Investing in Life360 (ASX:360) five years ago would have delivered you a 941% gain

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. To wit, the Life360, Inc. (ASX:360) share price has soared 934% over five years. If that doesn't get you thinking about long term investing, we don't know what will. Also pleasing for shareholders was the 68% gain in the last three months. It really delights us to see such great share price performance for investors.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

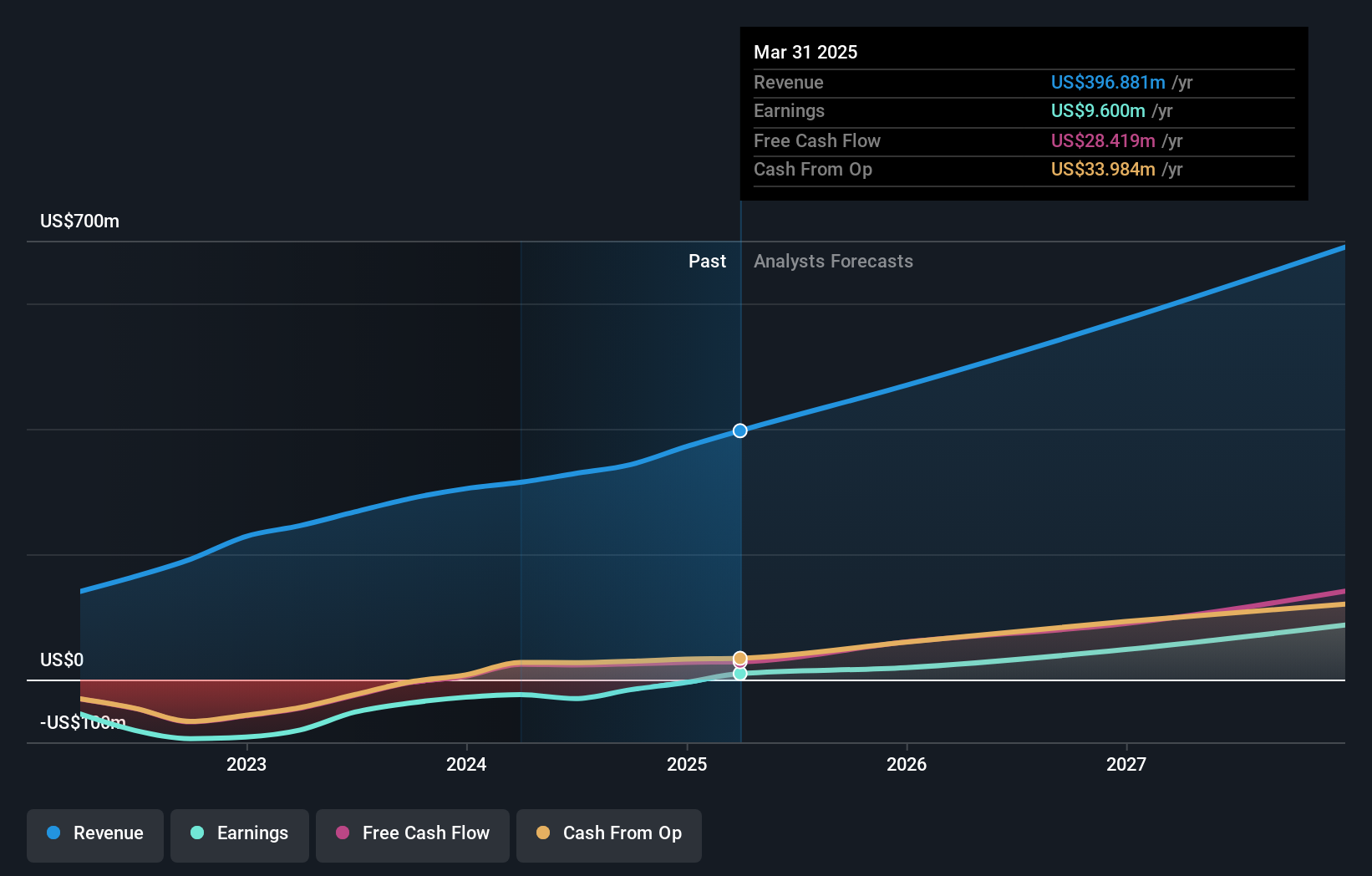

Given that Life360 only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Life360 saw its revenue grow at 35% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 60%(per year) over the same period. It's never too late to start following a top notch stock like Life360, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Life360 is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Life360 stock, you should check out this free report showing analyst consensus estimates for future profits.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Life360's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Life360's TSR, at 941% is higher than its share price return of 934%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

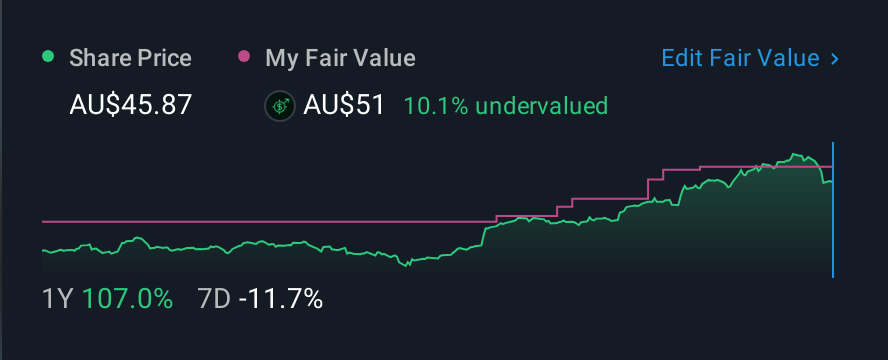

It's good to see that Life360 has rewarded shareholders with a total shareholder return of 166% in the last twelve months. That gain is better than the annual TSR over five years, which is 60%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Life360 that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:360

Life360

Operates a technology platform to locate people, pets, and things in North America, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives