Bravura Solutions Limited (ASX:BVS) Stock Rockets 65% As Investors Are Less Pessimistic Than Expected

Bravura Solutions Limited (ASX:BVS) shareholders have had their patience rewarded with a 65% share price jump in the last month. The annual gain comes to 130% following the latest surge, making investors sit up and take notice.

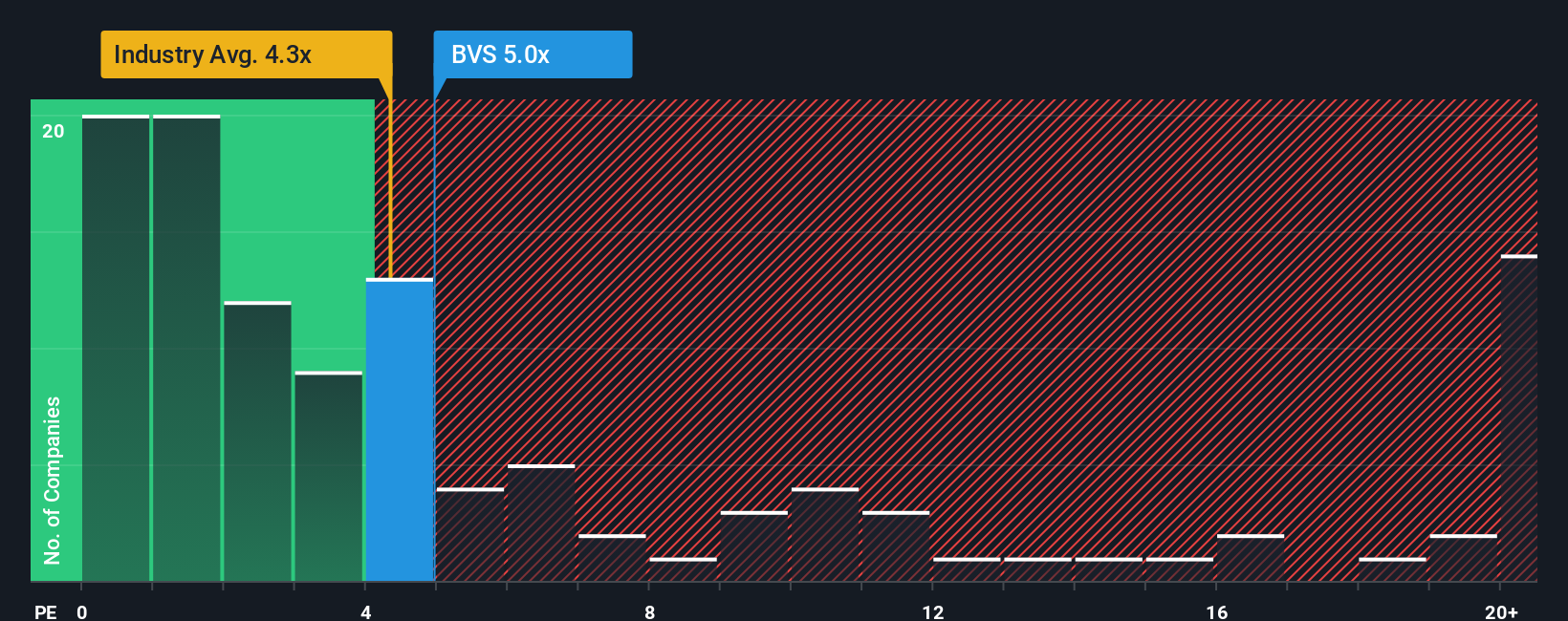

In spite of the firm bounce in price, there still wouldn't be many who think Bravura Solutions' price-to-sales (or "P/S") ratio of 5x is worth a mention when the median P/S in Australia's Software industry is similar at about 4.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Bravura Solutions

How Bravura Solutions Has Been Performing

Bravura Solutions certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Bravura Solutions will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Bravura Solutions' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. As a result, it also grew revenue by 19% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 3.0% per year during the coming three years according to the four analysts following the company. With the industry predicted to deliver 57% growth per annum, that's a disappointing outcome.

With this information, we find it concerning that Bravura Solutions is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Bottom Line On Bravura Solutions' P/S

Bravura Solutions appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears that Bravura Solutions currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Bravura Solutions, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Bravura Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bravura Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BVS

Bravura Solutions

Provides software solutions for the wealth management and transfer agency industries in Australia, the United Kingdom, New Zealand, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success