- Australia

- /

- Metals and Mining

- /

- ASX:LM8

ASX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Australian market has shown mixed performance, with the ASX200 closing slightly down at 8,436 points. Despite fluctuations across sectors, the materials sector has been a standout performer. In this context, penny stocks—often smaller or newer companies—remain an intriguing investment area due to their affordability and potential for growth. While the term may seem outdated, these stocks can offer value when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.05 | A$333.78M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.83 | A$101.23M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.79 | A$231.32M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.69 | A$828.23M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.01 | A$113.04M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$69.71M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.86 | A$479.51M | ★★★★☆☆ |

Click here to see the full list of 1,043 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Archer Materials (ASX:AXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Archer Materials Limited is an Australian technology company focused on developing and commercializing semiconductor devices and sensors for quantum computing and medical diagnostics, with a market cap of A$80.28 million.

Operations: The company's revenue segment is Materials Technology Research and Development, generating A$2.14 million.

Market Cap: A$80.28M

Archer Materials, with a market cap of A$80.28 million, operates in the technology sector focusing on semiconductors and sensors but remains pre-revenue with only A$2.14 million generated from research activities. The company is debt-free and has sufficient cash runway for over three years, which provides some financial stability despite its unprofitability and high share price volatility. The management team is experienced, averaging 6.9 years in tenure, which may offer strategic leadership as they navigate technological advancements discussed in recent presentations and meetings. However, the negative return on equity highlights ongoing profitability challenges amidst declining earnings over five years.

- Jump into the full analysis health report here for a deeper understanding of Archer Materials.

- Review our historical performance report to gain insights into Archer Materials' track record.

GTN (ASX:GTN)

