As the Australian market faces a slight downturn with shares projected to open lower, investors are keenly observing how global economic factors and domestic issues, such as rising property prices, might influence future movements. In this environment of uncertainty, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies and secure long-term value.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$3.09 | A$5.67 | 45.5% |

| Resimac Group (ASX:RMC) | A$1.155 | A$2.18 | 47% |

| Reckon (ASX:RKN) | A$0.615 | A$1.19 | 48.2% |

| Pantoro Gold (ASX:PNR) | A$5.87 | A$10.92 | 46.2% |

| NRW Holdings (ASX:NWH) | A$4.97 | A$9.25 | 46.3% |

| James Hardie Industries (ASX:JHX) | A$33.11 | A$66.04 | 49.9% |

| Cynata Therapeutics (ASX:CYP) | A$0.23 | A$0.44 | 47.6% |

| Credit Clear (ASX:CCR) | A$0.26 | A$0.47 | 44.5% |

| Aussie Broadband (ASX:ABB) | A$5.87 | A$10.69 | 45.1% |

| Airtasker (ASX:ART) | A$0.385 | A$0.71 | 46% |

Let's take a closer look at a couple of our picks from the screened companies.

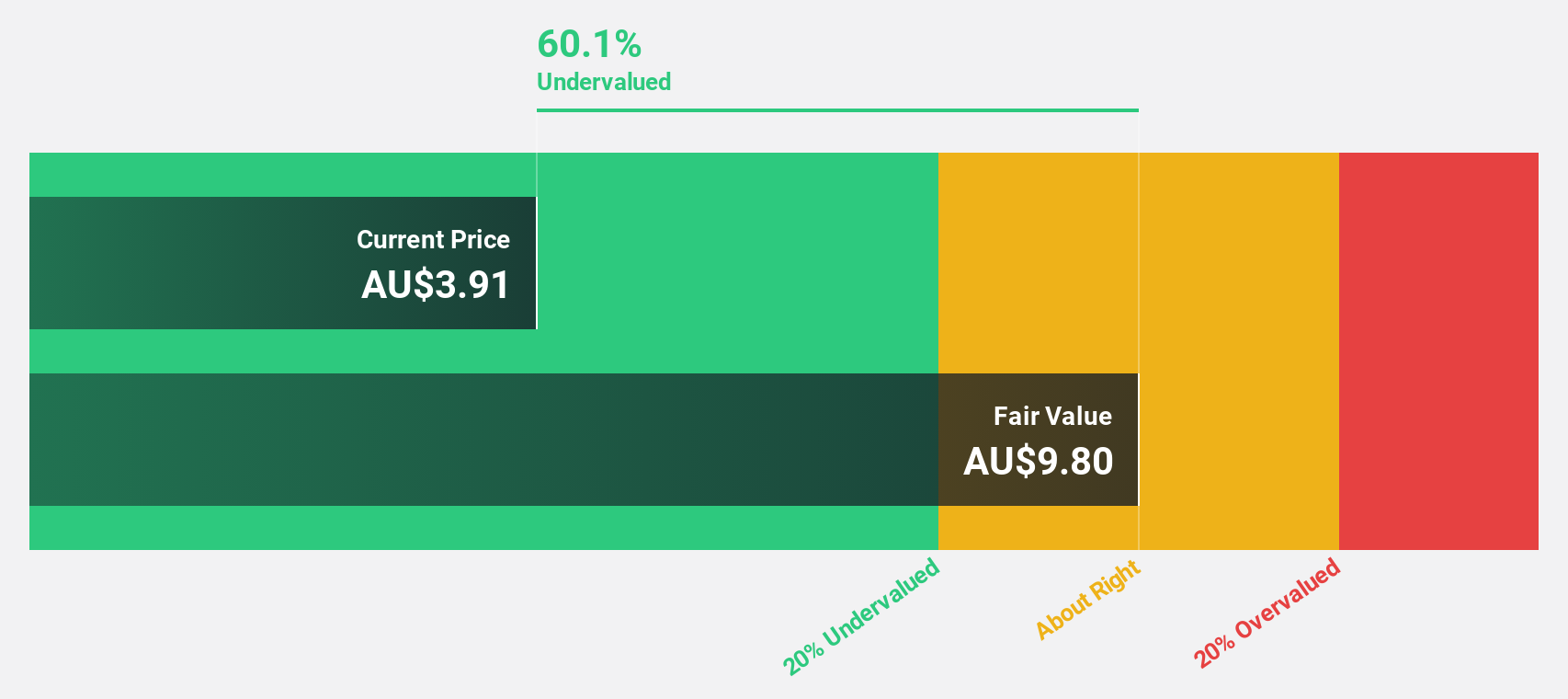

Aussie Broadband (ASX:ABB)

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia with a market capitalization of A$1.72 billion.

Operations: The company's revenue segments include Business at A$108.07 million, Wholesale at A$89.99 million, Residential at A$676.81 million, Symbio Group at A$214.48 million, and Enterprise and Government at A$97.79 million.

Estimated Discount To Fair Value: 45.1%

Aussie Broadband appears undervalued, trading 45.1% below its estimated fair value of A$10.69 per share, with a current price of A$5.87. Despite significant insider selling recently, the company reported solid earnings growth of 24.5% last year and forecasts annual profit growth at 21.4%, outpacing the Australian market's average. Recent buybacks worth A$35.86 million may enhance shareholder value as the company explores strategic acquisitions to bolster future cash flows and revenue streams.

- Our growth report here indicates Aussie Broadband may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Aussie Broadband.

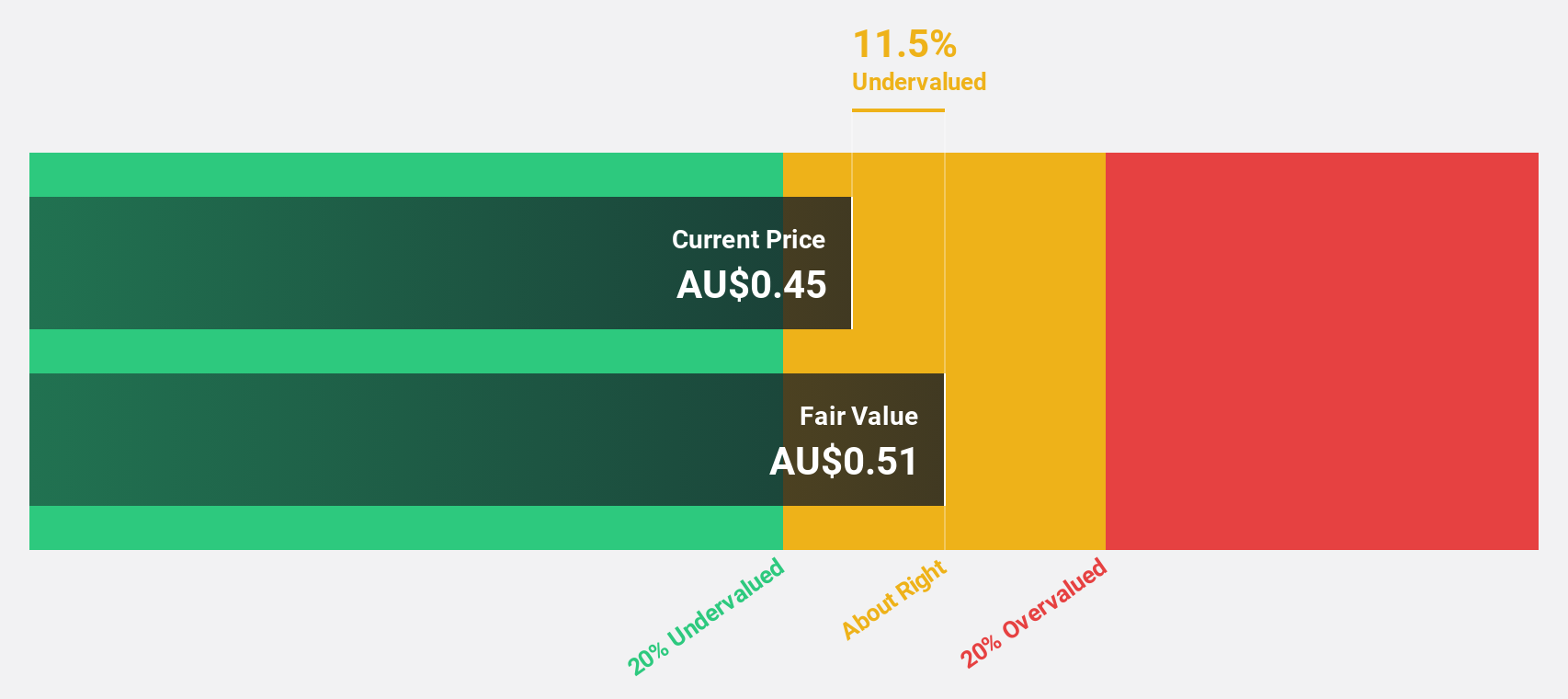

Myer Holdings (ASX:MYR)

Overview: Myer Holdings Limited operates department stores in Australia and New Zealand, with a market cap of A$786.27 million.

Operations: The company's revenue is primarily generated through its retail operations, which account for A$2.64 billion, and its apparel brands segment, contributing A$370.60 million.

Estimated Discount To Fair Value: 10.5%

Myer Holdings is trading at A$0.46, slightly below its estimated fair value of A$0.51, indicating it may be undervalued based on cash flow analysis. Despite a net loss of A$211.2 million for the full year 2025, revenue grew by 13.8% to A$3 billion compared to the previous year. Analysts forecast robust earnings growth of 64.13% annually and expect profitability within three years, with revenue growth outpacing the broader Australian market at 7.5%.

- Upon reviewing our latest growth report, Myer Holdings' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Myer Holdings' balance sheet health report.

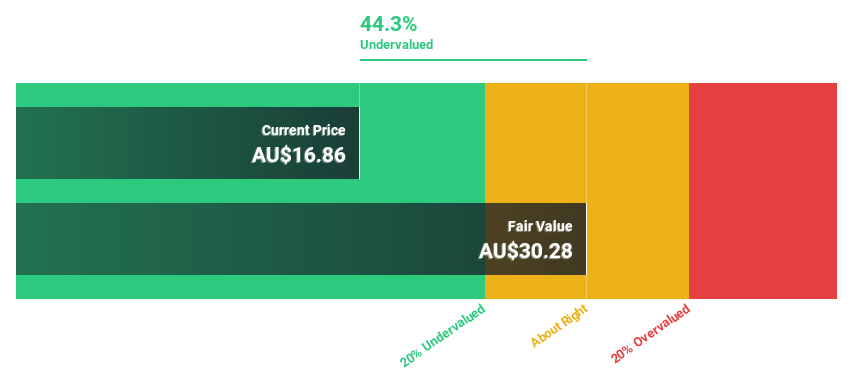

Nick Scali (ASX:NCK)

Overview: Nick Scali Limited, with a market cap of A$1.95 billion, operates in the sourcing and retailing of household furniture and related accessories across Australia, New Zealand, and the United Kingdom.

Operations: The company's revenue segment primarily comprises A$495.28 million from the retailing of furniture and related accessories in its operating regions.

Estimated Discount To Fair Value: 25.5%

Nick Scali is trading at A$22.78, over 25% below its estimated fair value of A$30.59, suggesting undervaluation based on cash flow analysis. Despite a decline in net income to A$57.68 million from the previous year, revenue increased to A$495.28 million. Earnings are forecasted to grow at 14.8% annually, outpacing the Australian market's growth rate of 11.5%. However, profit margins decreased from 17.2% to 11.6%, and dividends remain poorly covered by earnings.

- In light of our recent growth report, it seems possible that Nick Scali's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Nick Scali stock in this financial health report.

Seize The Opportunity

- Discover the full array of 34 Undervalued ASX Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MYR

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.