- Australia

- /

- Specialty Stores

- /

- ASX:LOV

With EPS Growth And More, Lovisa Holdings (ASX:LOV) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Lovisa Holdings (ASX:LOV). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Lovisa Holdings with the means to add long-term value to shareholders.

View our latest analysis for Lovisa Holdings

Lovisa Holdings' Improving Profits

Lovisa Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Lovisa Holdings' EPS has risen over the last 12 months, growing from AU$0.54 to AU$0.62. This amounts to a 15% gain; a figure that shareholders will be pleased to see.

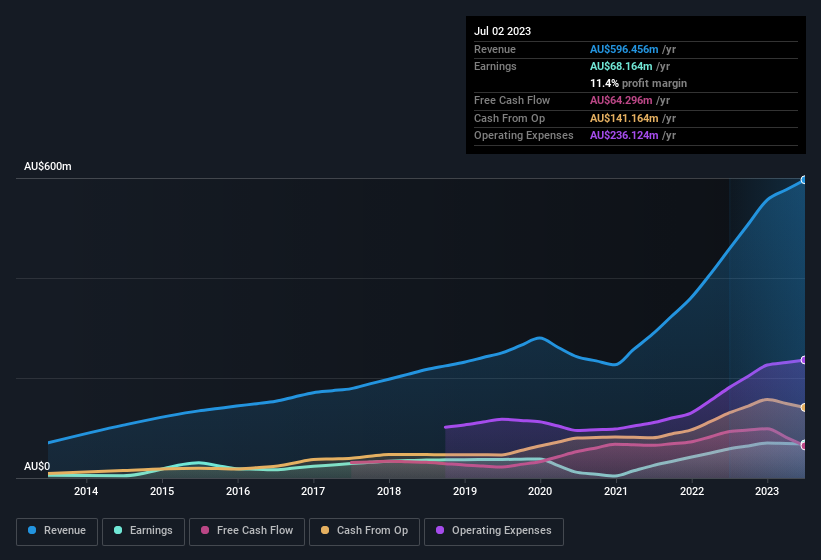

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Lovisa Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 30% to AU$596m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Lovisa Holdings' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Lovisa Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Lovisa Holdings insiders refrain from selling stock during the year, but they also spent AU$211k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by Independent Director Bruce Carter for AU$116k worth of shares, at about AU$23.28 per share.

On top of the insider buying, we can also see that Lovisa Holdings insiders own a large chunk of the company. Actually, with 43% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. That means they have plenty of their own capital riding on the performance of the business!

Should You Add Lovisa Holdings To Your Watchlist?

One important encouraging feature of Lovisa Holdings is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. You should always think about risks though. Case in point, we've spotted 1 warning sign for Lovisa Holdings you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Lovisa Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LOV

Lovisa Holdings

Engages in the retail sale of fashion jewelry and accessories.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives