Here's Why I Think Love Group Global (ASX:LVE) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Love Group Global (ASX:LVE), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Love Group Global

How Fast Is Love Group Global Growing Its Earnings Per Share?

Over the last three years, Love Group Global has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, Love Group Global's EPS soared from AU$0.013 to AU$0.018, in just one year. That's a impressive gain of 38%.

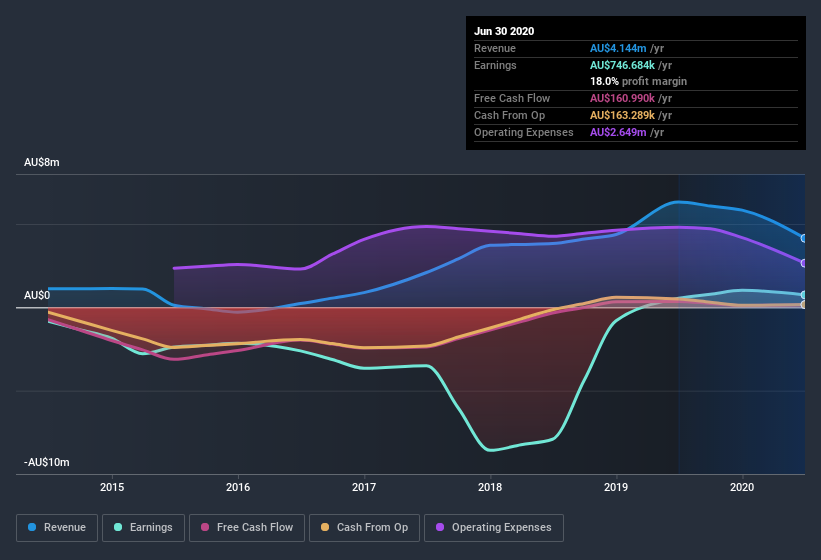

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Love Group Global's EBIT margins have actually improved by 10.7 percentage points in the last year, to reach 19%, but, on the flip side, revenue was down 34%. That falls short of ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Love Group Global isn't a huge company, given its market capitalization of AU$2.3m. That makes it extra important to check on its balance sheet strength.

Are Love Group Global Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Like a sturdy phalanx Love Group Global insiders have stood united by refusing to sell shares over the last year. But my excitement comes from the AU$81k that Founder Michael Ye spent buying shares (at an average price of about AU$0.052).

On top of the insider buying, we can also see that Love Group Global insiders own a large chunk of the company. Actually, with 49% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only AU$2.3m Love Group Global is really small for a listed company. That means insiders only have AU$1.1m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Michael Ye, is paid less than the median for similar sized companies. For companies with market capitalizations under AU$271m, like Love Group Global, the median CEO pay is around AU$382k.

Love Group Global offered total compensation worth AU$265k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Love Group Global Deserve A Spot On Your Watchlist?

You can't deny that Love Group Global has grown its earnings per share at a very impressive rate. That's attractive. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. It is worth noting though that we have found 3 warning signs for Love Group Global (2 are significant!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Love Group Global, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Love Group Global, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:LVE

Love Group Global

Provides social and dating products and services in Asia, Europe, Singapore, and Bangkok.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives