As the ASX200 faces a downturn, with sectors like materials and real estate experiencing notable declines, investors are closely monitoring new developments such as the DigiCo data centre REIT listing to gauge market sentiment. In this fluctuating environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to navigate uncertain market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.69% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.36% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.63% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.08% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.36% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.66% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.10% | ★★★★★☆ |

| CTI Logistics (ASX:CLX) | 5.64% | ★★★★☆☆ |

| Sugar Terminals (NSX:SUG) | 7.59% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 8.51% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

CTI Logistics (ASX:CLX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CTI Logistics Limited, with a market cap of A$156.52 million, operates in Australia offering transport and logistics services through its subsidiaries.

Operations: CTI Logistics Limited generates revenue through its main segments of Transport, contributing A$225.42 million, and Logistics, adding A$118.28 million.

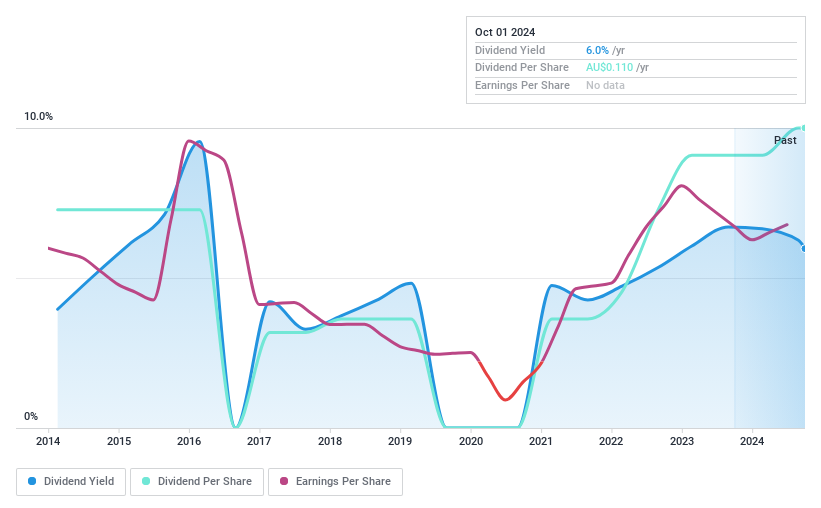

Dividend Yield: 5.6%

CTI Logistics offers a mixed dividend profile. Despite a reasonable payout ratio of 51.2% and coverage by cash flows at 57.2%, its dividend history has been unstable, with volatility over the past decade. The current yield of 5.64% is below the top tier in Australia, though dividends have grown over time. Trading at good value relative to peers and industry, CTI's earnings are expected to grow annually by 14.41%, which may support future dividends despite past inconsistencies.

- Take a closer look at CTI Logistics' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that CTI Logistics is trading behind its estimated value.

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited, with a market cap of A$1.29 billion, is involved in the sourcing and retailing of household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: Nick Scali Limited generates revenue of A$468.19 million from its furniture retailing operations.

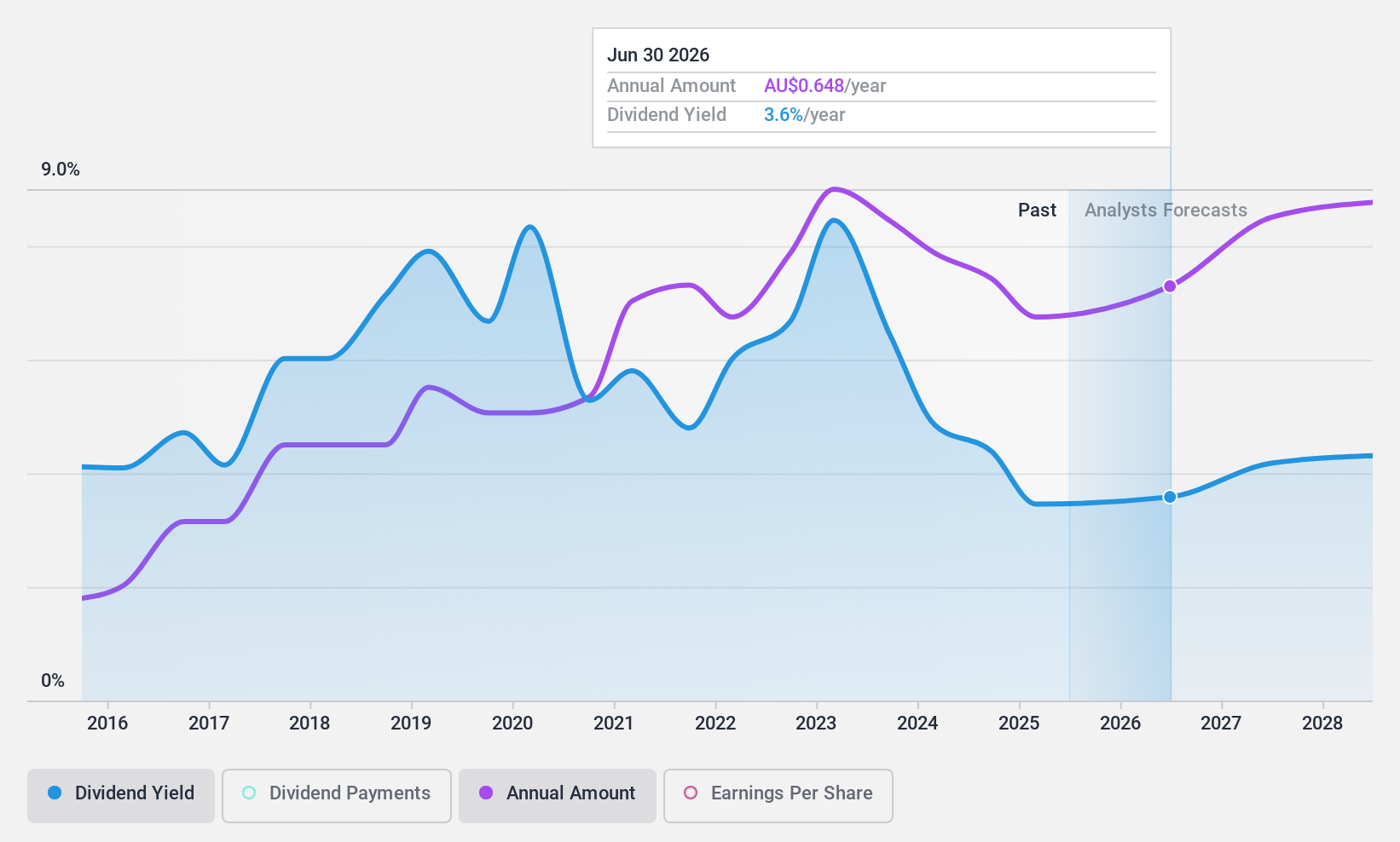

Dividend Yield: 4.4%

Nick Scali presents a solid dividend profile, with dividends covered by earnings (payout ratio: 68.9%) and cash flows (cash payout ratio: 55%). Its dividend yield of 4.36% is reliable but lower than the top quartile in Australia. Over the past decade, dividends have been stable and growing, supported by an anticipated earnings growth of 8.5% annually. Trading at a good value relative to peers and industry, Nick Scali's stock offers potential appeal for income-focused investors.

- Click to explore a detailed breakdown of our findings in Nick Scali's dividend report.

- According our valuation report, there's an indication that Nick Scali's share price might be on the cheaper side.

Shaver Shop Group (ASX:SSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shaver Shop Group Limited operates as a retailer of personal care and grooming products in Australia and New Zealand, with a market cap of A$171.63 million.

Operations: Shaver Shop Group Limited generates revenue through retail store sales of specialist personal grooming products, amounting to A$219.37 million.

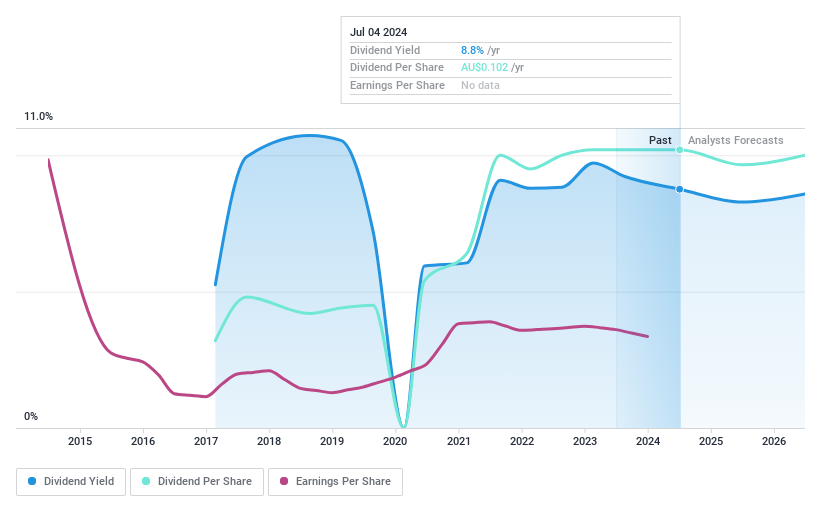

Dividend Yield: 7.8%

Shaver Shop Group's dividend yield is among the top 25% in Australia at 7.79%, with dividends covered by earnings (payout ratio: 87%) and cash flows (cash payout ratio: 48.1%). However, its dividend history is less stable, with only eight years of payments and some volatility. The stock trades at a substantial discount to its estimated fair value, offering potential value for investors despite recent insider selling and an unstable track record.

- Get an in-depth perspective on Shaver Shop Group's performance by reading our dividend report here.

- The analysis detailed in our Shaver Shop Group valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Reveal the 31 hidden gems among our Top ASX Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CLX

Undervalued with adequate balance sheet and pays a dividend.