- Australia

- /

- Oil and Gas

- /

- ASX:FAR

COSOL Leads The Charge Among 3 ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.36% at 8,408 points as investors adjust to the new Trump administration and respond positively to tariff outcomes. In this context of market fluctuations, identifying stocks with robust financial fundamentals becomes crucial for investors seeking opportunities. While the term 'penny stocks' might seem outdated, these smaller or newer companies can still offer significant growth potential when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$242.1M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.95 | A$107.87M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.945 | A$316.68M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.12 | A$328.36M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$240.95M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.33 | A$65.63M | ★★★★★☆ |

Click here to see the full list of 1,024 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

COSOL (ASX:COS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: COSOL Limited, with a market cap of A$170.16 million, offers information technology services across the Asia Pacific, North America, Europe, the Middle East, Africa, and other international markets.

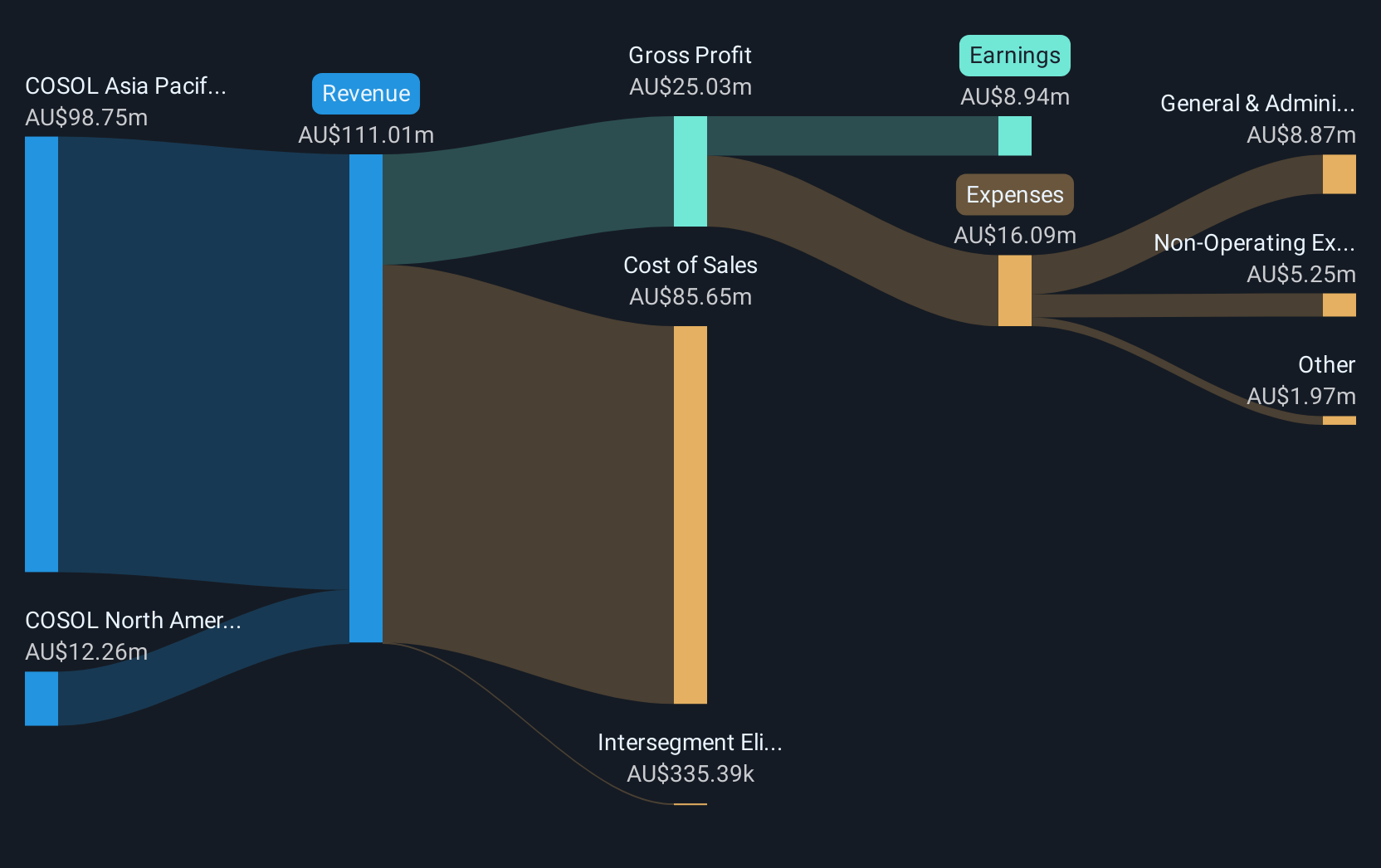

Operations: The company's revenue is primarily derived from its Asia Pacific segment, which generated A$88.99 million, followed by its North America segment with A$13.88 million.

Market Cap: A$170.16M

COSOL Limited, with a market cap of A$170.16 million, shows promise in the penny stock sector due to its stable financial position and growth prospects. Its short-term assets of A$30.1 million exceed both short and long-term liabilities, indicating strong liquidity. The company trades at a significant discount to estimated fair value and offers good relative value compared to peers. Despite lower recent earnings growth (6.7%) compared to its 5-year average (27.5%), COSOL's earnings are forecasted to grow by 23.84% annually, supported by well-covered interest payments and satisfactory debt levels, though management changes may impact strategic continuity.

- Click here to discover the nuances of COSOL with our detailed analytical financial health report.

- Learn about COSOL's future growth trajectory here.

FAR (ASX:FAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FAR Limited is an oil and gas exploration and development company operating in Africa, with a market cap of A$54.98 million.

Operations: FAR Limited does not report specific revenue segments.

Market Cap: A$54.98M

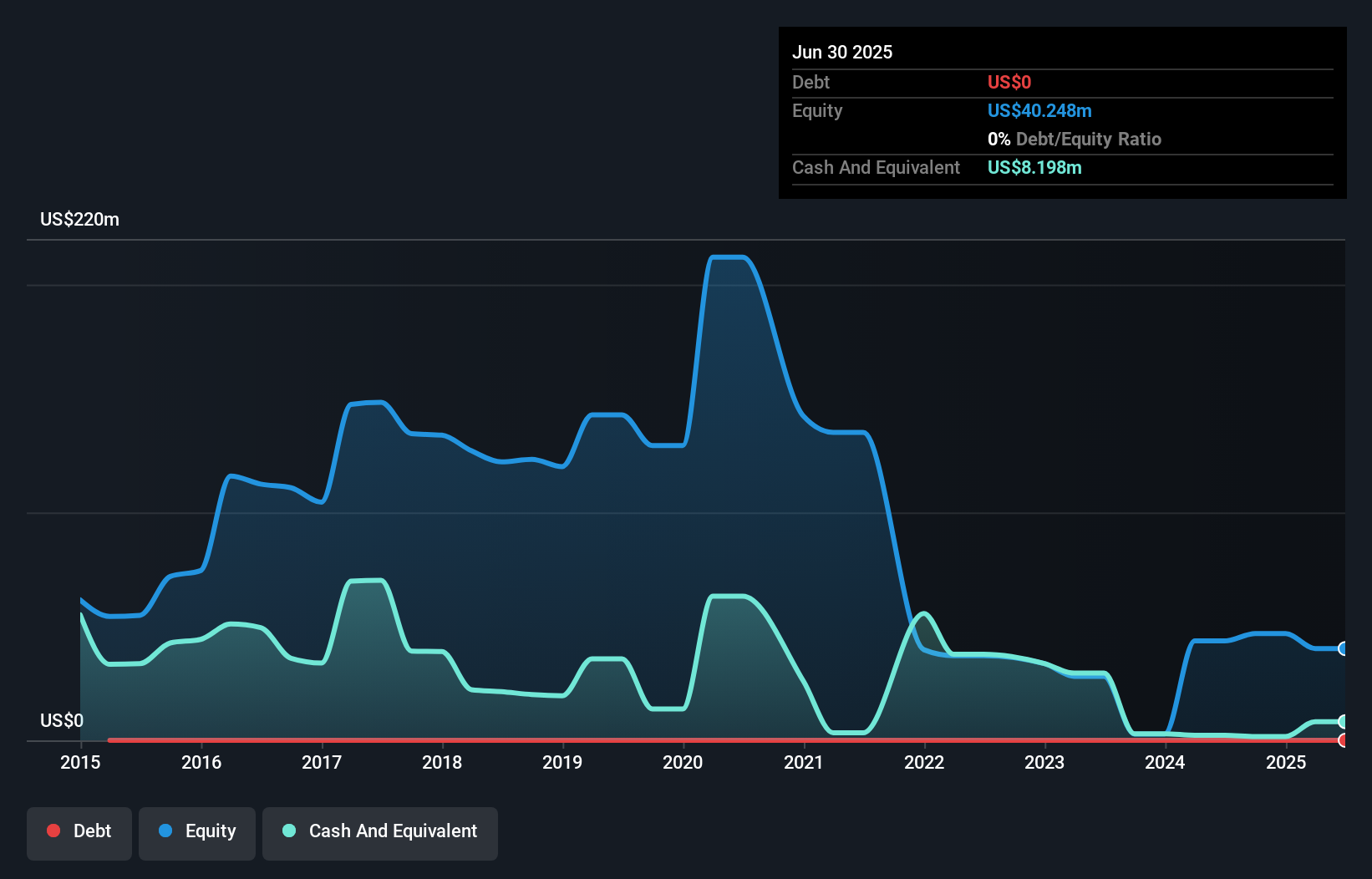

FAR Limited, with a market cap of A$54.98 million, presents an intriguing case in the penny stock arena due to its recent transition to profitability despite being pre-revenue. The company boasts an outstanding Return on Equity at 90% and trades at a very low Price-To-Earnings ratio of 0.9x compared to the broader Australian market. FAR's financial health is underscored by its lack of debt and strong liquidity, with short-term assets amounting to A$9.6 million far exceeding short-term liabilities of A$165,000. Additionally, shareholders have not faced meaningful dilution recently, enhancing investor confidence in the company's capital structure stability.

- Click to explore a detailed breakdown of our findings in FAR's financial health report.

- Explore historical data to track FAR's performance over time in our past results report.

Little Green Pharma (ASX:LGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Little Green Pharma Ltd is involved in the cultivation, production, and distribution of medicinal cannabis products both in Australia and internationally, with a market cap of A$36.34 million.

Operations: The company generates revenue of A$28.88 million from its pharmaceuticals segment.

Market Cap: A$36.34M

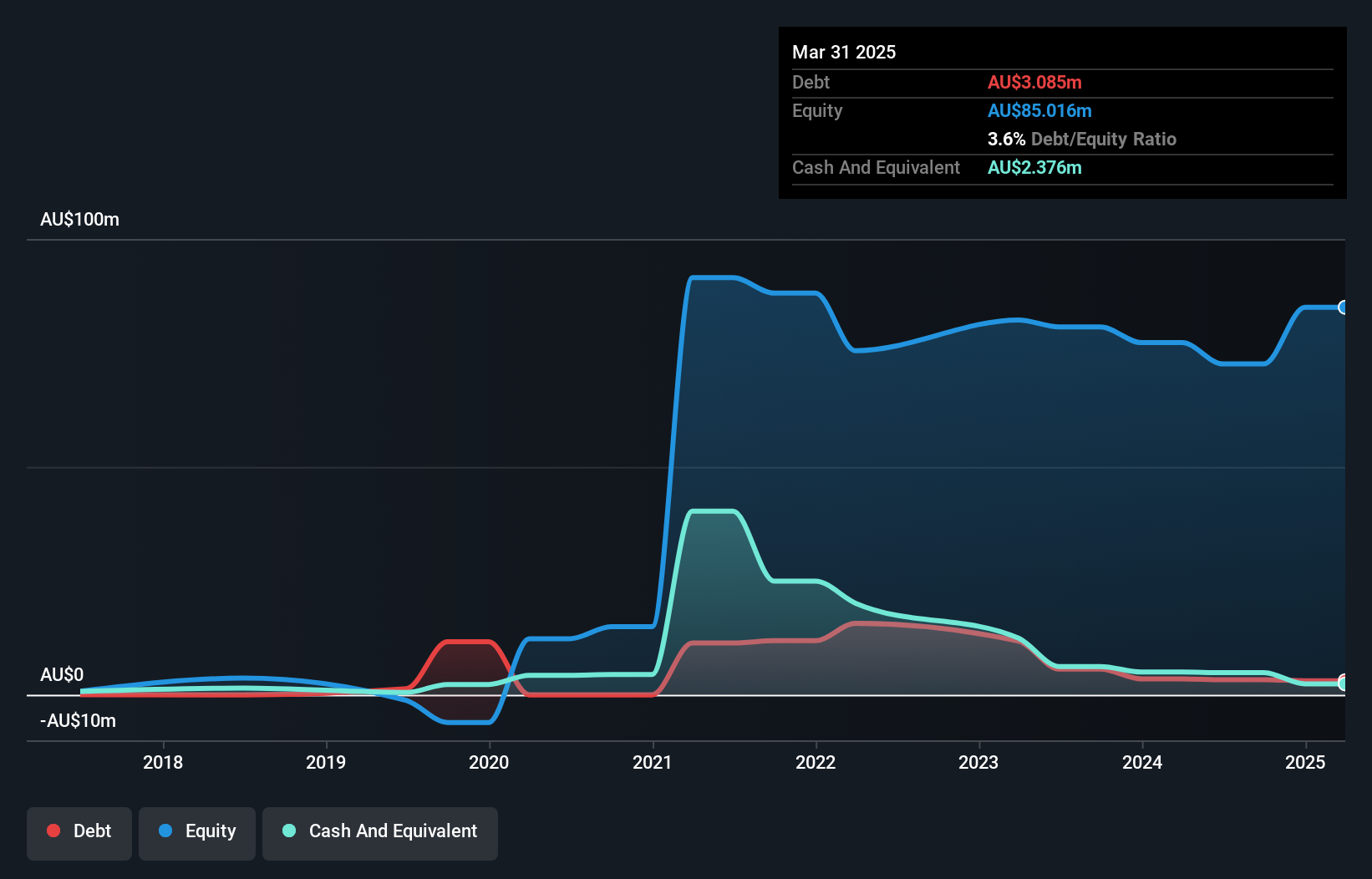

Little Green Pharma Ltd, with a market cap of A$36.34 million, is navigating the penny stock landscape with its focus on medicinal cannabis. Despite being unprofitable and experiencing increased losses over the past five years, the company reported half-year sales growth to A$17.51 million from A$12.8 million year-on-year. It maintains a strong cash position exceeding total debt, providing a runway of over three years despite negative earnings. The company's short-term assets cover both short and long-term liabilities comfortably; however, its share price remains highly volatile compared to most Australian stocks, reflecting ongoing investor uncertainty amidst management changes.

- Dive into the specifics of Little Green Pharma here with our thorough balance sheet health report.

- Understand Little Green Pharma's track record by examining our performance history report.

Taking Advantage

- Click through to start exploring the rest of the 1,021 ASX Penny Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FAR

FAR

Operates as an oil and gas exploration and development company in Africa.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives