The Redbubble (ASX:RBL) Share Price Has Soared 615%, Delighting Many Shareholders

It might be of some concern to shareholders to see the Redbubble Limited (ASX:RBL) share price down 20% in the last month. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. In that time, shareholders have had the pleasure of a 615% boost to the share price. So we wouldn't blame sellers for taking some profits. While winners often keep winning, it can pay to be cautious after a strong rise.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Redbubble

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Redbubble went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

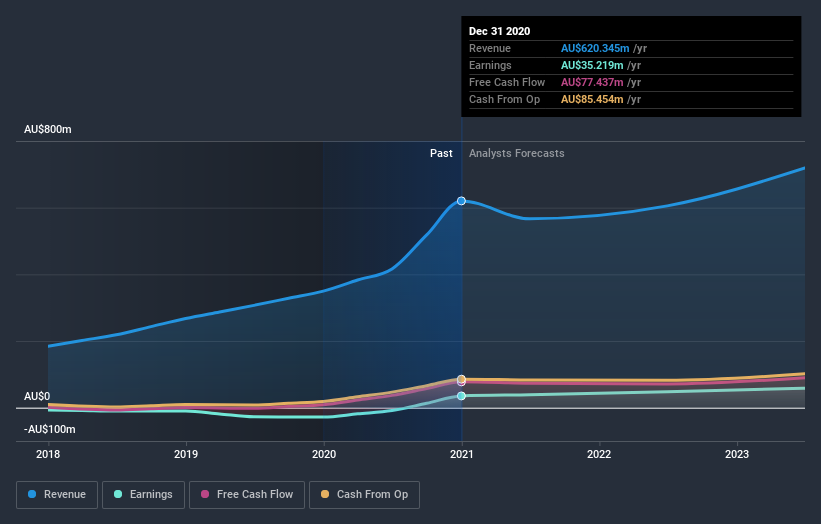

We think that the revenue growth of 77% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Redbubble in this interactive graph of future profit estimates.

A Different Perspective

Pleasingly, Redbubble's total shareholder return last year was 615%. That's better than the annualized TSR of 39% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Redbubble on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Redbubble better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Redbubble you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Redbubble, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ATG

Articore Group

Operates as an online marketplace that facilitates the sale of art and design products in Australia, the United States, the United Kingdom, and internationally.

Undervalued with adequate balance sheet.