- Australia

- /

- Retail Distributors

- /

- ASX:SNL

ASX Value Picks Eagers Automotive And 2 Other Stocks Below Estimated Worth

Reviewed by Simply Wall St

As the Australian stock market experiences a mix of optimism and caution, highlighted by fluctuating indices and recent corporate announcements, investors are keenly observing potential opportunities amidst the volatility. In such an environment, identifying undervalued stocks becomes crucial as they may offer attractive entry points for those looking to capitalize on discrepancies between current prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Telix Pharmaceuticals (ASX:TLX) | A$14.81 | A$24.99 | 40.7% |

| Regal Partners (ASX:RPL) | A$2.97 | A$4.91 | 39.5% |

| NRW Holdings (ASX:NWH) | A$5.41 | A$8.98 | 39.8% |

| LGI (ASX:LGI) | A$4.05 | A$7.76 | 47.8% |

| Immutep (ASX:IMM) | A$0.26 | A$0.48 | 45.9% |

| Guzman y Gomez (ASX:GYG) | A$22.31 | A$39.25 | 43.2% |

| Cromwell Property Group (ASX:CMW) | A$0.48 | A$0.87 | 44.9% |

| CleanSpace Holdings (ASX:CSX) | A$0.655 | A$1.11 | 41% |

| Betmakers Technology Group (ASX:BET) | A$0.175 | A$0.34 | 49% |

| Airtasker (ASX:ART) | A$0.34 | A$0.63 | 46.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Eagers Automotive (ASX:APE)

Overview: Eagers Automotive Limited operates motor vehicle dealerships across Australia and New Zealand, with a market cap of A$7.58 billion.

Operations: Eagers Automotive generates its revenue primarily from car retailing, amounting to A$12.23 billion, complemented by a property segment contributing A$54.69 million.

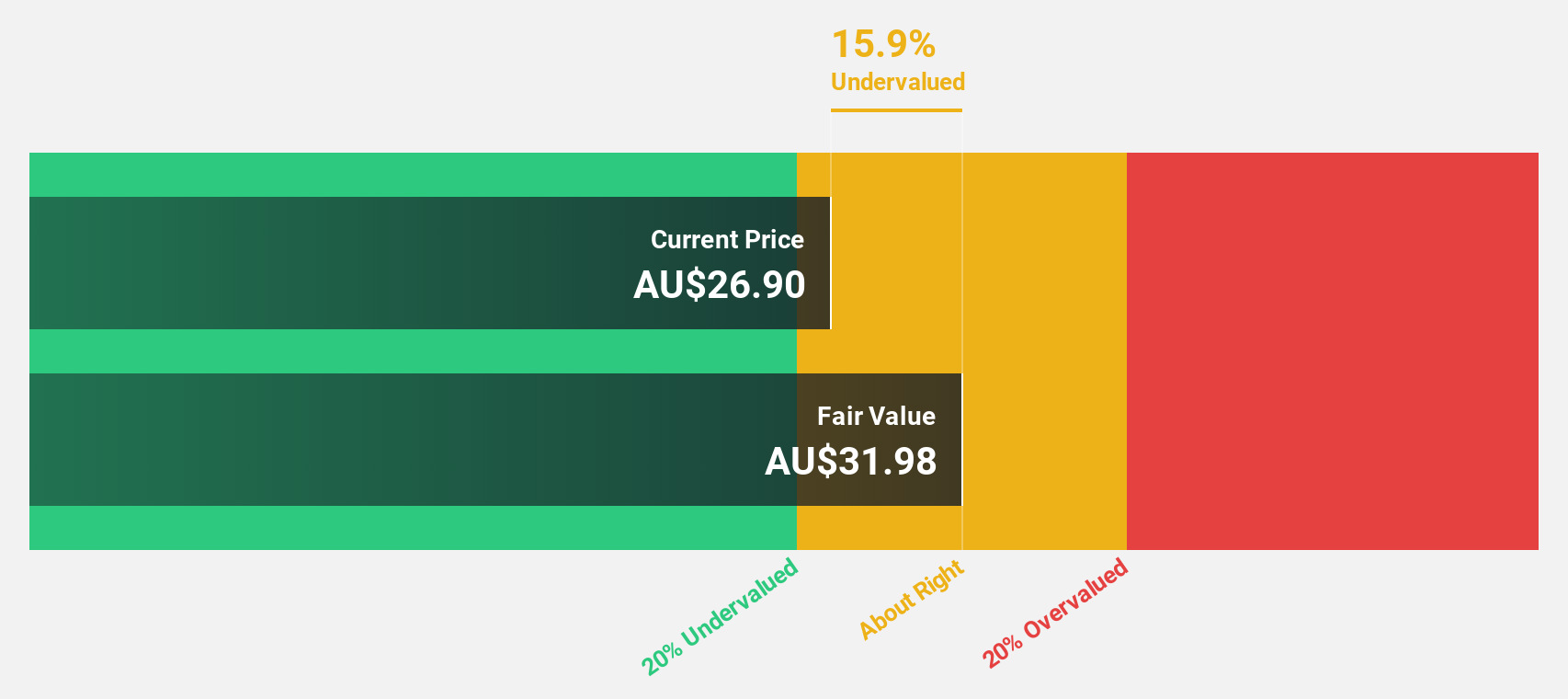

Estimated Discount To Fair Value: 16%

Eagers Automotive is trading at A$26.84, below its estimated fair value of A$31.96, suggesting it may be undervalued based on cash flows. Despite a profit margin decline to 1.7% from 2.5%, earnings are forecast to grow significantly over the next three years, outpacing the Australian market's growth rate of 12%. Recent equity offerings totaling over A$1 billion indicate strategic financial maneuvers aimed at bolstering capital for future growth initiatives and partnerships like that with Mitsubishi Corporation.

- Upon reviewing our latest growth report, Eagers Automotive's projected financial performance appears quite optimistic.

- Take a closer look at Eagers Automotive's balance sheet health here in our report.

Supply Network (ASX:SNL)

Overview: Supply Network Limited supplies aftermarket parts for commercial vehicles in Australia and New Zealand, with a market cap of A$1.44 billion.

Operations: The company's revenue segment consists of A$349.46 million from providing aftermarket parts for the commercial vehicle market in Australia and New Zealand.

