The Australian market has shown resilience with the ASX200 closing up 0.33% at 8226 points, driven by strong performances in the Energy and Industrials sectors. As investors navigate these shifting dynamics, penny stocks—often smaller or newer companies—continue to capture attention for their potential growth opportunities. Despite being a somewhat outdated term, penny stocks remain relevant as they can offer unique investment prospects when backed by solid fundamentals and financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.60 | A$69.75M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$295.51M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.555 | A$341.08M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$806.18M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.91 | A$134.6M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.49 | A$133.03M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$61M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.32 | A$111.83M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$5.10 | A$493.33M | ★★★★☆☆ |

Click here to see the full list of 1,036 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

BMG Resources (ASX:BMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BMG Resources Limited is a mineral exploration company focused on developing projects in the Republic of Cyprus and Australia, with a market cap of A$9.57 million.

Operations: BMG Resources Limited does not report any revenue segments.

Market Cap: A$9.57M

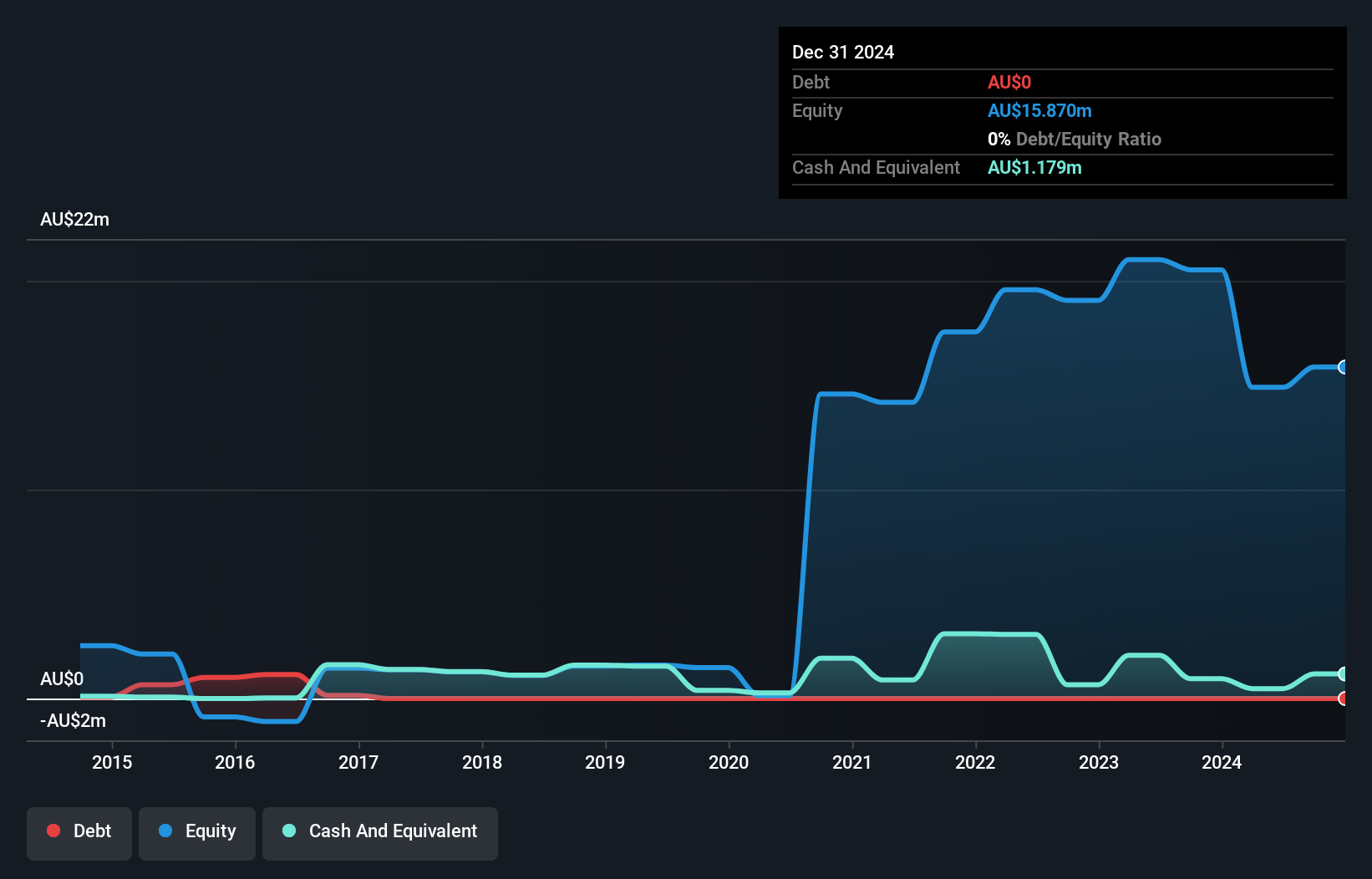

BMG Resources Limited, with a market cap of A$9.57 million, is a pre-revenue mineral exploration company facing significant challenges. The company recently filed for a follow-on equity offering to raise A$1.5 million, indicating efforts to secure additional capital amidst financial strain. BMG reported a net loss of A$7.19 million for the year ended June 30, 2024, compared to A$2.73 million the previous year, highlighting increasing losses over time. Despite being debt-free and having short-term assets exceeding liabilities by A$319.5K, its cash runway remains limited without further capital influxes from recent offerings or other sources.

- Get an in-depth perspective on BMG Resources' performance by reading our balance sheet health report here.

- Gain insights into BMG Resources' historical outcomes by reviewing our past performance report.

Complii FinTech Solutions (ASX:CF1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Complii FinTech Solutions Ltd provides an integrated corporate and adviser management platform for the financial services sector both in Australia and internationally, with a market cap of A$12.58 million.

Operations: The company's revenue segments include Complii at A$3.09 million, MIntegrity generating A$1.03 million, Primary Markets contributing A$2.09 million, Registry Direct with A$1.76 million, and Adviser Solutions Group at A$0.19 million.

Market Cap: A$12.58M

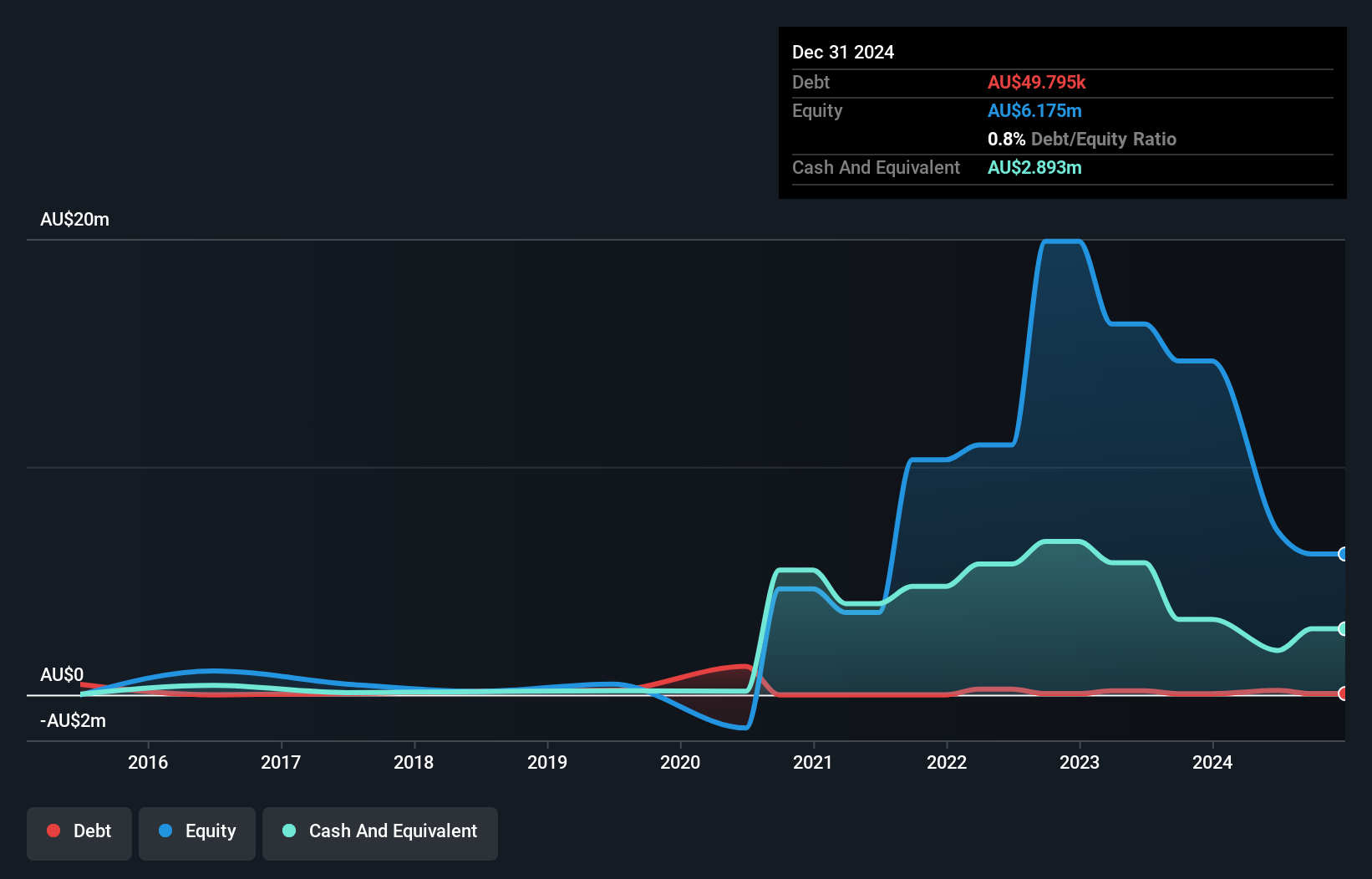

Complii FinTech Solutions Ltd, with a market cap of A$12.58 million, faces financial challenges typical of many penny stocks. Its revenue for the year ended June 30, 2024 was A$6.32 million, down from A$6.69 million the previous year, while net losses widened to A$10.22 million from A$5.45 million. The company remains unprofitable with less than a year's cash runway and high volatility in its share price over recent months. Despite having more cash than debt and short-term assets exceeding liabilities, its negative return on equity and declining earnings pose significant hurdles for future growth prospects without strategic changes or additional capital inflows.

