- Australia

- /

- Metals and Mining

- /

- ASX:SFR

ASX Stocks Trading Below Estimated Value January 2025

Reviewed by Simply Wall St

As the ASX200 closed down 1.23% at 8,191 points, driven by a sell-off in major banks and IT stocks, investors are closely monitoring market movements amid fluctuating sector performances. In such an environment, identifying undervalued stocks becomes crucial for investors seeking opportunities to capitalize on potential market mispricing and long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$6.15 | A$12.32 | 50.1% |

| Regal Partners (ASX:RPL) | A$3.63 | A$6.75 | 46.2% |

| Atlas Arteria (ASX:ALX) | A$4.90 | A$9.58 | 48.8% |

| MLG Oz (ASX:MLG) | A$0.60 | A$1.15 | 47.7% |

| Telix Pharmaceuticals (ASX:TLX) | A$24.02 | A$45.31 | 47% |

| Aussie Broadband (ASX:ABB) | A$3.48 | A$6.42 | 45.8% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Vault Minerals (ASX:VAU) | A$0.34 | A$0.66 | 48.3% |

| Genesis Minerals (ASX:GMD) | A$2.75 | A$4.84 | 43.2% |

| Megaport (ASX:MP1) | A$6.61 | A$12.07 | 45.3% |

We'll examine a selection from our screener results.

Lovisa Holdings (ASX:LOV)

Overview: Lovisa Holdings Limited operates in the retail sector, focusing on the sale of fashion jewelry and accessories, with a market capitalization of A$2.88 billion.

Operations: The company generates revenue of A$698.66 million from its retail segment dedicated to fashion jewelry and accessories.

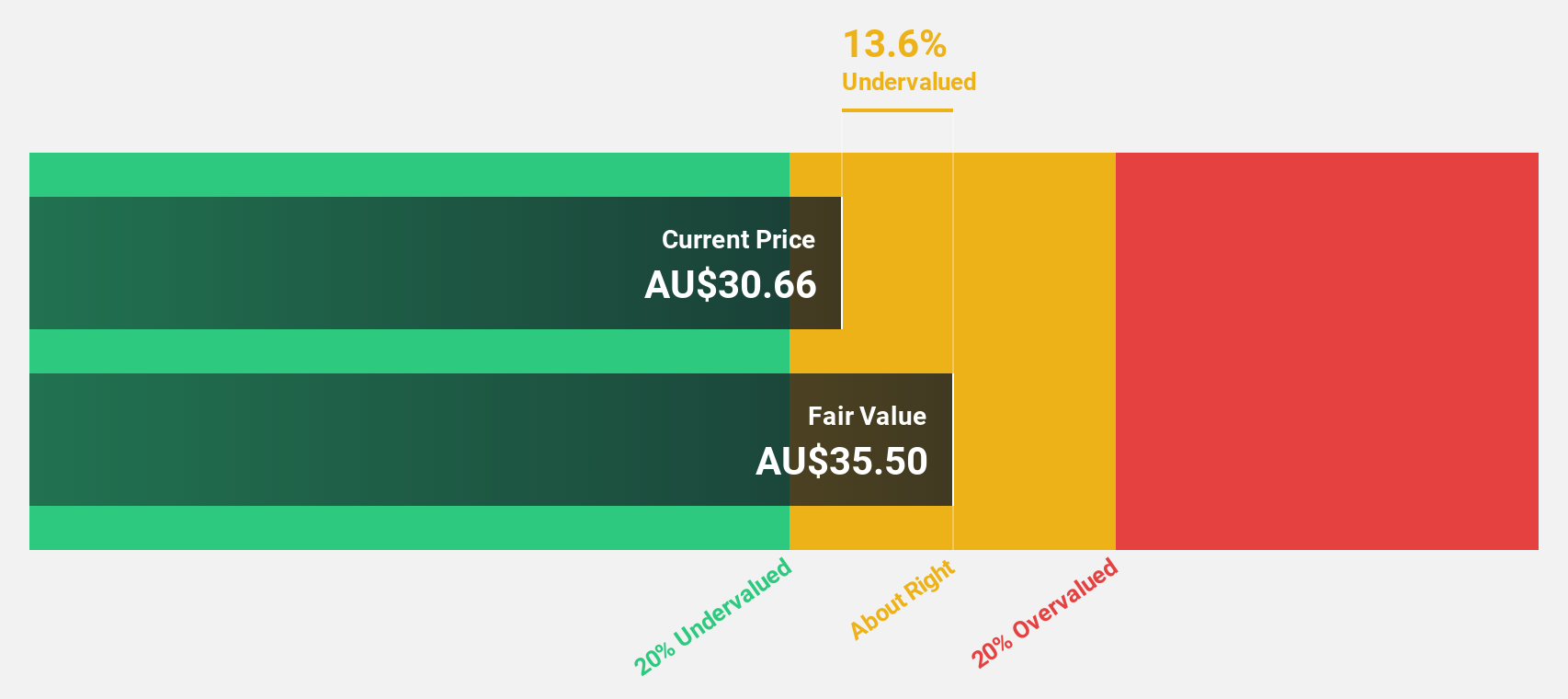

Estimated Discount To Fair Value: 10.5%

Lovisa Holdings is currently trading at A$25.54, slightly below its estimated fair value of A$28.54, suggesting it may be undervalued based on cash flows. The company's revenue is projected to grow at 12% annually, outpacing the broader Australian market's 6% growth rate. However, its dividend yield of 3.41% is not well covered by earnings. Earnings are expected to grow at 15.16% per year, surpassing the market average of 12.5%.

- Insights from our recent growth report point to a promising forecast for Lovisa Holdings' business outlook.

- Get an in-depth perspective on Lovisa Holdings' balance sheet by reading our health report here.

SiteMinder (ASX:SDR)

Overview: SiteMinder Limited develops, markets, and sells an online guest acquisition platform and commerce solutions for accommodation providers both in Australia and internationally, with a market cap of A$1.61 billion.

Operations: The company's revenue segment consists of Software & Programming, generating A$190.84 million.

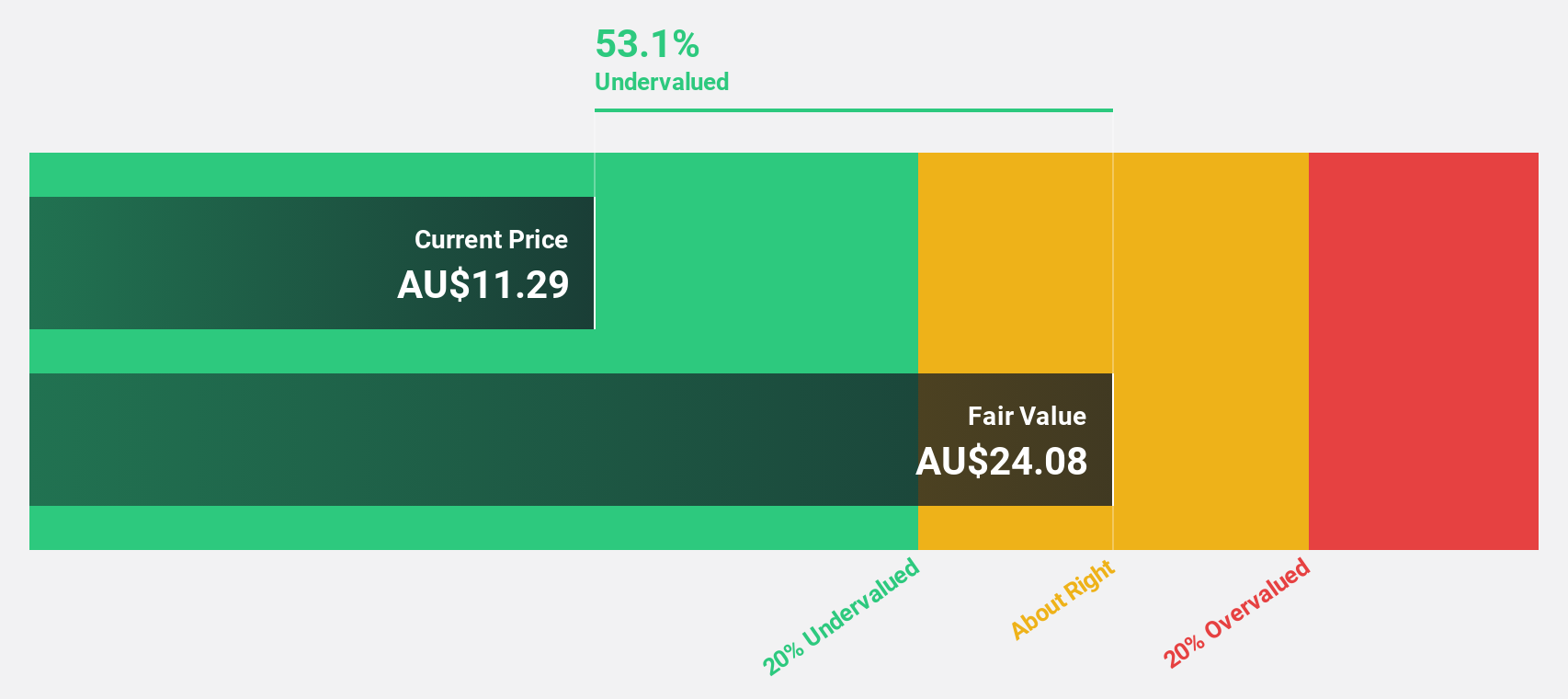

Estimated Discount To Fair Value: 18.5%

SiteMinder, trading at A$5.66, is undervalued relative to its fair value of A$6.95 and below analyst price targets with a projected 23.5% rise. The company has demonstrated robust earnings growth of 23.5% annually over the past five years and is expected to become profitable within three years, outpacing average market growth expectations. Revenue is anticipated to grow at 18.8% per year, faster than the Australian market's rate but below 20%.

