- Australia

- /

- Diversified Financial

- /

- ASX:FND

Strong week for Findi (ASX:FND) shareholders doesn't alleviate pain of three-year loss

It's nice to see the Findi Limited (ASX:FND) share price up 21% in a week. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 83% in the last three years, significantly under-performing the market. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the last three years has been tough for Findi shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Findi

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Findi became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

We note that, in three years, revenue has actually grown at a 119% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Findi more closely, as sometimes stocks fall unfairly. This could present an opportunity.

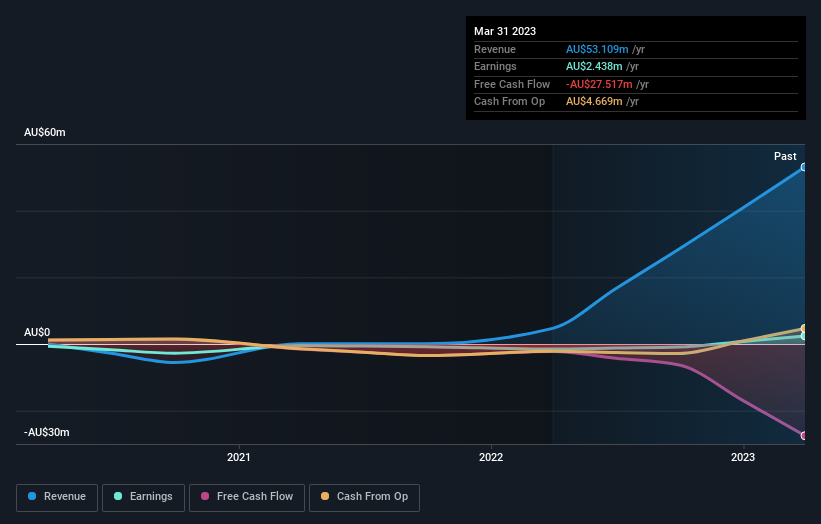

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Findi's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Findi's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Findi's TSR, at -11% is higher than its share price return of -83%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're pleased to report that Findi shareholders have received a total shareholder return of 16% over one year. Notably the five-year annualised TSR loss of 0.4% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Findi (at least 2 which can't be ignored) , and understanding them should be part of your investment process.

Findi is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FND

Findi

Through its subsidiaries, engages in the development of digital payment systems in India.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026