- Australia

- /

- Specialty Stores

- /

- ASX:NCK

Domino's Pizza Enterprises And 2 Other ASX Stocks That Might Be Trading Below Fair Value

Reviewed by Simply Wall St

The Australian market has recently shown positive momentum, with the ASX200 closing up 0.6% at 8,535 points, driven by strong performances in the Industrials and Financials sectors. As investors navigate these shifting landscapes, identifying undervalued stocks like Domino's Pizza Enterprises and others could offer potential opportunities for those seeking value in a buoyant yet selective market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| IDP Education (ASX:IEL) | A$12.38 | A$24.32 | 49.1% |

| COSOL (ASX:COS) | A$1.00 | A$1.92 | 47.8% |

| Atlas Arteria (ASX:ALX) | A$5.00 | A$9.11 | 45.1% |

| Symal Group (ASX:SYL) | A$1.98 | A$3.62 | 45.2% |

| Mesoblast (ASX:MSB) | A$2.97 | A$5.70 | 47.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.17 | A$5.73 | 44.7% |

| 29Metals (ASX:29M) | A$0.195 | A$0.39 | 49.9% |

| Integral Diagnostics (ASX:IDX) | A$2.92 | A$5.74 | 49.1% |

| Pantoro (ASX:PNR) | A$0.135 | A$0.25 | 47% |

| Sandfire Resources (ASX:SFR) | A$10.54 | A$19.34 | 45.5% |

Let's dive into some prime choices out of the screener.

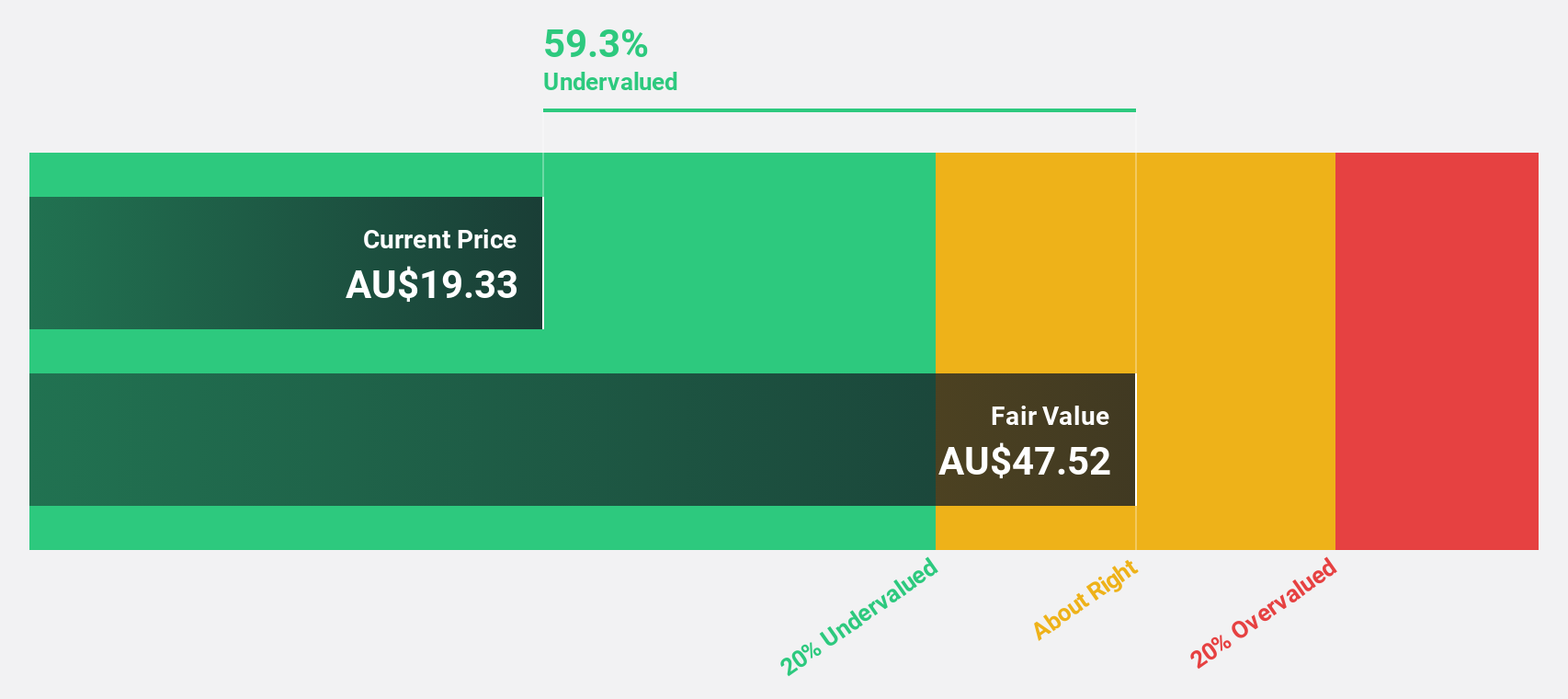

Domino's Pizza Enterprises (ASX:DMP)

Overview: Domino's Pizza Enterprises Limited operates retail food outlets and has a market cap of A$3.21 billion.

Operations: The company's revenue from its restaurants segment is A$2.38 billion.

Estimated Discount To Fair Value: 37.3%

Domino's Pizza Enterprises is trading at A$33.35, significantly below its estimated fair value of A$53.18, indicating potential undervaluation based on cash flows. Although revenue growth is modest at 3.8% annually, earnings are expected to grow significantly by 24.1% per year over the next three years, outpacing the broader Australian market's growth rate of 12.3%. However, a high debt level and an unsustainable dividend coverage may pose challenges despite strong profit forecasts and a high future return on equity of 26.2%.

- The analysis detailed in our Domino's Pizza Enterprises growth report hints at robust future financial performance.

- Get an in-depth perspective on Domino's Pizza Enterprises' balance sheet by reading our health report here.

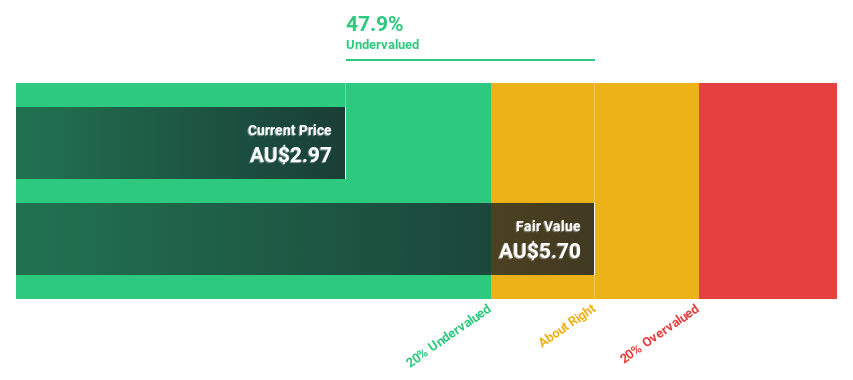

Mesoblast (ASX:MSB)

Overview: Mesoblast Limited is involved in the development of regenerative medicine products across Australia, the United States, Singapore, and Switzerland, with a market cap of A$3.78 billion.

Operations: The company generates revenue from the development of its cell technology platform for commercialization, amounting to $5.90 million.

Estimated Discount To Fair Value: 47.9%

Mesoblast, trading at A$2.97, is significantly undervalued compared to its fair value estimate of A$5.7. Despite recent shareholder dilution and volatile share prices, the company shows promising prospects with expected annual revenue growth of 49% and anticipated profitability within three years. Recent developments include the U.S. commercial launch of Ryoncil® for pediatric SR-aGvHD, targeting a market exceeding $1 billion annually, supported by a robust balance sheet and strategic cash management amid ongoing equity offerings totaling AUD 260 million.

- Our earnings growth report unveils the potential for significant increases in Mesoblast's future results.

- Delve into the full analysis health report here for a deeper understanding of Mesoblast.

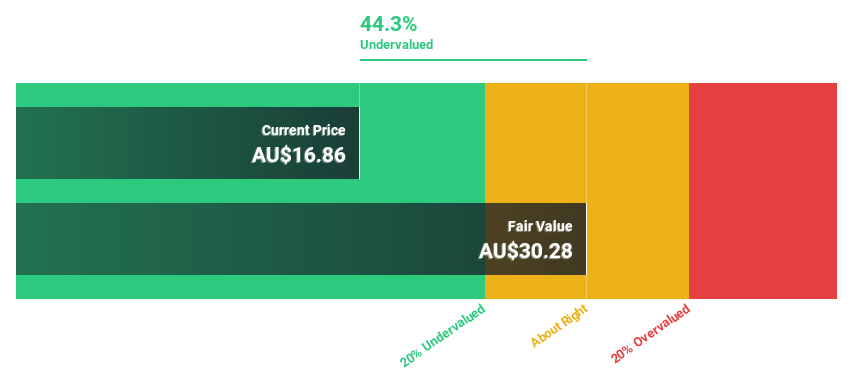

Nick Scali (ASX:NCK)

Overview: Nick Scali Limited, with a market cap of A$1.46 billion, is involved in the sourcing and retailing of household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: The company's revenue is primarily derived from the retailing of furniture, amounting to A$492.63 million.

Estimated Discount To Fair Value: 44.3%

Nick Scali, trading at A$16.86, is undervalued based on its discounted cash flow valuation, with a fair value estimate of A$30.28. Despite a decrease in interim dividend to 30 cents per share from 35 cents last year and lower net income of A$30.04 million compared to A$43.01 million previously, it remains attractive due to forecasted earnings growth of 12.61% annually and strong return on equity projections reaching 28.5% in three years.

- In light of our recent growth report, it seems possible that Nick Scali's financial performance will exceed current levels.

- Take a closer look at Nick Scali's balance sheet health here in our report.

Seize The Opportunity

- Dive into all 54 of the Undervalued ASX Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nick Scali might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NCK

Nick Scali

Engages in sourcing and retailing of household furniture and related accessories in Australia, the United Kingdom, and New Zealand.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives