- Australia

- /

- Semiconductors

- /

- ASX:AXE

Investors ignore increasing losses at Archer Materials (ASX:AXE) as stock jumps 19% this past week

While Archer Materials Limited (ASX:AXE) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 13% in the last quarter. But that doesn't change the fact that the returns over the last five years have been very strong. It's fair to say most would be happy with 292% the gain in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Ultimately business performance will determine whether the stock price continues the positive long term trend. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 43% drop, in the last year.

Since it's been a strong week for Archer Materials shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Archer Materials

SWOT Analysis for Archer Materials

- Currently debt free.

- Shareholders have been diluted in the past year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Lack of analyst coverage makes it difficult to determine AXE's earnings prospects.

- No apparent threats visible for AXE.

Because Archer Materials made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years Archer Materials saw its revenue grow at 47% per year. Even measured against other revenue-focussed companies, that's a good result. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 31% per year, compound, during the period. This suggests the market has well and truly recognized the progress the business has made. To our minds that makes Archer Materials worth investigating - it may have its best days ahead.

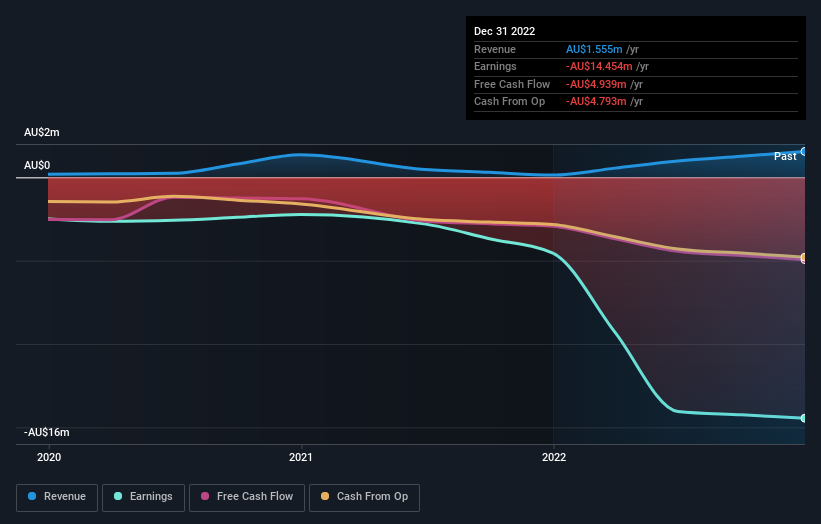

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Archer Materials' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Archer Materials had a tough year, with a total loss of 43%, against a market gain of about 2.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 31% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Archer Materials (1 doesn't sit too well with us) that you should be aware of.

Of course Archer Materials may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AXE

Archer Materials

A technology company, engages in development and commercialization of semiconductor devices and sensors related to quantum computing and medical diagnostics in Australia.

Flawless balance sheet low.

Market Insights

Community Narratives