Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, Appen (ASX:APX) shareholders have done very well over the last year, with the share price soaring by 112%. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given its strong share price performance, we think it's worthwhile for Appen shareholders to consider whether its cash burn is concerning. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

When Might Appen Run Out Of Money?

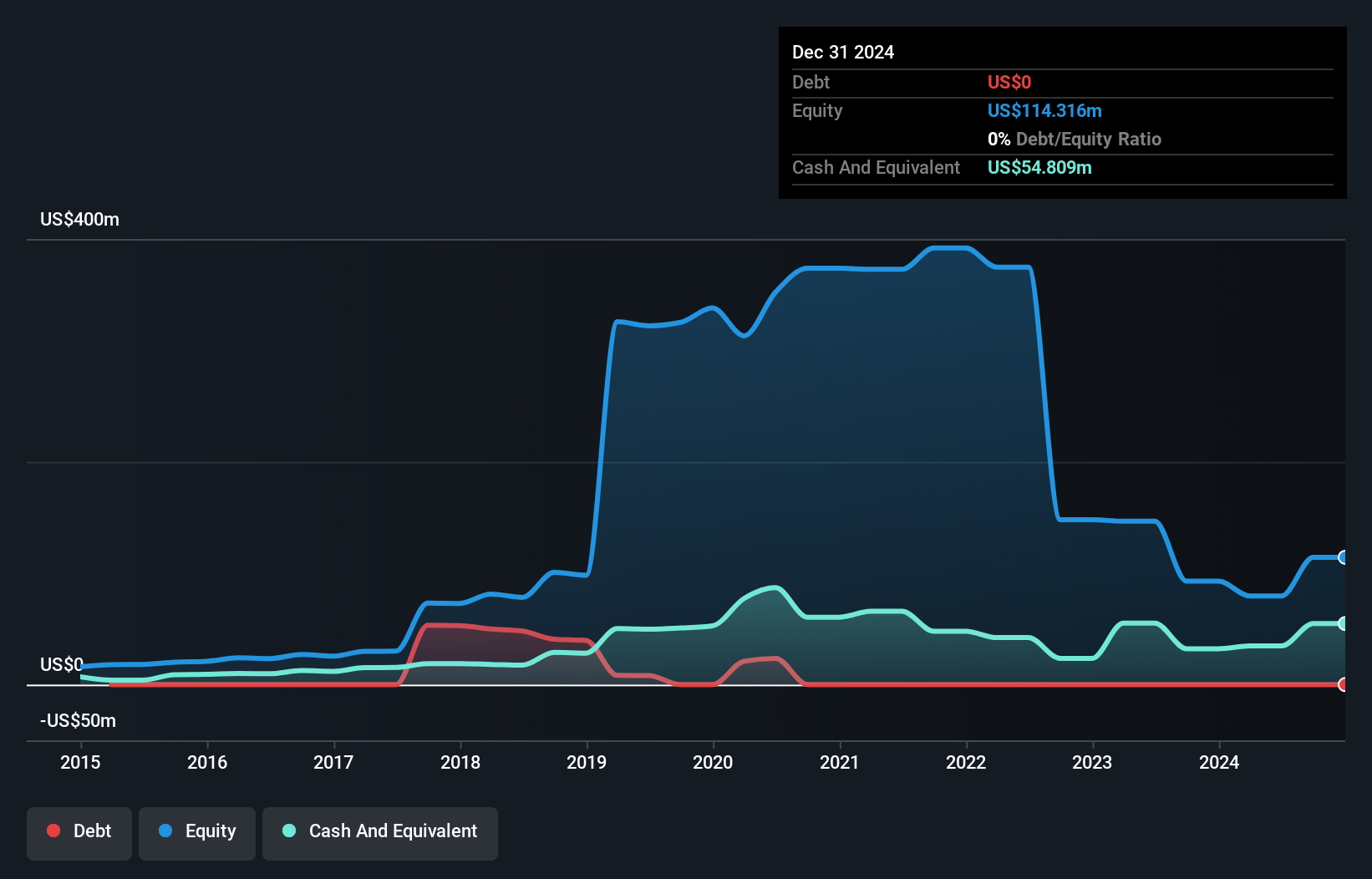

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at December 2024, Appen had cash of US$55m and no debt. In the last year, its cash burn was US$14m. That means it had a cash runway of about 4.1 years as of December 2024. Notably, however, analysts think that Appen will break even (at a free cash flow level) before then. If that happens, then the length of its cash runway, today, would become a moot point. You can see how its cash balance has changed over time in the image below.

See our latest analysis for Appen

How Well Is Appen Growing?

Happily, Appen is travelling in the right direction when it comes to its cash burn, which is down 68% over the last year. But it was a bit disconcerting to see operating revenue down 14% in that time. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Appen To Raise More Cash For Growth?

We are certainly impressed with the progress Appen has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Appen has a market capitalisation of US$181m and burnt through US$14m last year, which is 7.5% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Appen's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Appen's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. While its falling revenue wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. It's clearly very positive to see that analysts are forecasting the company will break even fairly soon. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Taking an in-depth view of risks, we've identified 2 warning signs for Appen that you should be aware of before investing.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:APX

Appen

Operates as an AI lifecycle company that provides data sourcing, data annotation, and model evaluation solutions in Australia, the United States, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.