As the Australian market experiences a modest upswing, with the ASX200 closing up 0.56% at 8,407 points and sectors like IT and Financials leading the charge, investors are keenly observing small-cap stocks for potential growth opportunities amidst fluctuating economic indicators. In this dynamic environment, identifying undiscovered gems requires a keen eye for innovation and strategic positioning within thriving sectors such as technology and financial services.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Carlton Investments (ASX:CIN)

Simply Wall St Value Rating: ★★★★★☆

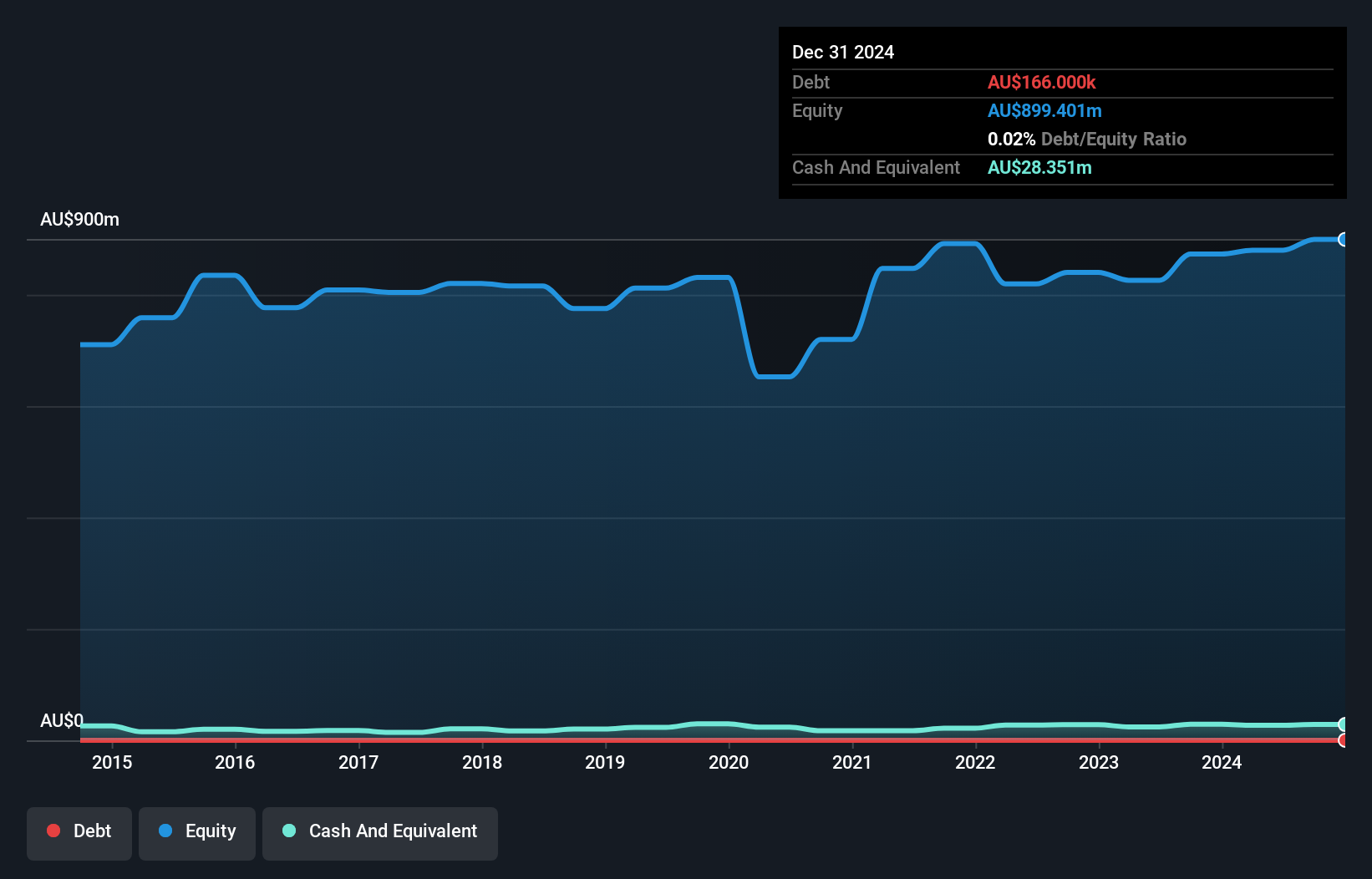

Overview: Carlton Investments Limited is a publicly owned asset management holding company with a market capitalization of A$884.34 million.

Operations: Carlton Investments generates revenue primarily through the acquisition and long-term holding of shares and units, amounting to A$42.01 million.

Carlton Investments, a smaller player in the Australian market, showcases robust financial health with its debt well-covered by EBIT at an impressive 3424 times. The company has maintained high-quality earnings while achieving an annual earnings growth of 4% over the past five years. Despite this steady performance, its recent yearly earnings growth of 3.4% lagged behind the broader Capital Markets industry average of 23.6%. With more cash than total debt and positive free cash flow, Carlton seems well-positioned financially but may need to accelerate growth to match industry pace.

- Get an in-depth perspective on Carlton Investments' performance by reading our health report here.

Assess Carlton Investments' past performance with our detailed historical performance reports.

Energy One (ASX:EOL)

Simply Wall St Value Rating: ★★★★☆☆

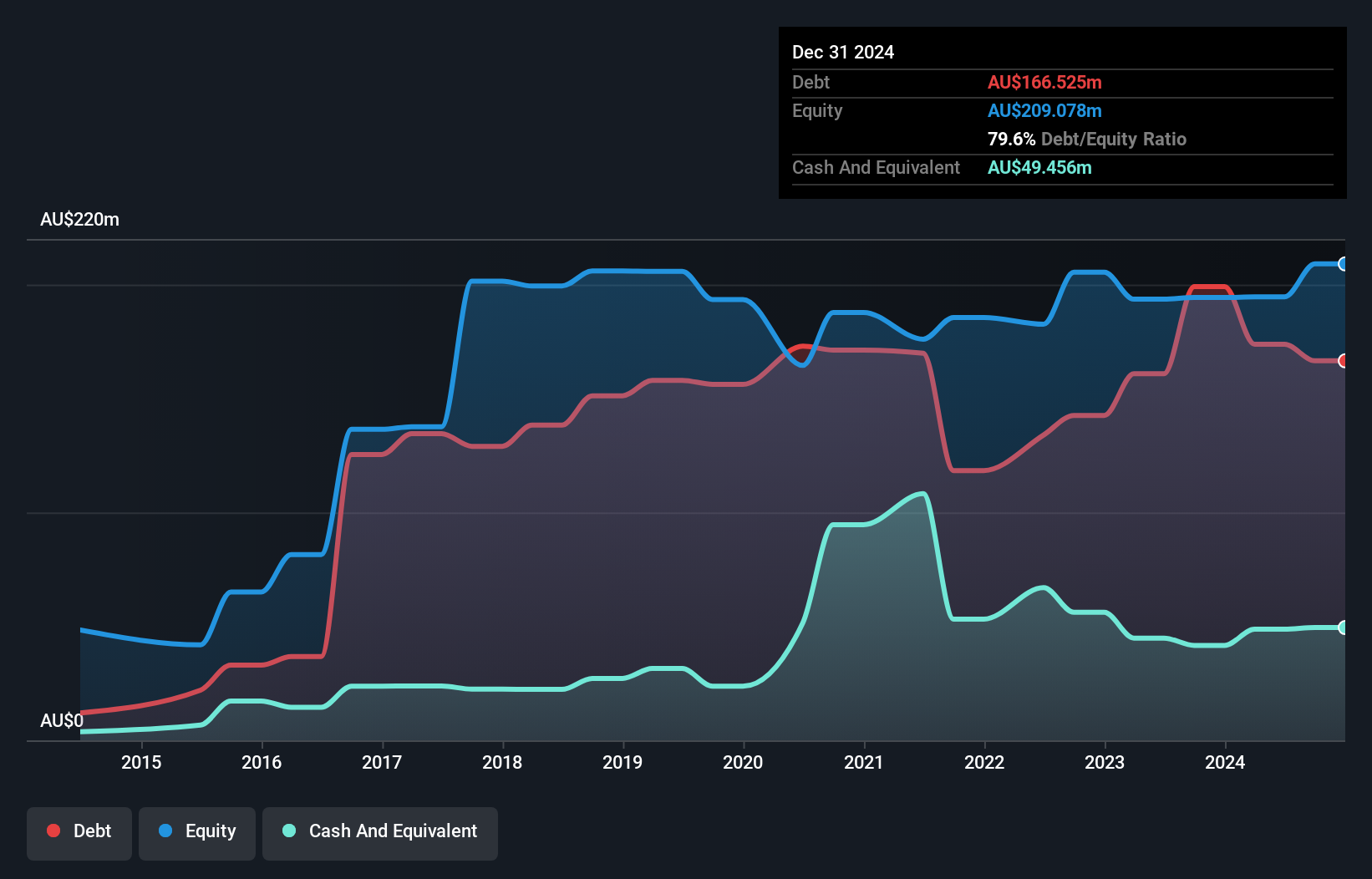

Overview: Energy One Limited offers software products, outsourced operations, and advisory services for wholesale energy, environmental, and carbon trading markets in Australasia and Europe with a market cap of A$449.90 million.

Operations: Energy One Limited generates revenue primarily from its energy software industry segment, which contributes A$55.81 million. The company's financial performance is reflected in its net profit margin, which stands at 5.2%.

Energy One, a nimble player in the software industry, showcases robust financial health with a net debt to equity ratio of 22.7%, deemed satisfactory. The company's earnings surged by 273% last year, outpacing the industry's modest growth of 5%. With EBIT covering interest payments 4.5 times over, its financial structure seems solid. Recent inclusion in the S&P/ASX All Ordinaries Index highlights its growing stature. However, significant insider selling and rising costs may weigh on margins despite forecasts of a 42% annual earnings growth and anticipated profit margin increase from 7.9% to 18.8%.

IVE Group (ASX:IGL)

Simply Wall St Value Rating: ★★★★★☆

Overview: IVE Group Limited operates within the marketing sector in Australia, with a market capitalization of A$399.33 million.

Operations: IVE Group generates revenue primarily from its advertising segment, amounting to A$975.43 million.

IVE Group seems to be carving a niche in the Australian market with its strategic moves in packaging and 3PL. The addition of a New South Wales facility aims to boost revenue capacity significantly, potentially reaching A$150 million over five years. Integrating Elastic into its creative services is likely to enhance operational efficiency. Although the company's debt remains high with a net debt to equity ratio at 56%, earnings have impressively grown by 180% last year, outpacing industry averages. With EBIT covering interest payments 4.5 times over, IVE's financial health appears robust despite some economic uncertainties ahead.

Key Takeaways

- Reveal the 47 hidden gems among our ASX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGL

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives