Kinatico (ASX:KYP): Valuation in Focus After ComplianceX SaaS Launch and Strategic SME Pivot

Reviewed by Simply Wall St

Kinatico (ASX:KYP) has drawn investor attention with its recent pivot to software as a service, marked by the launch of ComplianceX. The company is targeting underserved small and mid-sized enterprises through a freemium-led model.

See our latest analysis for Kinatico.

Kinatico’s share price has soared 175% since the start of the year, with momentum accelerating in recent weeks. The stock saw a 1-day gain of 10% and a 30-day share price return of over 24%. Over the past year, total shareholder return stands at an impressive 220%, reflecting renewed confidence around its SaaS transition and growth prospects with enterprise clients.

If Kinatico’s recent surge has you curious what else is gaining ground, it could be the perfect moment to explore fast growing stocks with high insider ownership.

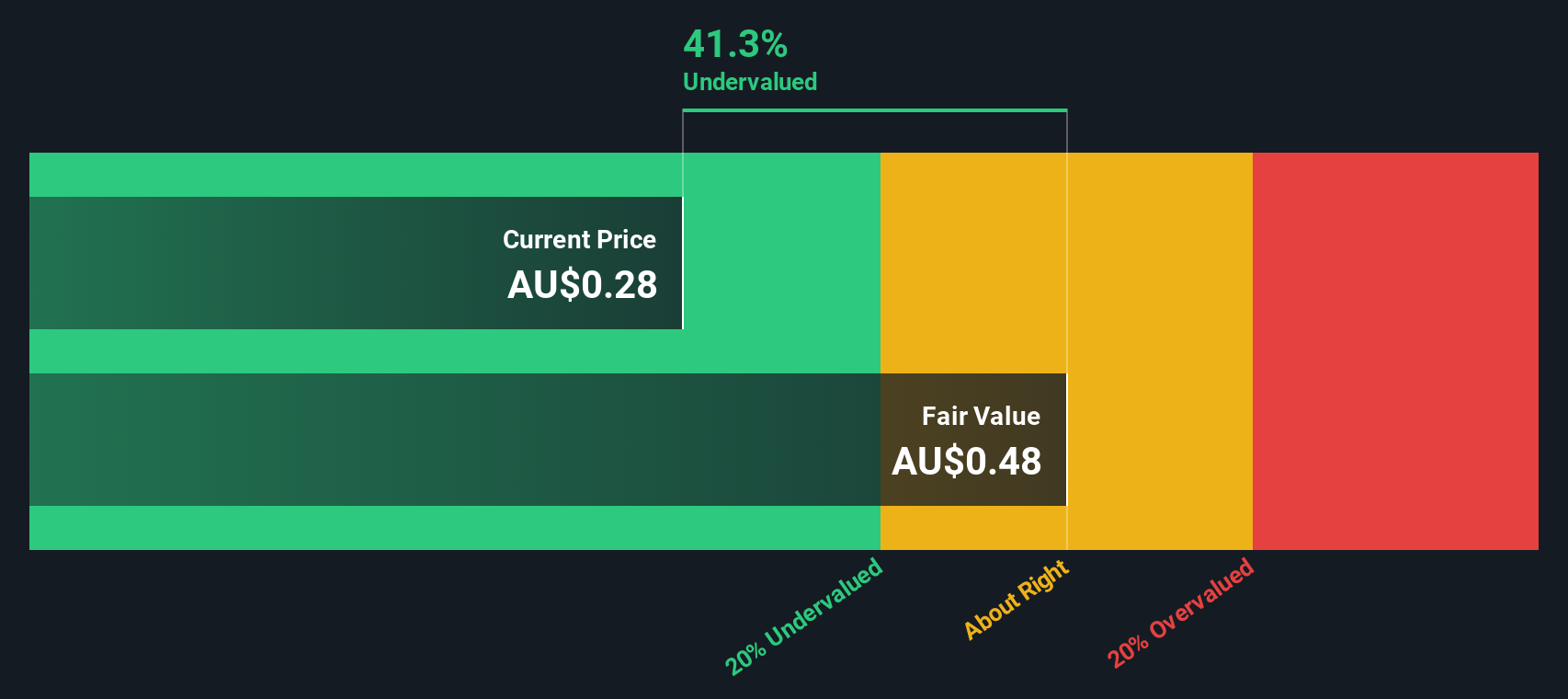

With performance this strong, investors may ask if Kinatico’s current valuation leaves more room to run, or if the recent surge means future growth is already fully reflected in the price.

Most Popular Narrative: 6% Overvalued

Kinatico's most followed narrative suggests its fair value sits slightly below the recent closing price, which calls into question the upside after this rally.

Persistent digitization of compliance processes, rising complexity of regulatory frameworks, and increasing demand for risk management are intensifying the need for integrated, user-friendly compliance solutions. Trends Kinatico is well-positioned to capitalize on, supporting sustained growth in new clients and average revenue per account.

Want to know which growth bets and margin leaps this narrative assumes? The numbers behind this price call might surprise you. Dig into the critical forecasts and see what drives this headline valuation.

Result: Fair Value of $0.36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower SME adoption or intense competition from global SaaS giants could quickly undermine Kinatico’s ambitious growth and margin forecasts.

Find out about the key risks to this Kinatico narrative.

Another View: Discounted Cash Flow Points Higher

While the consensus analysis suggests Kinatico is slightly overvalued at current prices, our DCF model paints a different picture. It estimates fair value at A$0.52, which is about 25% higher than the prevailing share price. Could DCF optimism hint at hidden long-term potential, or is it too bullish?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kinatico for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kinatico Narrative

If you want to explore the numbers your own way or question these conclusions, putting together your own perspective takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kinatico.

Looking for More Investment Ideas?

Smart investors keep their opportunity radar on. If you want to stay ahead of the market, don’t miss these powerful opportunities. Your next winning investment could be just a click away.

- Uncover tomorrow’s tech leaders by checking out these 27 AI penny stocks, which are shaking up industries and pushing boundaries in artificial intelligence innovation.

- Boost your income strategy as you browse these 17 dividend stocks with yields > 3%, delivering yields above 3% and offering stability in every market cycle.

- Stay ahead of financial trends with these 80 cryptocurrency and blockchain stocks, as new companies harness blockchain and digital currencies to transform the way the world transacts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kinatico might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KYP

Kinatico

Provides screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)