- In light of our recent growth report, it seems possible that SiteMinder's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of SiteMinder.

Sandfire Resources (ASX:SFR)

Overview: Sandfire Resources Limited is a mining company involved in the exploration, evaluation, and development of mineral tenements and projects, with a market cap of A$4.50 billion.

Operations: The company's revenue segments include the Motheo Copper Project generating $346.47 million, MATSA Copper Operations contributing $565.68 million, and Degrussa Copper Operations adding $29.40 million.

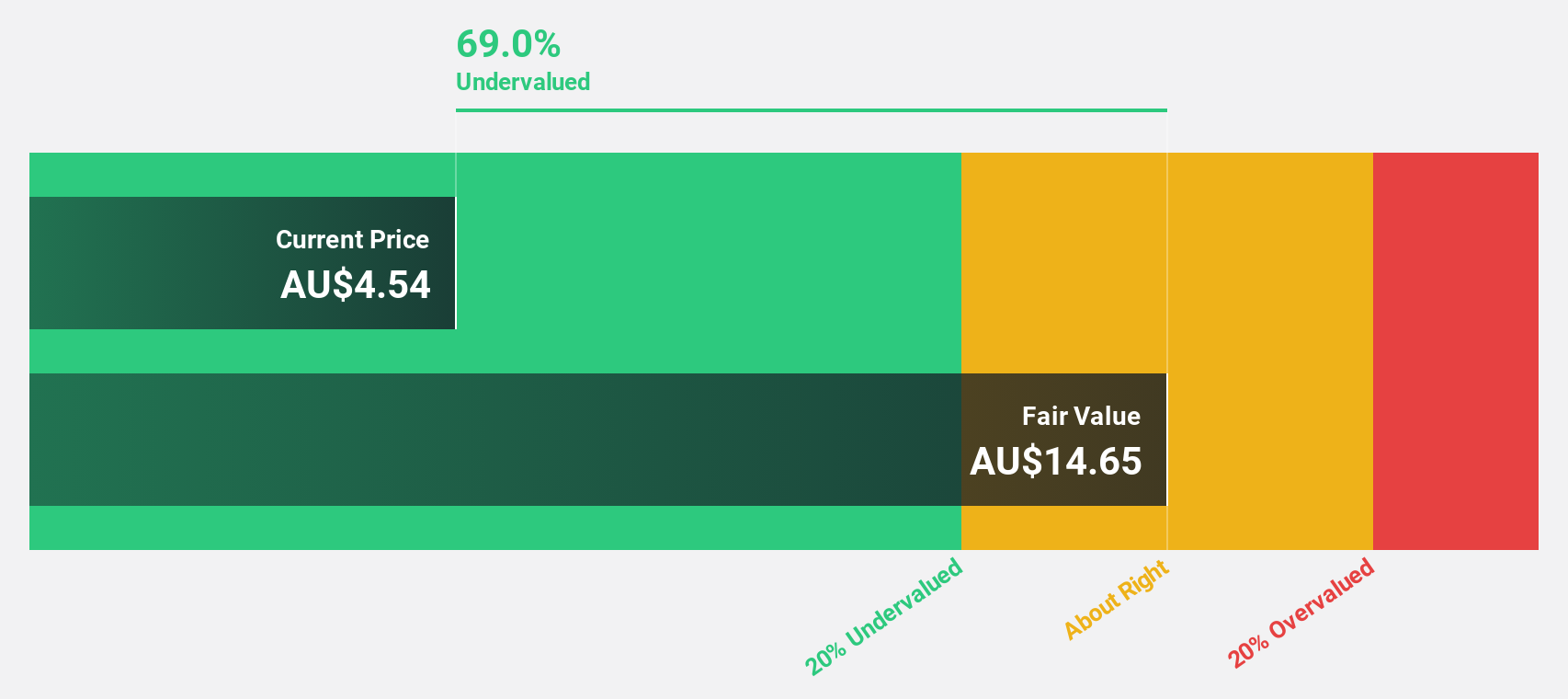

Estimated Discount To Fair Value: 40.4%

Sandfire Resources is trading at A$9.47, significantly undervalued compared to its estimated fair value of A$15.89, suggesting a potential upside of 40.4%. Revenue growth is forecasted at 8.4% annually, surpassing the Australian market's average yet below 20%. Earnings are projected to increase by 40% per year with profitability expected within three years, indicating strong future cash flows despite a forecasted low return on equity of 11.5%.

- Our expertly prepared growth report on Sandfire Resources implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Sandfire Resources here with our thorough financial health report.

Key Takeaways

- Investigate our full lineup of 42 Undervalued ASX Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SFR

Sandfire Resources

A mining company, engages in the exploration, evaluation, and development of mineral tenements and projects.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives