- Australia

- /

- Oil and Gas

- /

- ASX:ATS

Australis Oil & Gas And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian stock market is facing a cautious start as the ASX200 is set to open lower, influenced by concerns over China's economic data despite positive trends on Wall Street. In such uncertain times, investors often turn their attention to penny stocks, which, though historically associated with higher risk and volatility, can present unique opportunities when backed by strong financials. These smaller or emerging companies might offer potential value and growth prospects that are sometimes overlooked in larger firms; we'll explore Australis Oil & Gas and two other noteworthy ASX penny stocks that stand out for their financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.61 | A$71.5M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.885 | A$306.91M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.565 | A$350.38M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.86 | A$127.05M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.17 | A$1.08B | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.34 | A$114.39M | ★★★★★☆ |

Click here to see the full list of 1,037 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Australis Oil & Gas (ASX:ATS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Australis Oil & Gas Limited is an upstream oil and gas company focused on the exploration, development, and production of oil and gas assets, with a market capitalization of A$12.89 million.

Operations: The company generates revenue from its oil and gas production segment, which amounts to $20.34 million.

Market Cap: A$12.89M

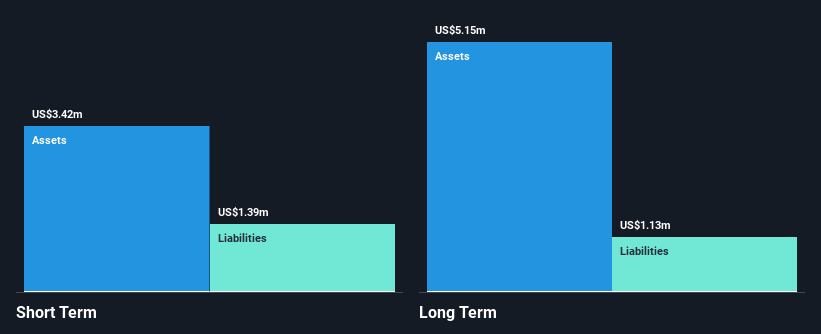

Australis Oil & Gas Limited, with a market cap of A$12.89 million, reported half-year sales of US$10.37 million and reduced its net loss to US$4.04 million from the previous year. Despite being unprofitable, the company has a satisfactory net debt to equity ratio of 7.4% and maintains a cash runway exceeding three years due to positive free cash flow growth at 49% annually. However, short-term assets fall short of covering liabilities by US$1.1 million, and shareholders have experienced dilution over the past year amidst high share price volatility compared to most Australian stocks.

- Dive into the specifics of Australis Oil & Gas here with our thorough balance sheet health report.

- Explore historical data to track Australis Oil & Gas' performance over time in our past results report.

AXP Energy (ASX:AXP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AXP Energy Limited is an oil and gas production and development company operating in the United States with a market cap of A$8.74 million.

Operations: The company's revenue is primarily derived from its operations in the Denver-Julesburg Basin, generating $0.64 million.

Market Cap: A$8.74M

AXP Energy Limited, with a market cap of A$8.74 million, is pre-revenue with sales under US$1 million primarily from the Denver-Julesburg Basin. Despite being unprofitable, it has reduced its net loss to US$4.46 million from the previous year and remains debt-free after eliminating past liabilities. The company faces high share price volatility but benefits from seasoned management and board members with significant tenure. Short-term assets exceed liabilities by US$2 million, providing some financial stability despite having less than a year of cash runway based on current free cash flow trends. Recent board changes include the resignation of a non-executive director.

- Click here and access our complete financial health analysis report to understand the dynamics of AXP Energy.

- Gain insights into AXP Energy's historical outcomes by reviewing our past performance report.

LiveHire (ASX:LVH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: LiveHire Limited provides talent acquisition software and an engagement platform through software as a service and direct sourcing channels in Australia, with a market cap of A$11.45 million.

Operations: The company generates revenue of A$7.19 million from its online talent acquisition software segment.

Market Cap: A$11.45M

LiveHire Limited, with a market cap of A$11.45 million, generates revenue of A$7.19 million from its talent acquisition software but remains unprofitable. The company recently raised A$3.54 million through a rights offering to bolster its cash runway, which is currently sufficient for 5 to 7 months based on free cash flow estimates. Despite the recent CEO departure and board restructuring, the management team has experienced leadership with an average tenure of 4.1 years. However, shareholders have faced dilution over the past year and must navigate significant share price volatility amidst ongoing strategic changes including Humanforce Holdings' proposed acquisition stake in LiveHire.

- Navigate through the intricacies of LiveHire with our comprehensive balance sheet health report here.

- Understand LiveHire's track record by examining our performance history report.

Turning Ideas Into Actions

- Discover the full array of 1,037 ASX Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Australis Oil & Gas, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ATS

Australis Oil & Gas

An upstream oil and gas company, engages in the exploration, development, and production of oil and gas assets in the United States of America.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives