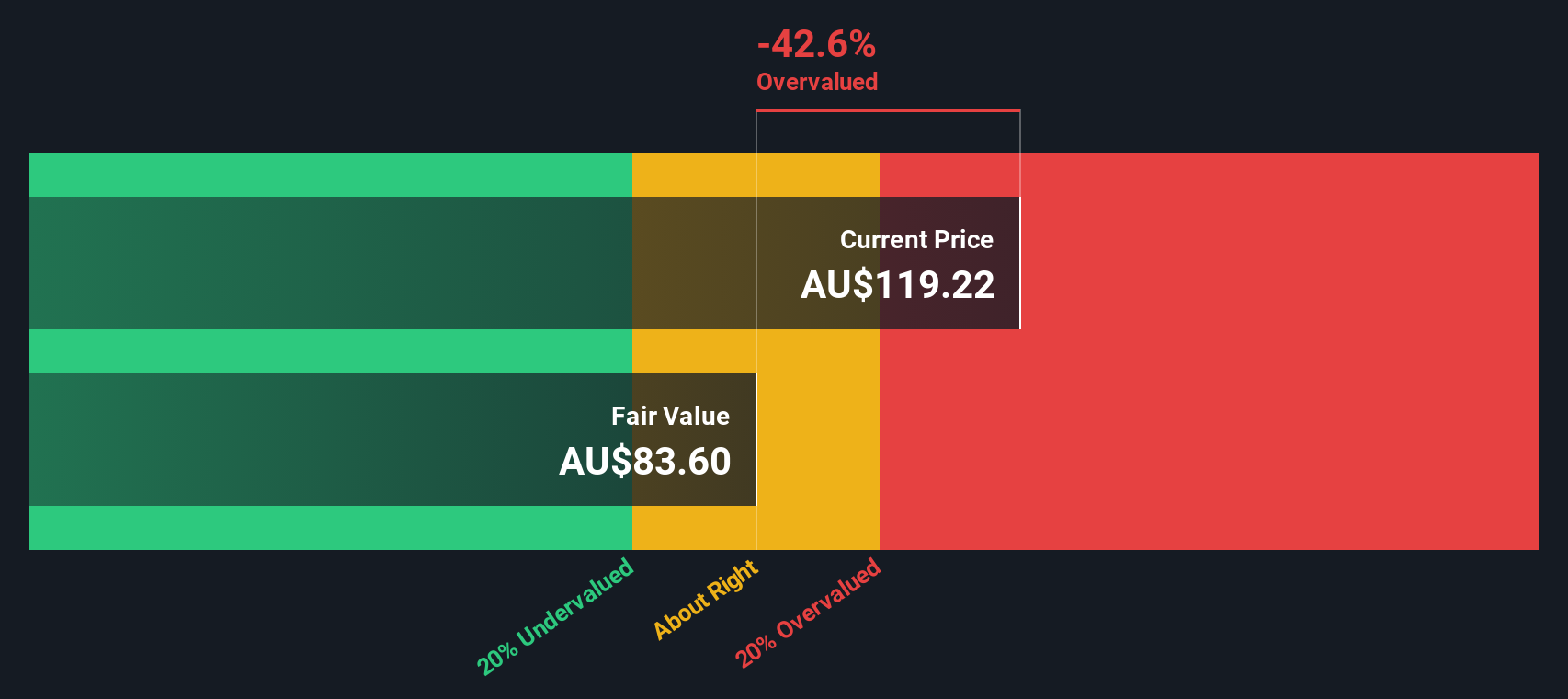

Despite its financial strengths, Xero faces challenges with a low return on equity (ROE) of 11.4%, which is expected to remain under the industry threshold at 19.3% over the next three years. The company's valuation, trading above its estimated fair value with a high Price-To-Earnings Ratio of 132.2x compared to industry averages, suggests potential overvaluation. This could pose risks if market conditions shift unfavorably. Additionally, the increase in share-based compensation to 9% of sales, as noted by CFO Kirsty Godfrey-Billy, highlights rising costs that could impact profitability if not managed effectively. The need for restructuring, which included $31 million in redundancy payments, points to past inefficiencies that may affect short-term stability.

Emerging Markets Or Trends for Xero

Opportunities abound for Xero, particularly with its expansion in payments and platform revenue, which grew by 28% and now accounts for 11% of operating revenues. This diversification is crucial for enhancing revenue streams. The acquisition of Syft Analytics, a cloud-based reporting platform, is set to enhance Xero's analytics capabilities, offering more value to customers and opening new market opportunities. Regulatory changes in the U.K., such as the confirmation of MTD Phase 3, are expected to drive further subscriber growth, providing a tailwind for Xero's market expansion.

Regulatory Challenges Facing Xero

Economic headwinds remain a concern, with potential downturns in key markets possibly impacting growth. Kirsty Godfrey-Billy highlighted the importance of monitoring these conditions through internal metrics like Xero Small Business Insights. Competitive pressures from established players like Intuit, which charges per user, could challenge Xero's pricing strategy and market share. Additionally, the execution risks associated with new product launches and strategic initiatives require careful management to ensure they translate into revenue growth, as noted by Sukhinder Singh Cassidy. These factors underline the need for strategic agility in navigating competitive pressures.

Conclusion

Xero's strong market position is reinforced by its impressive revenue growth and operational efficiency, as evidenced by a 25% increase in revenue and a 52% rise in adjusted EBITDA. However, challenges such as a low return on equity and high Price-To-Earnings Ratio suggest that the stock may not align with its intrinsic value, which could be problematic if market conditions change. Despite these challenges, Xero's strategic expansion into payments and analytics, coupled with regulatory tailwinds in the U.K., presents significant growth opportunities. The company's ability to navigate competitive pressures and manage costs effectively will be crucial in translating these opportunities into sustainable long-term performance.

Next Steps

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:XRO

Xero

A software as a service company, provides online business solutions for small businesses and their advisors in Australia, New Zealand, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives