We note that a SOCO Corporation Ltd (ASX:SOC) insider, Carlo Liviani, recently sold AU$77k worth of stock for AU$0.10 per share. On the bright side, that's just a small sale and only reduced their holding by 4.1%.

View our latest analysis for SOCO

The Last 12 Months Of Insider Transactions At SOCO

Notably, that recent sale by Carlo Liviani is the biggest insider sale of SOCO shares that we've seen in the last year. That means that an insider was selling shares at around the current price of AU$0.10. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

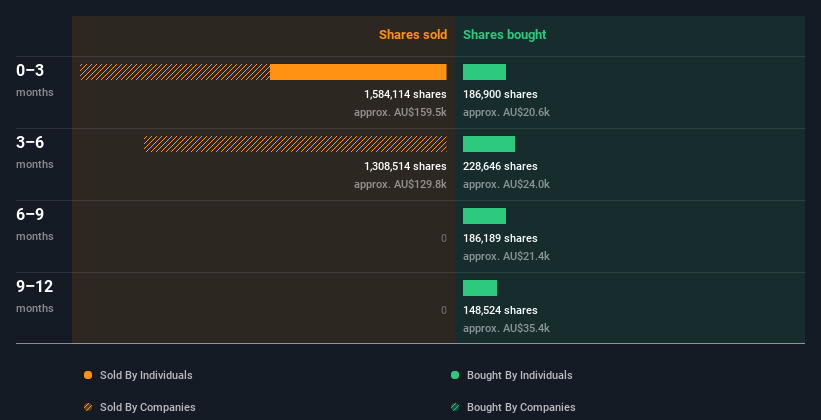

Over the last year, we can see that insiders have bought 750.26k shares worth AU$100k. On the other hand they divested 762.00k shares, for AU$77k. In the last twelve months there was more buying than selling by SOCO insiders. Their average price was about AU$0.13. I'd consider this a positive as it suggests insiders see value at around the current price. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Does SOCO Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 32% of SOCO shares, worth about AU$4.4m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

What Might The Insider Transactions At SOCO Tell Us?

The insider sales have outweighed the insider buying, at SOCO, in the last three months. In contrast, they appear keener if you look at the last twelve months. And insiders do own shares. So we're happy enough to look past some selling. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. At Simply Wall St, we've found that SOCO has 5 warning signs (3 don't sit too well with us!) that deserve your attention before going any further with your analysis.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SOC

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives