- Australia

- /

- Specialty Stores

- /

- ASX:STP

Little Excitement Around Step One Clothing Limited's (ASX:STP) Earnings As Shares Take 38% Pounding

The Step One Clothing Limited (ASX:STP) share price has fared very poorly over the last month, falling by a substantial 38%. For any long-term shareholders, the last month ends a year to forget by locking in a 80% share price decline.

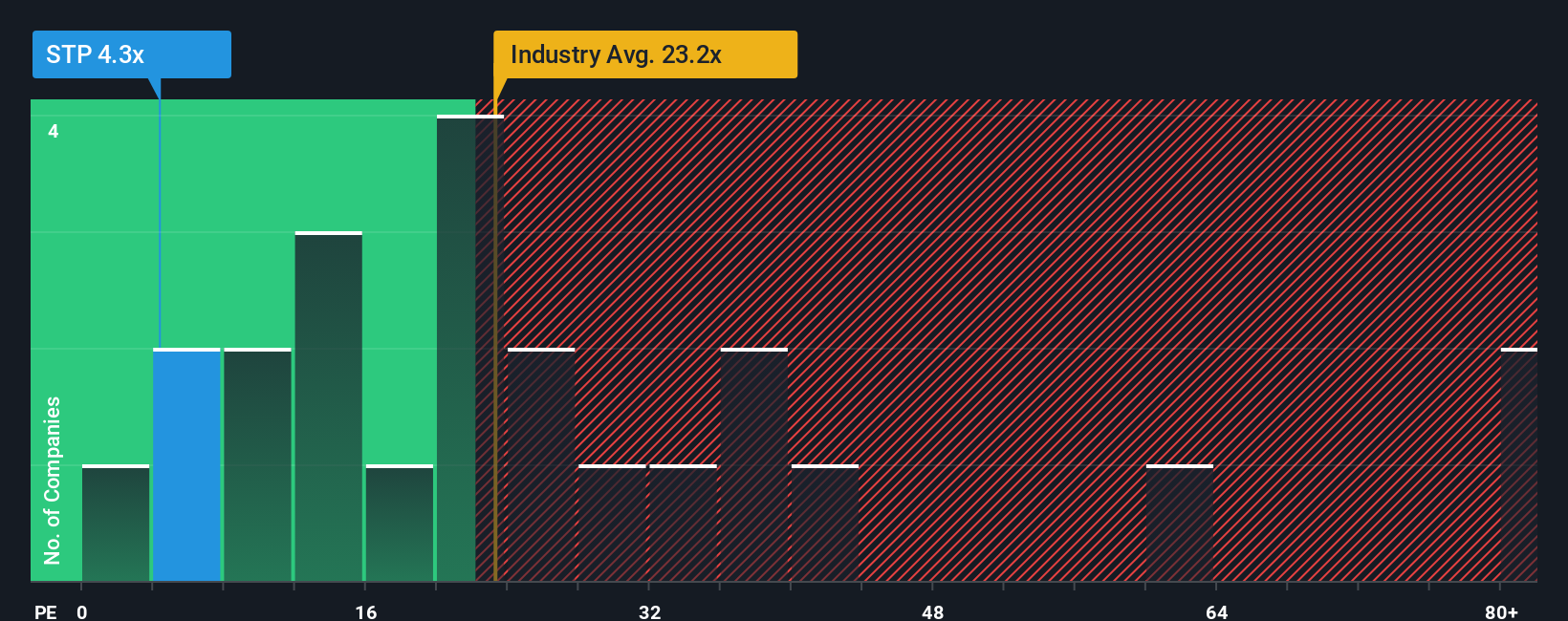

Although its price has dipped substantially, given about half the companies in Australia have price-to-earnings ratios (or "P/E's") above 22x, you may still consider Step One Clothing as a highly attractive investment with its 4.3x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Step One Clothing could be doing better as it's been growing earnings less than most other companies lately. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

View our latest analysis for Step One Clothing

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Step One Clothing would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings growth is heading into negative territory, declining 10% per annum over the next three years. With the market predicted to deliver 18% growth each year, that's a disappointing outcome.

In light of this, it's understandable that Step One Clothing's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Step One Clothing's P/E

Having almost fallen off a cliff, Step One Clothing's share price has pulled its P/E way down as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Step One Clothing maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Step One Clothing (3 don't sit too well with us!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Step One Clothing, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:STP

Step One Clothing

Operates as a direct-to-consumer online retailer for underwear in the United Kingdom, the United States, and Australia.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026