The one-year decline in earnings for ReadyTech Holdings ASX:RDY) isn't encouraging, but shareholders are still up 84% over that period

It's been a soft week for ReadyTech Holdings Limited (ASX:RDY) shares, which are down 10%. But that doesn't change the reality that over twelve months the stock has done really well. To wit, it had solidly beat the market, up 84%.

While the stock has fallen 10% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for ReadyTech Holdings

We don't think that ReadyTech Holdings' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

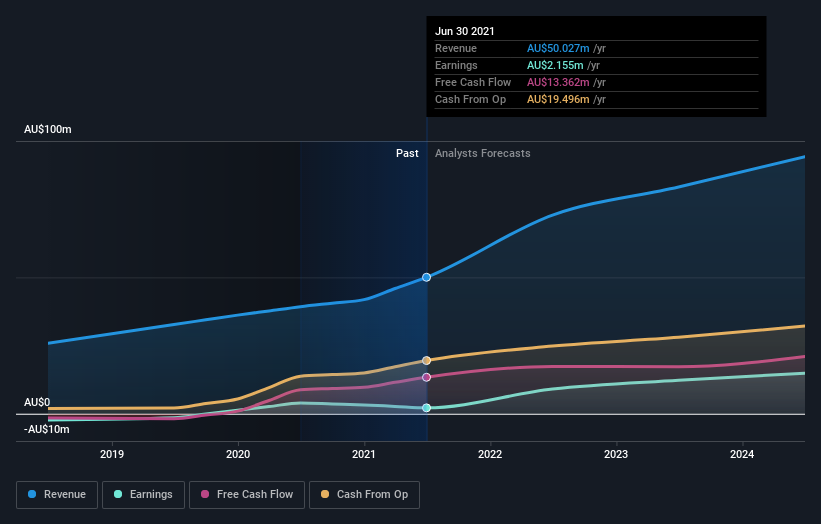

ReadyTech Holdings grew its revenue by 27% last year. We respect that sort of growth, no doubt. Buyers pushed the share price 84% in response, which isn't unreasonable. If revenue stays on trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling ReadyTech Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's nice to see that ReadyTech Holdings shareholders have gained 84% over the last year. A substantial portion of that gain has come in the last three months, with the stock up 18% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand ReadyTech Holdings better, we need to consider many other factors. Even so, be aware that ReadyTech Holdings is showing 4 warning signs in our investment analysis , you should know about...

ReadyTech Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:RDY

ReadyTech Holdings

Provides technology-based solutions in Australia and New Zealand, the United Kingdom, and the United States of America.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026