Bravura Solutions Limited (ASX:BVS) Analysts Just Cut Their EPS Forecasts Substantially

Today is shaping up negative for Bravura Solutions Limited (ASX:BVS) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

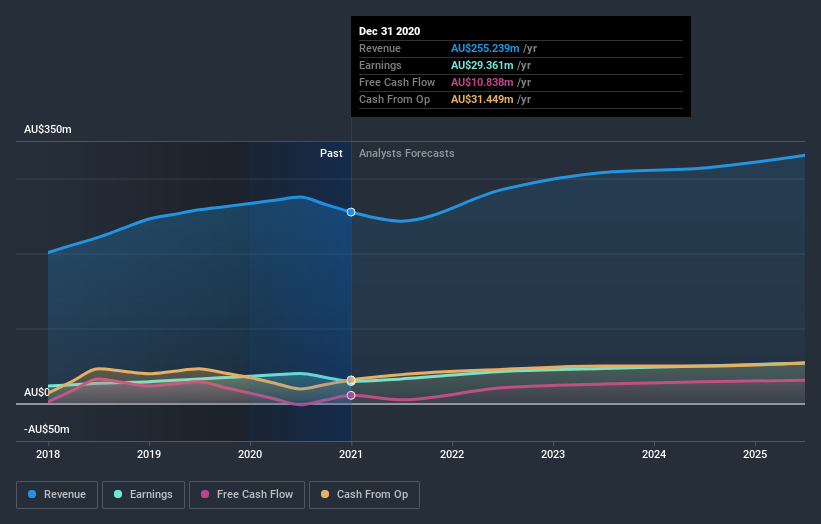

Following the latest downgrade, the current consensus, from the five analysts covering Bravura Solutions, is for revenues of AU$243m in 2021, which would reflect a measurable 4.7% reduction in Bravura Solutions' sales over the past 12 months. Statutory earnings per share are presumed to accumulate 9.6% to AU$0.13. Previously, the analysts had been modelling revenues of AU$272m and earnings per share (EPS) of AU$0.15 in 2021. It looks like analyst sentiment has declined substantially, with a substantial drop in revenue estimates and a considerable drop in earnings per share numbers as well.

Check out our latest analysis for Bravura Solutions

Analysts made no major changes to their price target of AU$3.49, suggesting the downgrades are not expected to have a long-term impact on Bravura Solutions' valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Bravura Solutions at AU$5.00 per share, while the most bearish prices it at AU$2.80. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 9.2% by the end of 2021. This indicates a significant reduction from annual growth of 8.6% over the last three years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 17% per year. It's pretty clear that Bravura Solutions' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Bravura Solutions. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Bravura Solutions' revenues are expected to grow slower than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of Bravura Solutions.

Uncomfortably, our automated valuation tool also suggests that Bravura Solutions stock could be overvalued following the downgrade. Shareholders could be left disappointed if these estimates play out. Learn why, and examine the assumptions that underpin our valuation by visiting our free platform here to learn more about our valuation approach.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Bravura Solutions or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bravura Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BVS

Bravura Solutions

Develops, licenses, and maintains administration and management software applications for the wealth management and funds administration sectors in Australia, the United Kingdom, New Zealand, and internationally.

Flawless balance sheet with acceptable track record.