FINEOS Corporation Holdings plc's (ASX:FCL) Shares Climb 32% But Its Business Is Yet to Catch Up

Despite an already strong run, FINEOS Corporation Holdings plc (ASX:FCL) shares have been powering on, with a gain of 32% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

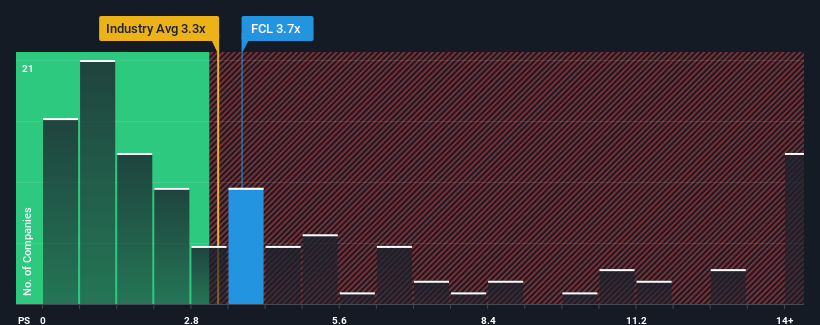

Even after such a large jump in price, it's still not a stretch to say that FINEOS Corporation Holdings' price-to-sales (or "P/S") ratio of 3.7x right now seems quite "middle-of-the-road" compared to the Software industry in Australia, where the median P/S ratio is around 3.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for FINEOS Corporation Holdings

How Has FINEOS Corporation Holdings Performed Recently?

Recent times haven't been great for FINEOS Corporation Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on FINEOS Corporation Holdings.Is There Some Revenue Growth Forecasted For FINEOS Corporation Holdings?

FINEOS Corporation Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 9.0% gain to the company's revenues. The latest three year period has also seen a 10.0% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.4% per annum during the coming three years according to the five analysts following the company. That's shaping up to be materially lower than the 41% each year growth forecast for the broader industry.

With this information, we find it interesting that FINEOS Corporation Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

FINEOS Corporation Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that FINEOS Corporation Holdings' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for FINEOS Corporation Holdings with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FCL

FINEOS Corporation Holdings

Engages in the development and sale of enterprise claims and policy management software for life, accident and health insurers, and employee benefits providers in North America, the Asia Pacific, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives