- Australia

- /

- Specialty Stores

- /

- ASX:LOV

Lovisa Holdings Limited's (ASX:LOV) 26% Jump Shows Its Popularity With Investors

Lovisa Holdings Limited (ASX:LOV) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

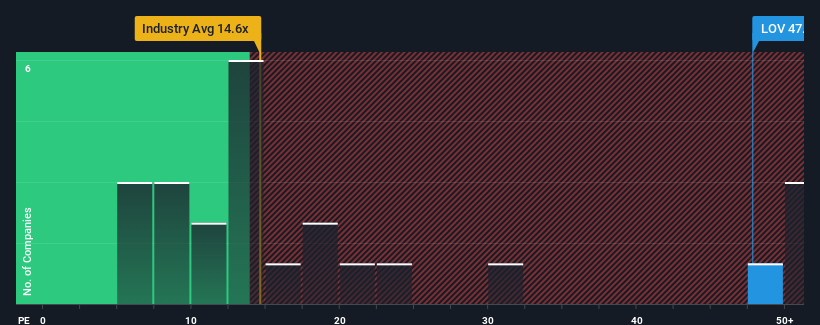

Following the firm bounce in price, given close to half the companies in Australia have price-to-earnings ratios (or "P/E's") below 19x, you may consider Lovisa Holdings as a stock to avoid entirely with its 47.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's superior to most other companies of late, Lovisa Holdings has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Lovisa Holdings

Does Growth Match The High P/E?

In order to justify its P/E ratio, Lovisa Holdings would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.0% last year. The latest three year period has also seen an excellent 1,660% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 22% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 17% each year, which is noticeably less attractive.

With this information, we can see why Lovisa Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has got Lovisa Holdings' P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Lovisa Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Lovisa Holdings with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Lovisa Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LOV

Lovisa Holdings

Engages in the retail sale of fashion jewelry and accessories.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives