- Australia

- /

- Aerospace & Defense

- /

- ASX:OEC

ASX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

In the last week, the Australian market has stayed flat, but it is up 16% over the past year, with earnings forecast to grow by 13% annually. For investors willing to explore beyond well-known names, penny stocks—typically smaller or newer companies—can offer intriguing prospects. Despite being a somewhat outdated term, penny stocks remain relevant for those seeking affordable entry points and growth potential; this article highlights three such stocks that combine financial strength with opportunity.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.6025 | A$72.09M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$323.19M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.545 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.89 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$789.03M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.445 | A$1.57B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.155 | A$69.71M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.93 | A$493.33M | ★★★★☆☆ |

Click here to see the full list of 1,038 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Andromeda Metals (ASX:ADN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Andromeda Metals Limited is a mineral exploration company in Australia with a market capitalization of A$20.35 million.

Operations: Andromeda Metals Limited does not have any reported revenue segments.

Market Cap: A$20.35M

Andromeda Metals Limited, with a market capitalization of A$20.35 million, is pre-revenue and currently unprofitable. Recent developments include the appointment of Miguel J. Galindo as a Non-Executive Director, bringing expertise in industrial minerals and aiding in Andromeda's European market entry for its kaolin products. Despite being debt-free, the company has experienced shareholder dilution over the past year and maintains a short cash runway even after raising additional capital through equity offerings totaling around A$6.53 million since August 2024. The management team is relatively new with an average tenure of 1.8 years, indicating ongoing organizational changes amidst financial challenges.

- Dive into the specifics of Andromeda Metals here with our thorough balance sheet health report.

- Examine Andromeda Metals' earnings growth report to understand how analysts expect it to perform.

Janison Education Group (ASX:JAN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Janison Education Group Limited provides online assessment software, products, and services across Australia, New Zealand, Asia, and internationally with a market cap of A$45.48 million.

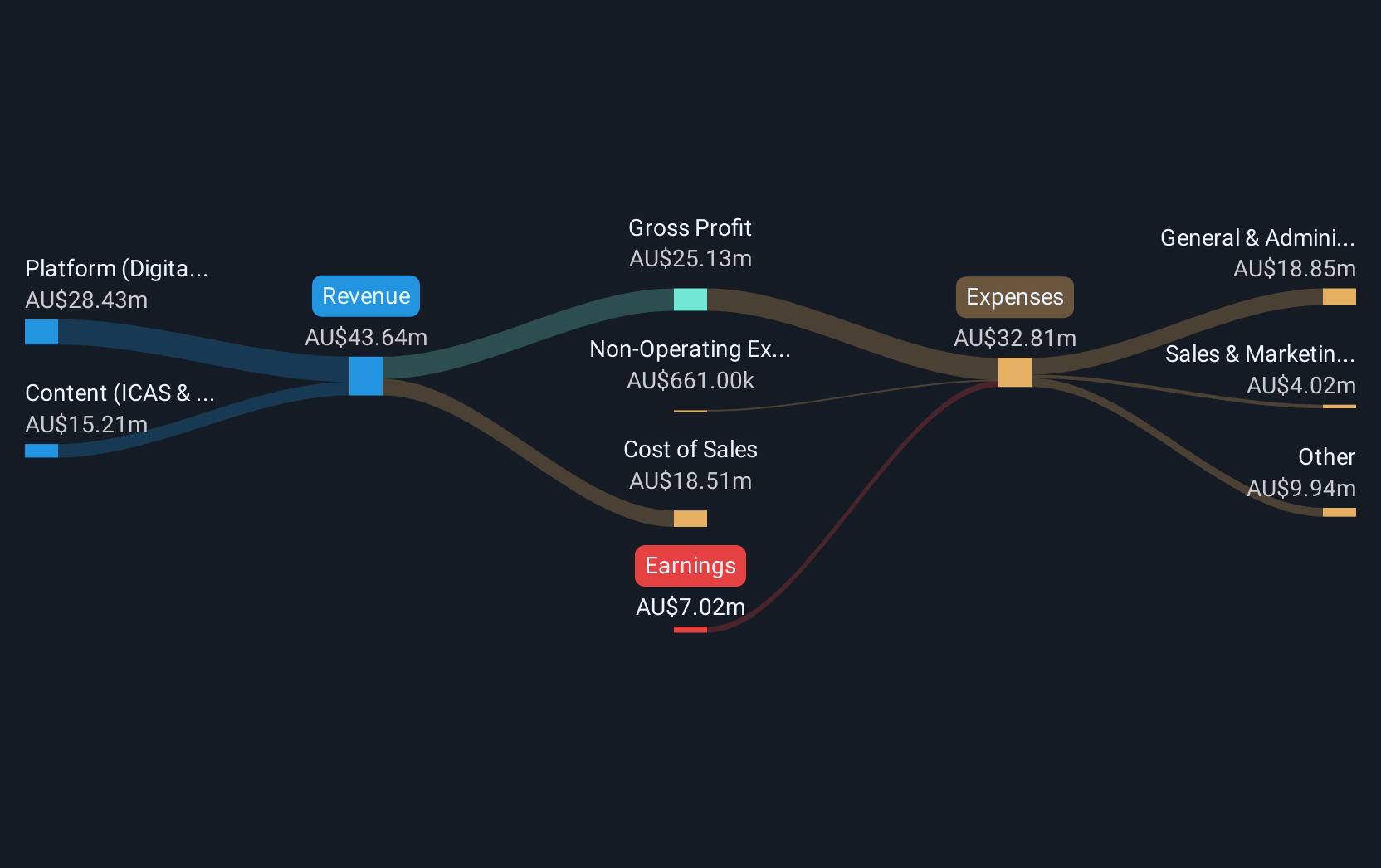

Operations: The company generates revenue from its Solutions segment, contributing A$28.03 million, and its Assessments segment, which brings in A$15.03 million.

Market Cap: A$45.48M

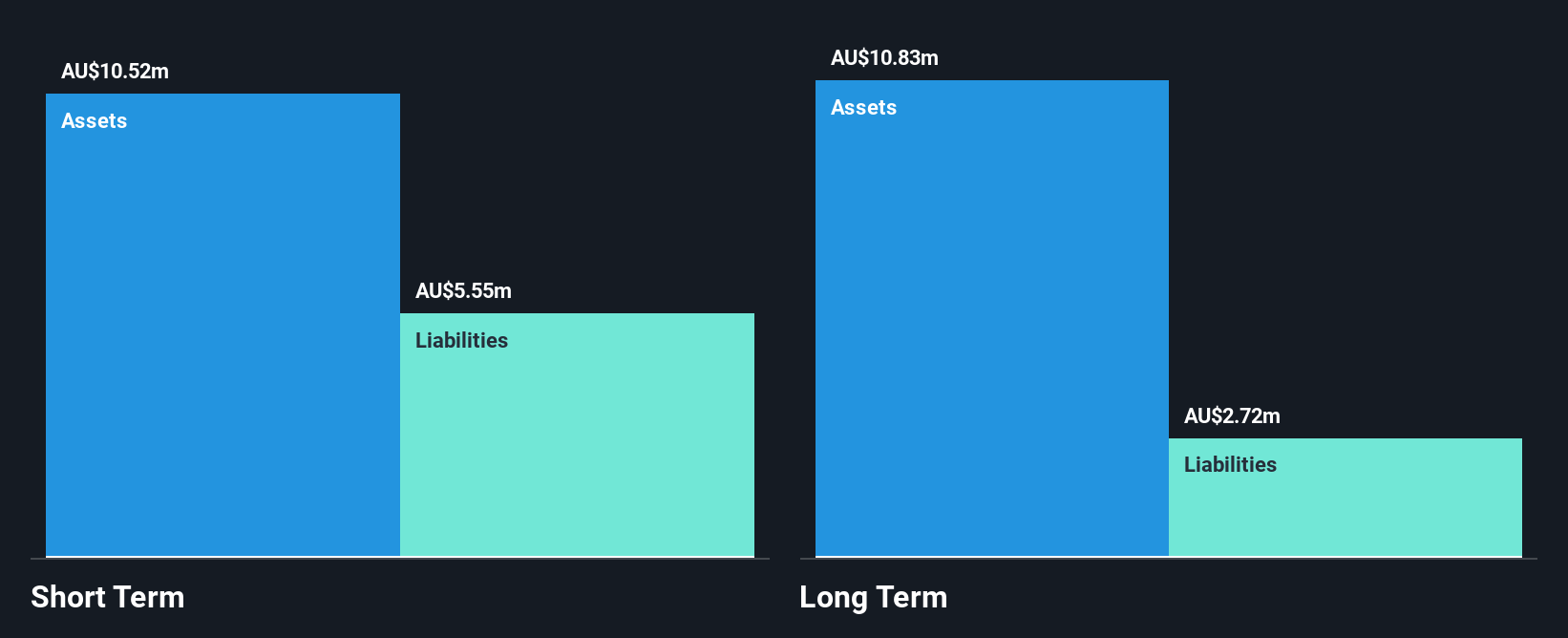

Janison Education Group, with a market cap of A$45.48 million, generates significant revenue from its Solutions and Assessments segments. Despite being unprofitable, Janison has reduced its net loss from A$13.71 million to A$8.09 million over the past year and maintains a strong cash runway exceeding three years without debt obligations. Its short-term assets surpass both short-term and long-term liabilities, indicating solid financial management in the near term. Analysts anticipate a 31.8% rise in stock price, though shareholder dilution occurred recently with shares outstanding increasing by 2.3%. The management team is relatively new with an average tenure of 1.4 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Janison Education Group.

- Assess Janison Education Group's future earnings estimates with our detailed growth reports.

Orbital (ASX:OEC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Orbital Corporation Limited develops integrated propulsion systems and flight critical components for tactical unmanned aerial vehicles, primarily serving markets in Australia and the United States, with a market cap of A$13.98 million.

Operations: The company's revenue segment is primarily derived from Australia, amounting to A$12.66 million.

Market Cap: A$13.98M

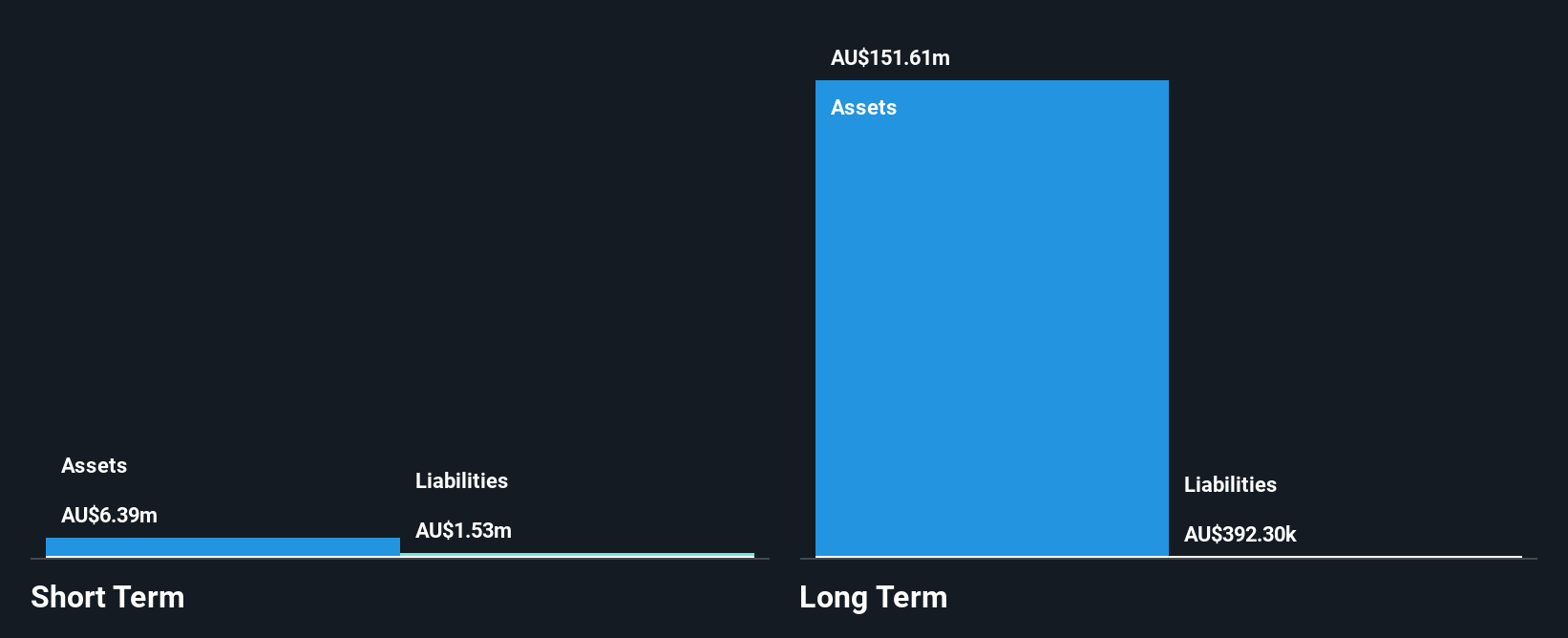

Orbital Corporation Limited, with a market cap of A$13.98 million, has demonstrated significant earnings growth of 235% over the past year, surpassing industry averages. Despite this, its share price remains highly volatile and shareholders experienced dilution with a recent follow-on equity offering raising A$2 million. The company maintains more cash than debt but struggles with negative operating cash flow and low return on equity at 0.6%. Recent changes include adopting a new constitution and electing new directors during the annual general meeting, reflecting ongoing corporate restructuring efforts to support future growth initiatives.

- Navigate through the intricacies of Orbital with our comprehensive balance sheet health report here.

- Explore historical data to track Orbital's performance over time in our past results report.

Next Steps

- Click this link to deep-dive into the 1,038 companies within our ASX Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OEC

Orbital

Provides integrated propulsion systems and flight critical components for tactical unmanned aerial vehicles primarily in Australia and the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives