Catapult Group International And 2 Other High Growth Tech Stocks In Australia

Reviewed by Simply Wall St

The Australian market has shown a mix of performances recently, with the ASX 200 closing up by 0.52% and sectors like Energy and Health Care leading gains, while Industrials lagged behind. In this context of varied sector performance, identifying high growth tech stocks such as Catapult Group International requires careful consideration of their innovation potential and adaptability to current market dynamics.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| WiseTech Global | 20.14% | 25.01% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Wrkr | 57.01% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| Immutep | 70.42% | 42.39% | ★★★★★☆ |

| Echo IQ | 61.50% | 65.86% | ★★★★★★ |

| SiteMinder | 19.93% | 69.52% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our ASX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Catapult Group International (ASX:CAT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Catapult Group International Ltd is a sports science and analytics company that offers technologies to enhance athlete performance, prevent injuries, and facilitate recovery for sporting teams across multiple regions including Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas; it has a market cap of A$1.29 billion.

Operations: Catapult Group International Ltd specializes in providing innovative technologies to sporting teams and athletes for optimizing performance and injury prevention. The company operates across various regions, leveraging its expertise in sports science and analytics to support athlete recovery and return-to-play strategies.

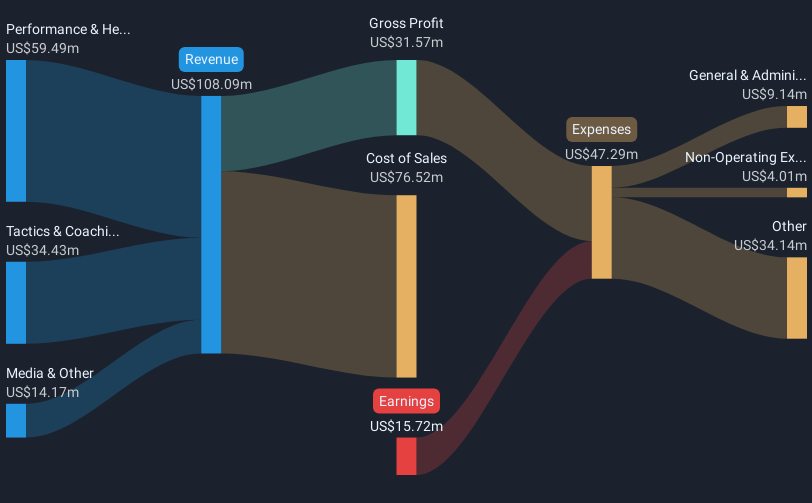

Catapult Group International Ltd has demonstrated a robust trajectory with its annual revenue surging by 16.53% to USD 116.53 million, alongside reducing its net loss significantly from USD 16.7 million to USD 8.81 million in the latest fiscal year. The launch of Vector 8 marks a pivotal advancement in sports technology, offering real-time performance analytics and operational efficiencies that could revolutionize athlete management across various sports by integrating advanced sensors and AI-driven data analysis into its platform. This innovation aligns with Catapult's inclusion in the S&P/ASX Small Ordinaries Index, reflecting growing investor confidence amidst forecasts of revenue growth at an annual rate of 13.9% and becoming profitable within three years—a pace set to outstrip broader market expectations.

- Get an in-depth perspective on Catapult Group International's performance by reading our health report here.

Understand Catapult Group International's track record by examining our Past report.

Nuix (ASX:NXL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market capitalization of approximately A$823.53 million.

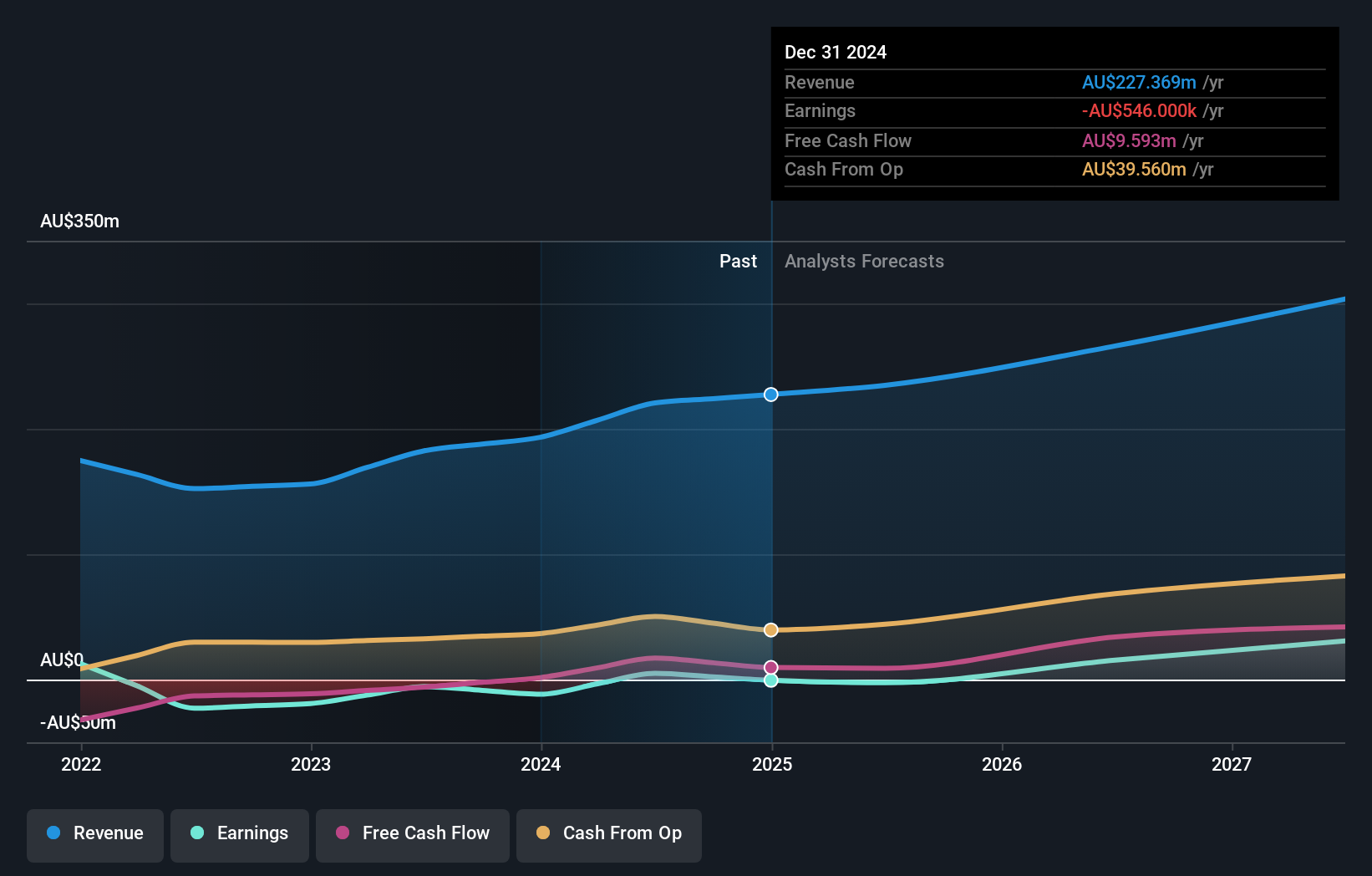

Operations: Nuix Limited generates revenue primarily from its Software & Programming segment, which amounted to A$227.37 million. The company's business model focuses on providing software solutions for investigative analytics and intelligence across multiple global regions.

Nuix, recently added to the S&P/ASX 200 Index, is navigating a challenging phase with a reported increase in sales to AUD 105.19 million from AUD 98.44 million year-over-year, yet experiencing a widening net loss from AUD 4.83 million to AUD 10.4 million in the latest half-year results. Despite current unprofitability, Nuix's revenue growth is projected at an impressive annual rate of 15.3%, outpacing the Australian market average of 5.5%. This growth trajectory is supported by strategic R&D investments aimed at enhancing their software solutions, positioning Nuix to potentially turn profitable within the next three years as forecasted by industry analysts who expect earnings to surge by approximately 54% annually.

- Delve into the full analysis health report here for a deeper understanding of Nuix.

Gain insights into Nuix's historical performance by reviewing our past performance report.

Telix Pharmaceuticals (ASX:TLX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Telix Pharmaceuticals Limited is a commercial-stage biopharmaceutical company that develops and commercializes therapeutic and diagnostic radiopharmaceuticals for cancer and rare diseases across Australia, Belgium, Japan, Switzerland, and the United States with a market cap of A$8.68 billion.

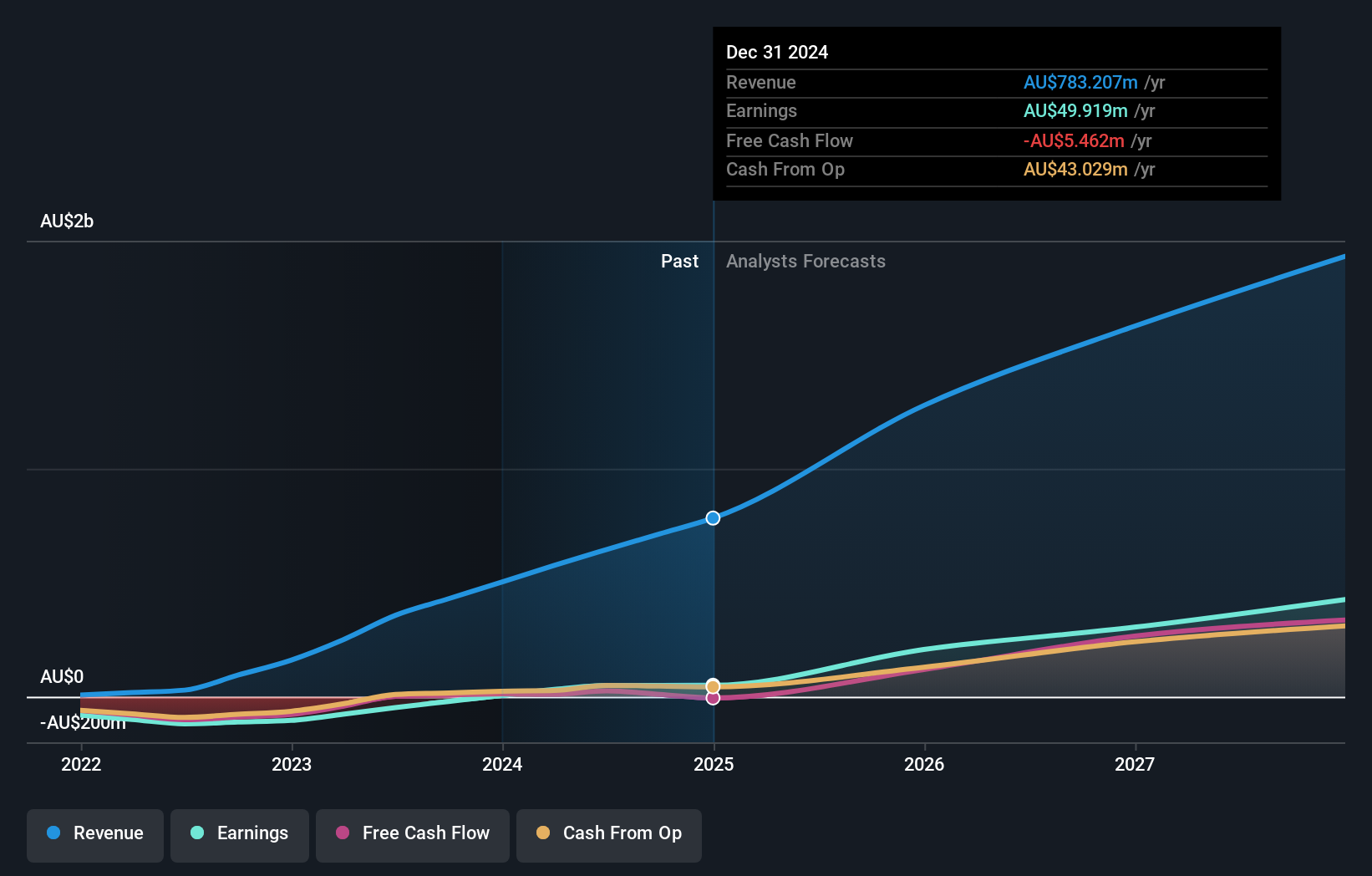

Operations: The company generates revenue primarily from Precision Medicine (A$771.11 million), followed by Therapeutics (A$9.35 million) and Manufacturing Solutions (A$2.75 million).

Telix Pharmaceuticals, a frontrunner in the high-growth sector of radiopharmaceuticals, is making significant strides in expanding its global footprint. Recently securing marketing authorization for Illuccix® in multiple European countries, Telix is enhancing prostate cancer diagnosis with its advanced PSMA-PET imaging technology. This expansion follows a robust 19.5% annual revenue growth and an impressive 33.2% forecast in earnings growth, underpinned by strategic R&D investments which totaled $50 million last year—approximately 12% of their total revenue. These developments not only underscore Telix's commitment to innovation but also position it well for sustained growth in the dynamic field of medical diagnostics and treatment solutions.

Seize The Opportunity

- Navigate through the entire inventory of 49 ASX High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet and good value.

Market Insights

Community Narratives