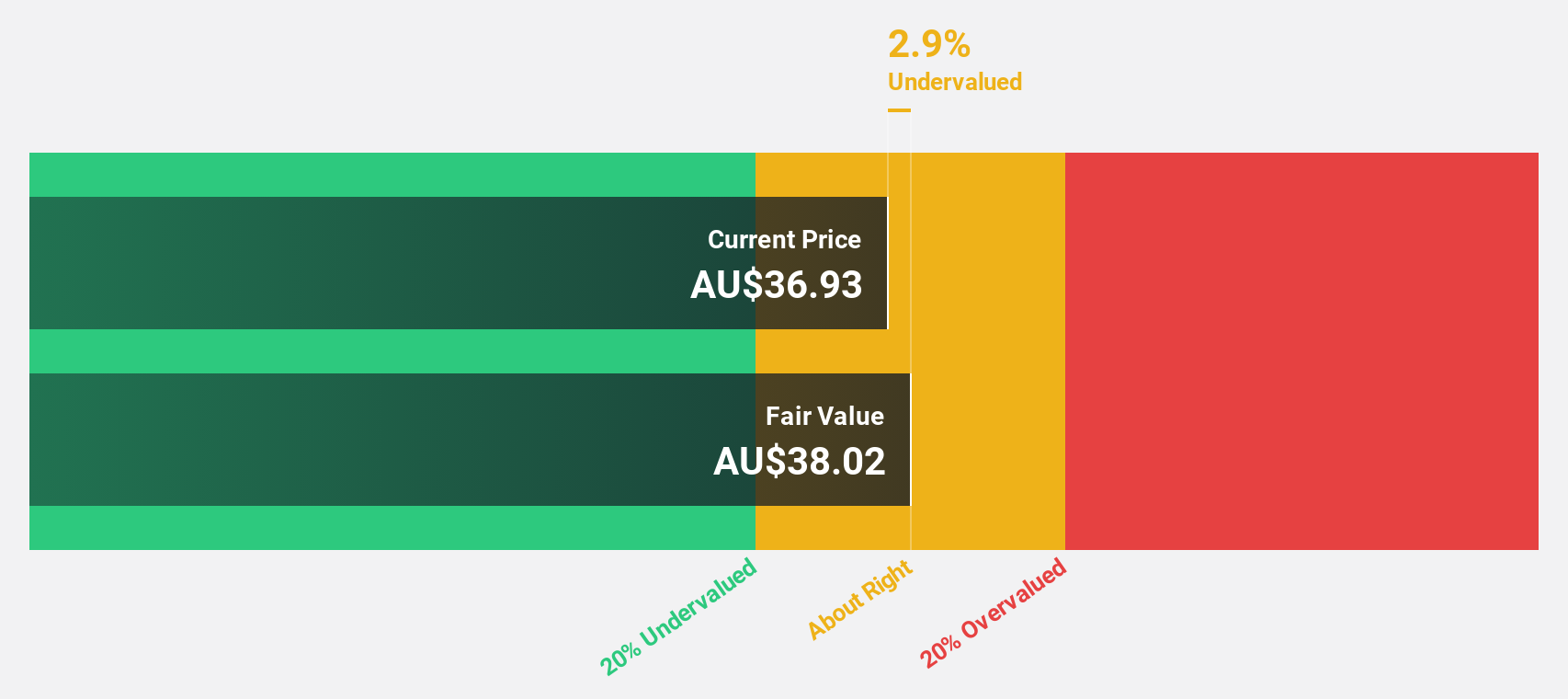

Estimated Discount To Fair Value: 11.9%

Supply Network is trading at A$32.96, slightly below its estimated fair value of A$37.4, indicating potential undervaluation based on cash flows. Earnings are projected to grow at 14.4% annually, surpassing the Australian market's 12% growth rate, while revenue is expected to increase by 11% per year. Recent board changes include Karen Phin's appointment as an independent director and her membership in key committees, enhancing governance and strategic oversight capabilities.

- Our growth report here indicates Supply Network may be poised for an improving outlook.

- Navigate through the intricacies of Supply Network with our comprehensive financial health report here.

Smart Parking (ASX:SPZ)

Overview: Smart Parking Limited, with a market cap of A$559.42 million, operates in the design, development, and management of parking management solutions across New Zealand, Australia, Denmark, Germany, and the United Kingdom.

Operations: The company's revenue segments include A$5.27 million from the Technology Division and A$75.51 million from Parking Management across Denmark, Germany, Australia, New Zealand, the United States, and the United Kingdom.

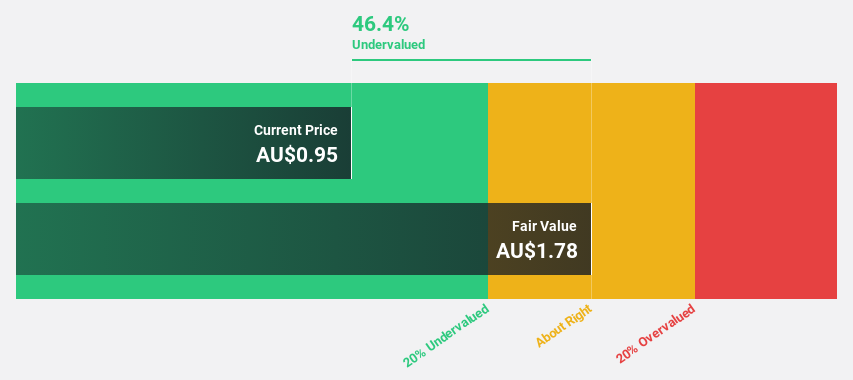

Estimated Discount To Fair Value: 39.5%

Smart Parking is trading at A$1.37, significantly below its estimated fair value of A$2.26, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow 35% annually, outpacing the Australian market's 12% growth rate, although revenue growth is slower than 20% per year but faster than the market average. Despite recent shareholder dilution and low future return on equity forecasts, its addition to the S&P Global BMI Index underscores its market relevance.

- The growth report we've compiled suggests that Smart Parking's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Smart Parking.

Taking Advantage

- Unlock our comprehensive list of 30 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SNL

Supply Network

Provides aftermarket parts to the commercial vehicle market in Australia and New Zealand.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026