- Navigate through the intricacies of Complii FinTech Solutions with our comprehensive balance sheet health report here.

- Assess Complii FinTech Solutions' previous results with our detailed historical performance reports.

Marvel Gold (ASX:MVL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Marvel Gold Limited focuses on acquiring, developing, and exploring gold projects in Mali, with a market capitalization of A$11.23 million.

Operations: There are no reported revenue segments for the company.

Market Cap: A$11.23M

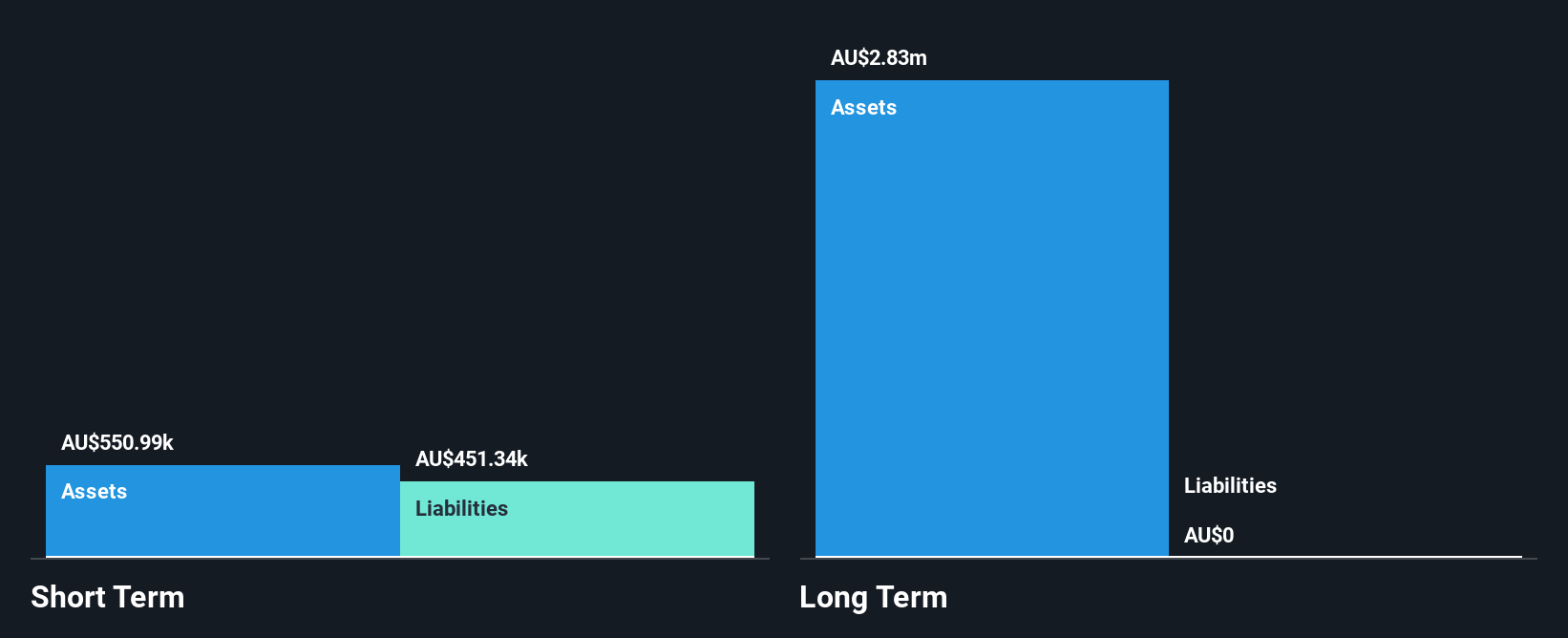

Marvel Gold Limited, with a market cap of A$11.23 million, is pre-revenue and faces typical challenges for penny stocks. The company reported a net loss of A$3.05 million for the half year ending June 2024, an improvement from the previous year's loss. Despite being debt-free and having short-term assets exceeding liabilities, it has less than a year of cash runway based on current free cash flow trends. Shareholders have not faced significant dilution recently, but high share price volatility and an inexperienced board present additional risks. The company's financial position highlights the need for careful management to sustain operations without immediate revenue streams.

- Take a closer look at Marvel Gold's potential here in our financial health report.

- Examine Marvel Gold's past performance report to understand how it has performed in prior years.

Key Takeaways

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,033 more companies for you to explore.Click here to unveil our expertly curated list of 1,036 ASX Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CF1

Complii FinTech Solutions

Operates integrated corporate and adviser management platform for financial services sector in Australia and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives