For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Nick Scali (ASX:NCK). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Nick Scali

Nick Scali's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Nick Scali has grown EPS by 15% per year. That growth rate is fairly good, assuming the company can keep it up.

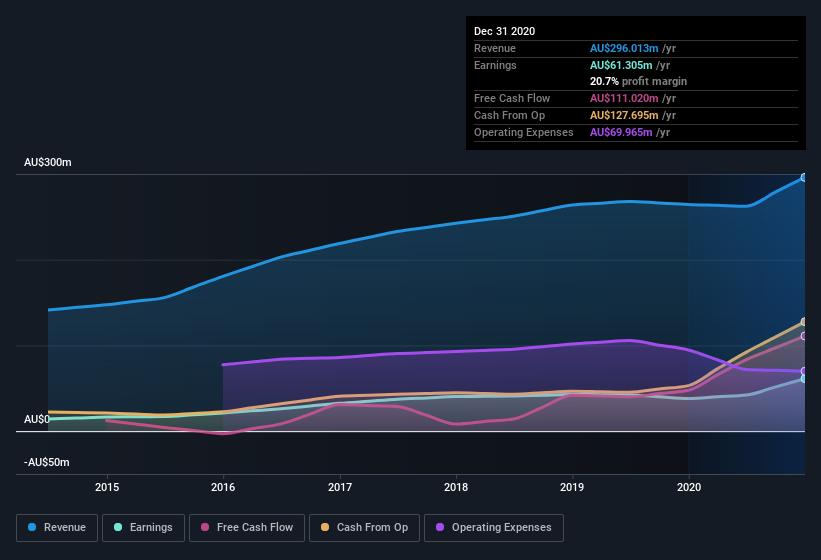

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Nick Scali shareholders can take confidence from the fact that EBIT margins are up from 21% to 30%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Nick Scali EPS 100% free.

Are Nick Scali Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Nick Scali shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that William Koeck, the Independent Non-Executive Director of the company, paid AU$49k for shares at around AU$8.36 each.

I do like that insiders have been buying shares in Nick Scali, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalizations between AU$519m and AU$2.1b, like Nick Scali, the median CEO pay is around AU$1.1m.

The Nick Scali CEO received AU$726k in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Nick Scali Deserve A Spot On Your Watchlist?

One important encouraging feature of Nick Scali is that it is growing profits. Like chocolate chips in vanilla ice cream, the insider buying, and modest CEO pay, make it better. If that doesn't automatically earn it a spot on your watchlist then I'd posit it warrants a closer look at the very least. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Nick Scali (at least 1 which makes us a bit uncomfortable) , and understanding these should be part of your investment process.

As a growth investor I do like to see insider buying. But Nick Scali isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Nick Scali or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nick Scali might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:NCK

Nick Scali

Engages in sourcing and retailing of household furniture and related accessories in Australia, the United Kingdom, and New Zealand.

Undervalued with excellent balance sheet and pays a dividend.