Simply Wall St Financial Health Rating: ★★★★★★

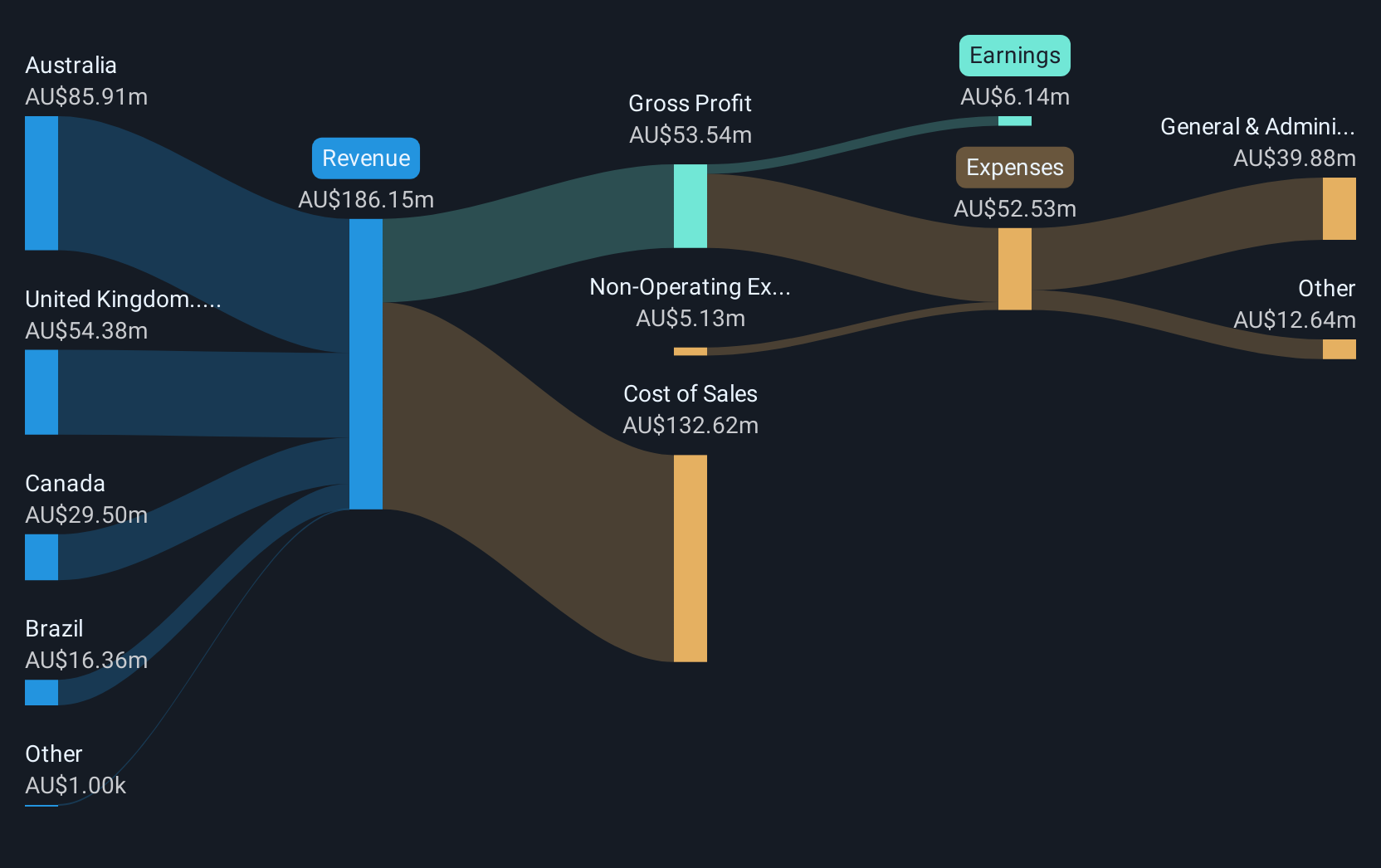

Overview: GTN Limited operates broadcast media advertising platforms providing traffic and news information reports to radio stations in Australia, Canada, the United Kingdom, and Brazil, with a market cap of A$104.85 million.

Operations: The company generates revenue of A$184.23 million from its advertising segment.

Market Cap: A$104.85M

GTN Limited, with a market cap of A$104.85 million, has shown robust earnings growth of 114.9% over the past year, surpassing industry averages and reversing a five-year decline trend. The company benefits from strong financial health, with short-term assets exceeding liabilities and more cash than total debt. Despite this positive outlook, GTN's dividend is not well covered by earnings and its return on equity remains low at 2.6%. Recent board changes reflect Viburnum Funds' influence following their proposal to acquire a larger stake in GTN; however, the board advises shareholders against taking action on this offer currently.

- Unlock comprehensive insights into our analysis of GTN stock in this financial health report.

- Assess GTN's future earnings estimates with our detailed growth reports.

Lunnon Metals (ASX:LM8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lunnon Metals Limited is engaged in the exploration and development of nickel and gold in Australia, with a market cap of A$58.42 million.

Operations: The company generates revenue from its mineral exploration activities, amounting to A$0.001551 million.

