Here's Why We Think Etherstack (ASX:ESK) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Etherstack (ASX:ESK). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Etherstack

How Fast Is Etherstack Growing Its Earnings Per Share?

Over the last three years, Etherstack has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Etherstack's EPS catapulted from US$0.0063 to US$0.018, over the last year. It's a rarity to see 182% year-on-year growth like that. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

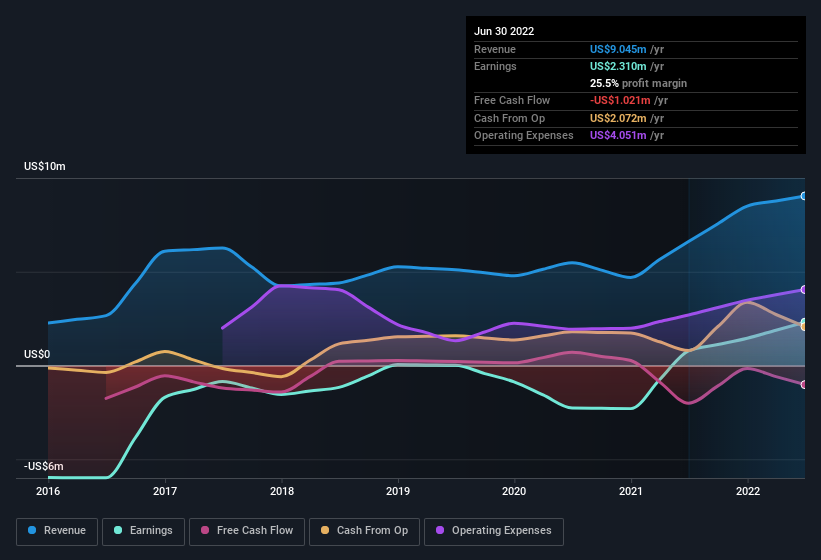

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Etherstack shareholders can take confidence from the fact that EBIT margins are up from 12% to 21%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Etherstack isn't a huge company, given its market capitalisation of AU$59m. That makes it extra important to check on its balance sheet strength.

Are Etherstack Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Etherstack shareholders is that no insiders reported selling shares in the last year. Add in the fact that Peter Francis Stephens, the Non-Executive Chairman of the company, paid US$36k for shares at around US$0.40 each. It seems that at least one insider is prepared to show the market there is potential within Etherstack.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Etherstack insiders own more than a third of the company. Indeed, with a collective holding of 82%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. To give you an idea, the value of insiders' holdings in the business are valued at US$49m at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Etherstack To Your Watchlist?

Etherstack's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Etherstack deserves timely attention. It is worth noting though that we have found 2 warning signs for Etherstack (1 is significant!) that you need to take into consideration.

Keen growth investors love to see insider buying. Thankfully, Etherstack isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Etherstack might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ESK

Etherstack

A wireless technology company, engages in the development, manufacture, licensing, and sale of mission critical radio technologies to equipment manufacturers and network operators in the United Kingdom, the United States, Japan, and Australia.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Phase 3 HALEO results have a high probability of Success

Mader Group (ASX: MAD): Strong Growth, Strong Returns — But at a Price

Netflix - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion