Megaport (ASX:MP1) Valuation in Focus Following Global Network Expansion With SharonAI Partnership

Reviewed by Kshitija Bhandaru

Megaport (ASX:MP1) just announced a collaboration with SharonAI Inc., expanding its global network to provide private cloud connectivity for enterprise, government, and research clients across more than a thousand data centers in 26 countries.

See our latest analysis for Megaport.

Megaport’s latest partnership is just the most recent in a line of strategic moves that has fueled remarkable market momentum. The impressive year-to-date share price return of 100.1% reflects renewed optimism around growth and network expansion. While short-term volatility remains, the one-year total shareholder return of 98% underscores both the stock’s resilience and investors’ shifting appetite for high-growth tech infrastructure.

Curious to see what other dynamic growth stories are out there? Don’t miss the opportunity to discover fast growing stocks with high insider ownership

With shares up sharply and analyst targets not far above the current price, the question now is whether Megaport’s strong momentum leaves more room for upside or if investors are already paying for future growth.

Most Popular Narrative: Fairly Valued

Megaport’s last close price sits just below the consensus narrative's fair value. With the market treading close to analyst assumptions, the story turns to what could drive the next move.

Heavy upfront investment in go-to-market and engineering capabilities, particularly in the US and key growth markets, is likely to yield significant operating leverage over the next 18-24 months as these investments mature. This is expected to enable revenue growth to outpace cost increases and drive EBITDA margin expansion.

Want to know what bold expectations underlie that price target? Discover which ambitious revenue and margin projections form the basis of this valuation. Learn why analysts see so much future potential hinging on operating leverage. Click through to uncover the full set of narrative assumptions.

Result: Fair Value of $15.17 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger competition or the possibility that major cloud vendors exclude independent players could easily undermine Megaport’s impressive growth trajectory and optimistic forecasts.

Find out about the key risks to this Megaport narrative.

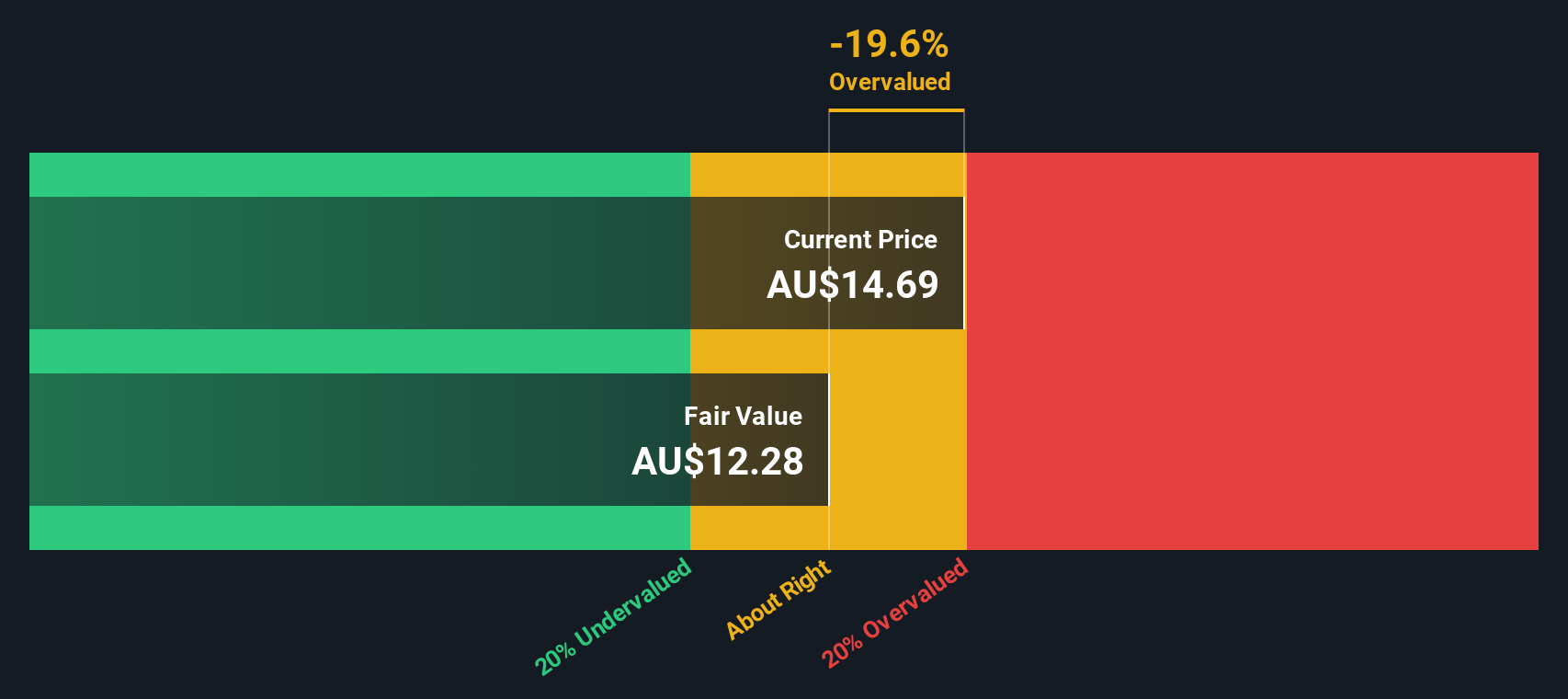

Another View: SWS DCF Model Puts a Spotlight on Risks

While analysts see Megaport as about fairly valued, our SWS DCF model suggests a different story. It estimates fair value at A$12.15 per share, which is actually below the current market price. This signals potential downside risk if today's growth assumptions do not play out as expected.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Megaport for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Megaport Narrative

If the current analysis does not match your perspective or you prefer to reach your own conclusions, crafting your own Megaport narrative takes less than three minutes, so why not Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Megaport.

Looking for more investment ideas?

Expand your portfolio horizons now with handpicked opportunities you won’t want to miss. Make smarter moves by seeing what savvy investors are tracking next.

- Uncover potential blue-chip winners offering steady income when you check out these 18 dividend stocks with yields > 3%.

- Fuel your curiosity with groundbreaking innovations in artificial intelligence through these 25 AI penny stocks.

- Tap into tomorrow’s breakthroughs by exploring companies driving the future of quantum computing via these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MP1

Megaport

Provides on-demand interconnection services in Australia, New Zealand, Hong Kong, Singapore, Japan, the United States of America, Canada, Mexico, and Brazil, and Europe.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives