Investors bid BrainChip Holdings (ASX:BRN) up AU$62m despite increasing losses YoY, taking three-year CAGR to 51%

It hasn't been the best quarter for BrainChip Holdings Ltd (ASX:BRN) shareholders, since the share price has fallen 18% in that time. But that doesn't change the fact that the returns over the last three years have been very strong. In fact, the share price is up a full 248% compared to three years ago. It's not uncommon to see a share price retrace a bit, after a big gain. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for BrainChip Holdings

BrainChip Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

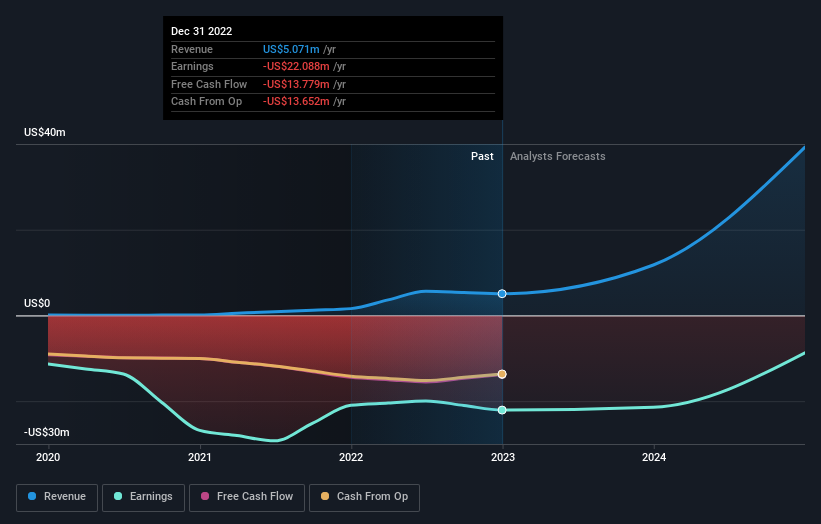

In the last 3 years BrainChip Holdings saw its revenue grow at 110% per year. That's well above most pre-profit companies. Along the way, the share price gained 51% per year, a solid pop by our standards. This suggests the market has recognized the progress the business has made, at least to a significant degree. Nonetheless, we'd say BrainChip Holdings is still worth investigating - successful businesses can often keep growing for long periods.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at BrainChip Holdings' financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 15% in the last year, BrainChip Holdings shareholders lost 63%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 21%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand BrainChip Holdings better, we need to consider many other factors. For instance, we've identified 2 warning signs for BrainChip Holdings that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BrainChip Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BRN

BrainChip Holdings

Develops software and hardware accelerated solutions for artificial intelligence and machine learning applications in North America, Oceania, Europe, the Middle East, and Asia.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026