- Australia

- /

- Specialty Stores

- /

- ASX:NCK

Nick Scali (ASX:NCK) Valuation Spotlight: Strong Earnings Outlook Draws Investor Interest

Reviewed by Kshitija Bhandaru

Investor optimism is building around Nick Scali (ASX:NCK) as the company’s sound return on equity and rising earnings projections catch attention. Recent market reports highlight Nick Scali’s value and potential for above average growth.

See our latest analysis for Nick Scali.

Nick Scali’s momentum has been hard to ignore, with a 23.9% share price return over the past three months and a stellar 53.5% year-to-date gain. Impressively, the one-year total shareholder return stands at 44.8%. Long-term holders have benefited from a 182.7% three-year return and a remarkable 228% five-year total return. These moves suggest investors are growing more optimistic about Nick Scali’s long-term fundamentals and growth potential, amid a wave of upbeat earnings expectations.

If you’re tracking market standouts like Nick Scali, now’s the perfect moment to expand your watchlist and discover fast growing stocks with high insider ownership

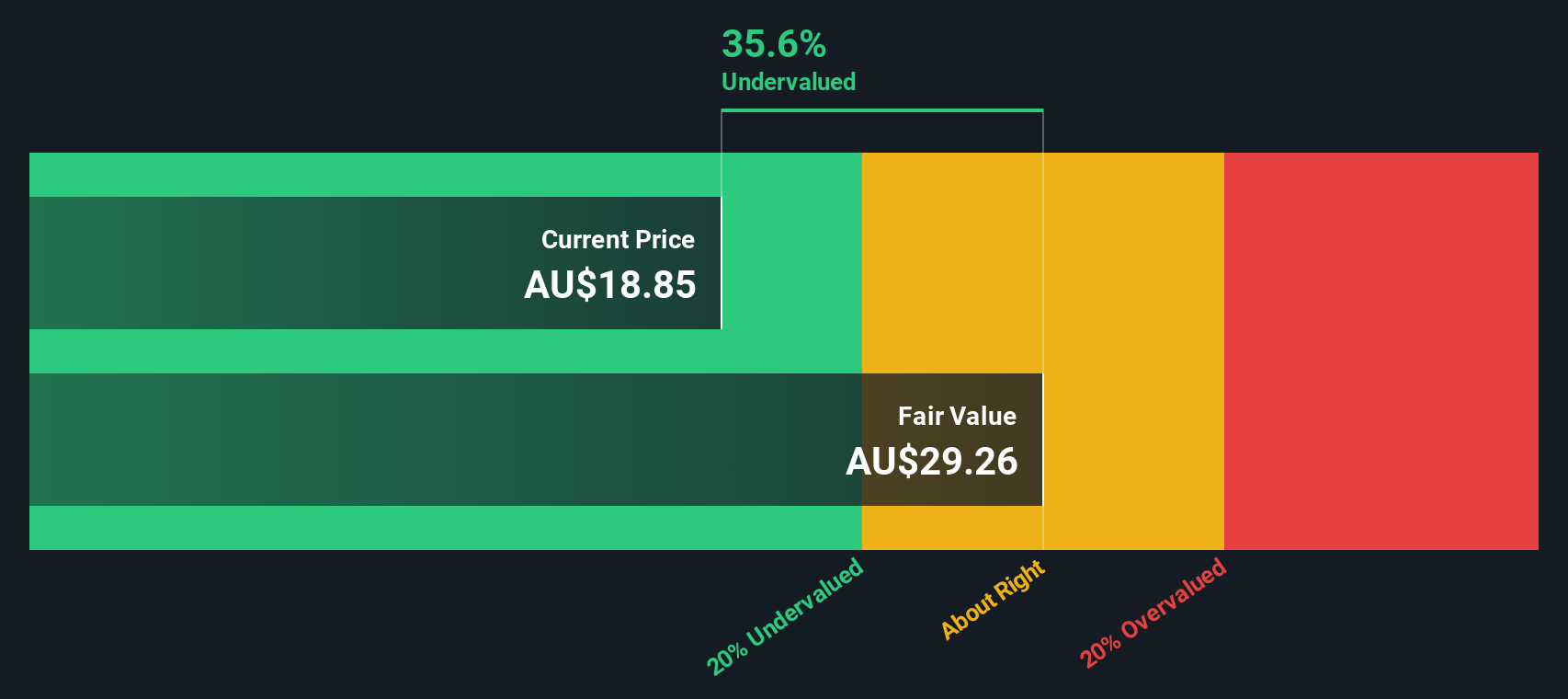

Still, with shares recently flagged as undervalued and analyst projections pointing to accelerating earnings, the real question for investors is whether Nick Scali is trading below its true worth or if the market is already factoring in all the future growth.

Most Popular Narrative: 5% Overvalued

With Nick Scali trading at A$22.74 and the most widely followed narrative placing fair value at A$21.58, analysts currently see the shares as modestly ahead of their projected fundamentals. The following outlook offers a revealing look into what’s shaping that perspective.

Execution of the U.K. turnaround, refurbishing and rebranding of stores, optimisation of logistics, and increased marketing spend once scale is achieved creates a clear pathway toward breakeven and profitability. This represents significant potential uplift to group earnings as the international footprint grows.

Curious what's really fueling Nick Scali’s valuation buzz? The narrative centers around a major bet on international expansion and margin uplift. Find out how bold assumptions about future profit and revenue growth are used to justify today's price. These details might surprise even seasoned investors.

Result: Fair Value of $21.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, costly UK store turnarounds and potential supply chain disruptions in Asia could quickly challenge Nick Scali’s growth narrative if these issues are not carefully managed.

Find out about the key risks to this Nick Scali narrative.

Another View: A Different Take on Value

While analyst consensus sees Nick Scali as slightly overvalued, our DCF model suggests that the company is actually trading about 25.6% below its fair value. This approach places greater emphasis on future cash flows rather than relying solely on earnings projections. Could the market be underestimating Nick Scali’s long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nick Scali for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nick Scali Narrative

If you see things differently or want to dig deeper on your own, you can easily craft your own Nick Scali narrative in just a few minutes. Do it your way

A great starting point for your Nick Scali research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead by putting your money to work in unique corners of the market. The right stock at the right time could transform your investment outlook.

- Grow your income stream as you tap into stable companies offering generous payouts by checking out these 19 dividend stocks with yields > 3%.

- Get in early on the digital revolution and seize opportunities in tech trends by browsing these 25 AI penny stocks.

- Unlock the next underappreciated bargain with strong fundamentals and find smart value picks using these 897 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nick Scali might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NCK

Nick Scali

Engages in the sourcing and retailing of household furniture and related accessories in Australia, New Zealand, and the United Kingdom.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives