Bravura Solutions (ASX:BVS): Assessing Valuation After Upgraded Outlook and CEO Appointment

Reviewed by Kshitija Bhandaru

Bravura Solutions (ASX:BVS) shares are drawing fresh interest after the company raised its annual revenue and profit outlook and named a new CEO. These moves suggest shifting momentum and evolving leadership.

See our latest analysis for Bravura Solutions.

Bravura’s latest leadership shake-up and raised guidance have prompted the shares to touch fresh 12-month highs, supported by a stronger British pound and improved project revenue in EMEA. While the one-year total shareholder return is just 1.7%, investors are now watching to see if momentum can build on these signs of operational improvement and strategic focus.

If Bravura’s renewed outlook has you thinking bigger, it might be the perfect time to broaden your investing search and discover fast growing stocks with high insider ownership

But do Bravura’s upgraded guidance and leadership changes signal a true undervaluation? Alternatively, have recent gains already factored in the company’s brighter outlook, leaving little room for further upside?

Most Popular Narrative: 17% Overvalued

Bravura Solutions' current narrative-implied fair value of A$2.86 sits below the most recent closing price of A$3.33, highlighting a premium in recent trading. This gap underscores the market’s heightened expectations. The narrative points to efficiency initiatives as a driving force for value ahead.

Bullish analysts see improved profit margins as a sign that operational efficiency initiatives are taking effect. This supports a more favorable earnings outlook.

Curious what underpins this valuation? There is a quantitative formula at play, hinting at major shifts in profit margins and a future earnings multiple that outpaces much of the sector. To see how these financial ingredients combine to drive the fair value higher than you might expect, delve deeper into the full narrative.

Result: Fair Value of $2.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent client attrition and limited new customer wins could undermine Bravura’s outlook. These factors may signal potential hurdles for future revenue stability.

Find out about the key risks to this Bravura Solutions narrative.

Another View: Multiples Tell a Different Story

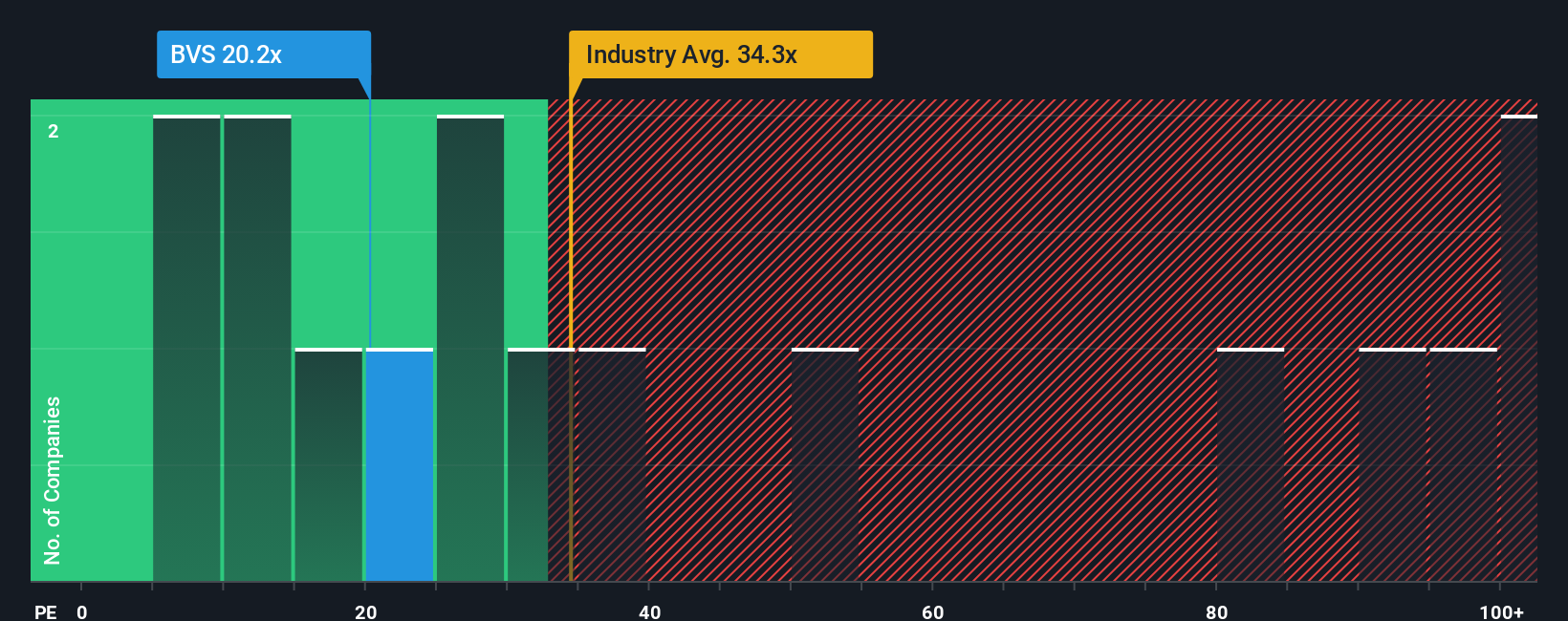

Looking at valuation through a different lens, Bravura Solutions trades on a price-to-earnings ratio of 20.1x, which stands well below the industry average of 38.1x and its peer group’s 34.9x. Interestingly, this ratio also sits under its fair ratio of 26.6x. This suggests the shares may actually offer value despite concerns from the narrative-based approach. Could this gap mean the market is missing something, or is caution still justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bravura Solutions Narrative

If you think there’s another angle or want to dig into the numbers on your own terms, you can craft your own view in just a few minutes, Do it your way

A great starting point for your Bravura Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Make your next move count by tapping into market trends that others might overlook. The right idea could put you ahead of the crowd.

- Tap into surging market innovation with these 24 AI penny stocks as they are positioned to benefit from artificial intelligence breakthroughs.

- Maximize your income potential by scanning these 19 dividend stocks with yields > 3% that offer high dividend yields to boost your returns.

- Ride the momentum of financial disruption by evaluating these 78 cryptocurrency and blockchain stocks which power the future of digital assets and payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bravura Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BVS

Bravura Solutions

Provides software solutions for the wealth management and transfer agency industries in Australia, the United Kingdom, New Zealand, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)