Market Cap: A$58.42M

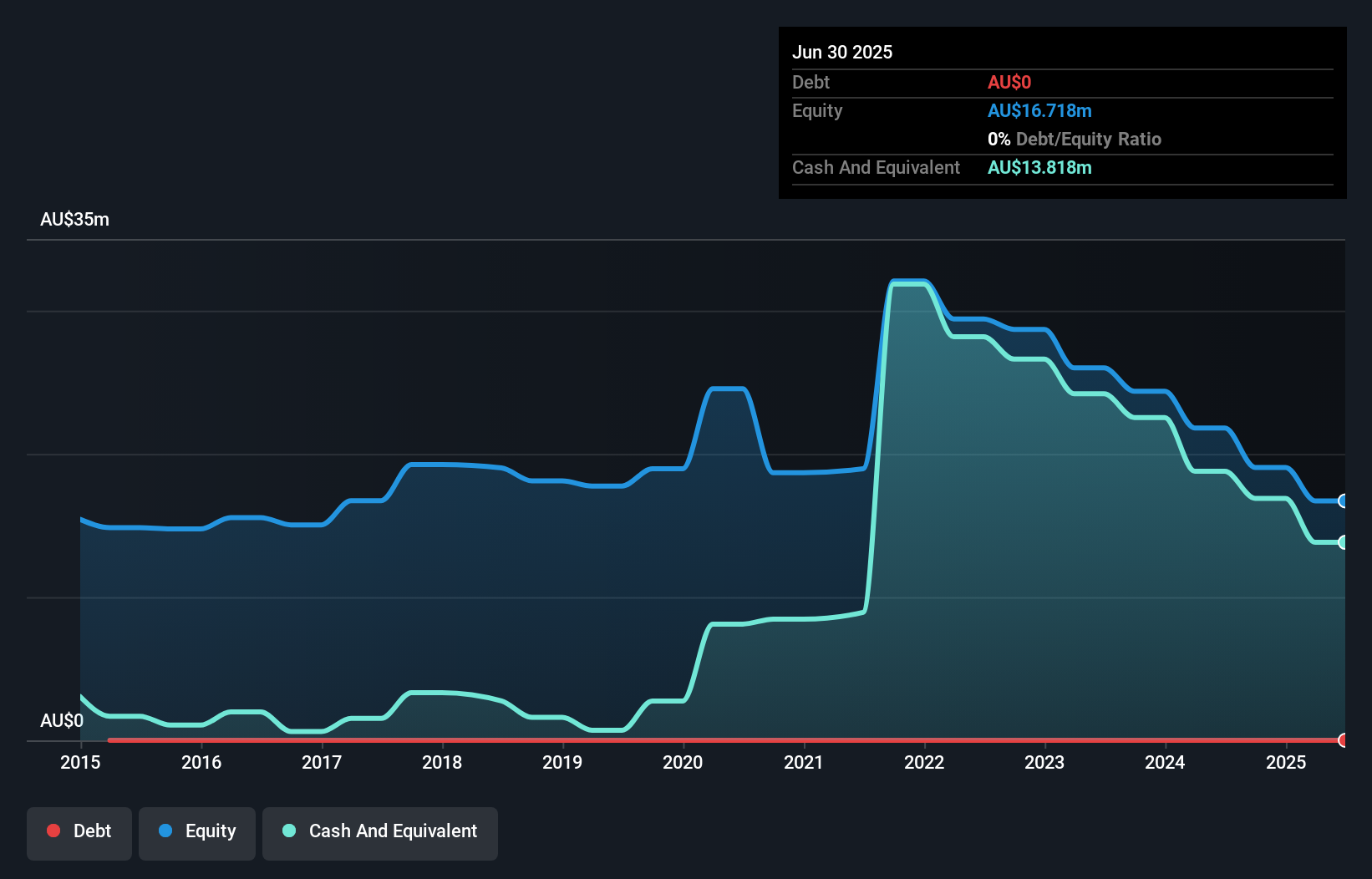

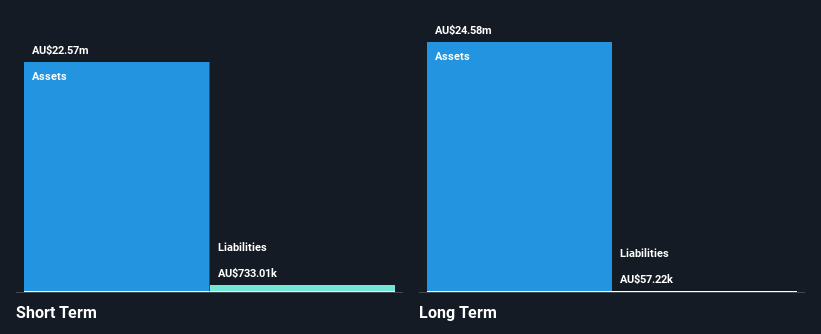

Lunnon Metals, with a market cap of A$58.42 million, remains pre-revenue with its focus on nickel and gold exploration. Despite being debt-free and having short-term assets significantly exceeding liabilities, the company faces challenges in profitability, reflected by a negative return on equity of -52%. Its share price has been highly volatile recently. The recent resignation of its CFO and delisting from OTC Equity due to inactivity highlight operational hurdles. However, Lunnon's seasoned management team is shifting focus towards gold exploration in the St Ives camp while deferring nickel project developments amid challenging market conditions.

- Dive into the specifics of Lunnon Metals here with our thorough balance sheet health report.

- Examine Lunnon Metals' earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Investigate our full lineup of 1,043 ASX Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LM8

Lunnon Metals

Focuses on the exploration and development of nickel and gold in Australia.

Flawless balance sheet with moderate growth potential.