Trade Alert: The Independent Non-Executive Director Of Frugl Group Limited (ASX:FGL), Mathew Walker, Has Just Spent AU$300k Buying 100% More Shares

Potential Frugl Group Limited (ASX:FGL) shareholders may wish to note that the Independent Non-Executive Director, Mathew Walker, recently bought AU$300k worth of stock, paying AU$0.03 for each share. That certainly has us anticipating the best, especially since they thusly increased their own holding by 100%, potentially signalling some real optimism.

See our latest analysis for Frugl Group

The Last 12 Months Of Insider Transactions At Frugl Group

Notably, that recent purchase by Mathew Walker is the biggest insider purchase of Frugl Group shares that we've seen in the last year. Even though the purchase was made at a significantly lower price than the recent price (AU$0.045), we still think insider buying is a positive. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

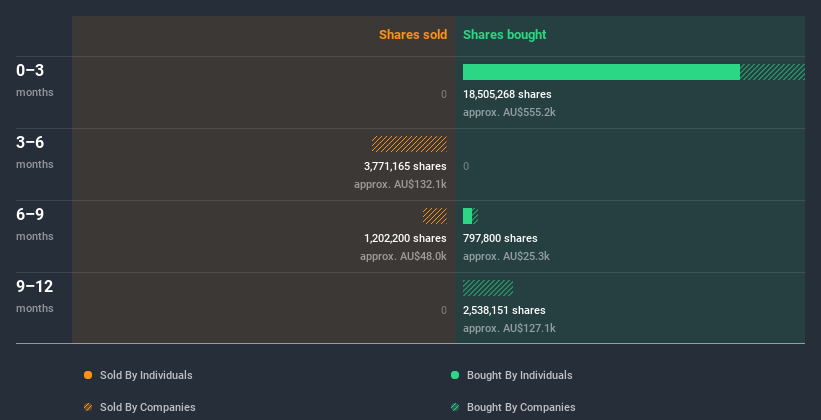

While Frugl Group insiders bought shares during the last year, they didn't sell. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Frugl Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership of Frugl Group

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 33% of Frugl Group shares, worth about AU$2.4m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Frugl Group Insider Transactions Indicate?

It is good to see recent purchasing. And the longer term insider transactions also give us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. Given that insiders also own a fair bit of Frugl Group we think they are probably pretty confident of a bright future. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. At Simply Wall St, we've found that Frugl Group has 4 warning signs (3 are a bit concerning!) that deserve your attention before going any further with your analysis.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Frugl Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:IFG

InFocus Group Holdings

Operates as a data intelligence and software solutions company in Australia.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026