Why Harvey Norman (ASX:HVN) Is Up 20.7% After Lifting Dividend and Reporting Strong Earnings Growth

Reviewed by Simply Wall St

- Harvey Norman Holdings Limited announced a fully franked dividend of A$0.145 per share for the six months ended June 30, 2025, payable on November 3, 2025, alongside its full-year earnings for the period.

- The company reported a substantial increase in net income and earnings per share compared to the previous year, highlighting improved performance and stronger shareholder returns.

- We’ll explore how Harvey Norman’s improved profitability and higher dividend payout could influence its investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Harvey Norman Holdings' Investment Narrative?

To back Harvey Norman, investors need to believe the business can maintain both its improved profitability and upgraded dividend amid ongoing challenges in retail. The sharply higher earnings (A$518 million net income) and boosted fully franked dividend standout as strong signals that recent strategies are working, especially after several turbulent years. These results follow a period of accelerated profit growth and appear to have reignited confidence, as reflected in the stock’s very large short-term price gains. The bigger dividend may attract more income-focused buyers, further supporting the share price over the near term. However, structural risks remain unchanged: board independence is still below recommended levels, dividend stability has been patchy, and future profit estimates remain much lower than this year’s jump. The recent news alleviates immediate concerns but doesn’t erase the underlying governance and earnings quality questions investors should keep in mind.

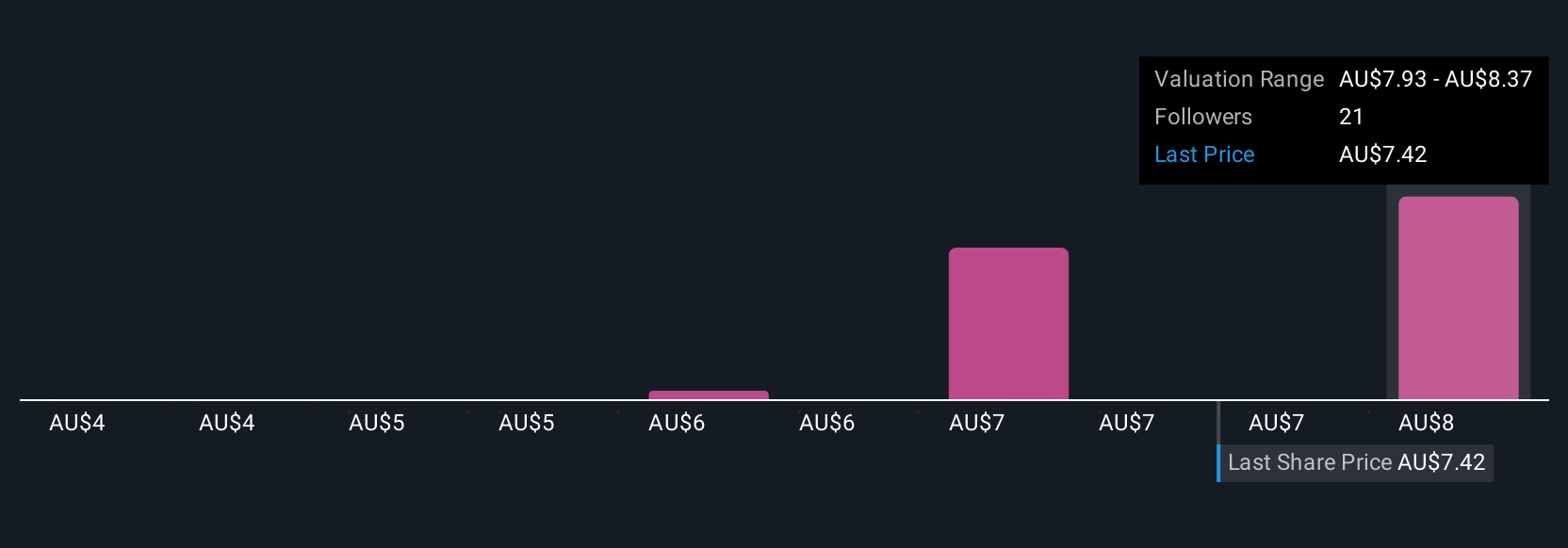

But, low board independence could affect Harvey Norman’s longer-term decision making, a risk to watch. Harvey Norman Holdings' shares have been on the rise but are still potentially undervalued by 11%. Find out what it's worth.Exploring Other Perspectives

Explore 5 other fair value estimates on Harvey Norman Holdings - why the stock might be worth as much as 12% more than the current price!

Build Your Own Harvey Norman Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harvey Norman Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Harvey Norman Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harvey Norman Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harvey Norman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HVN

Harvey Norman Holdings

Engages in the integrated retail, franchise, property, and digital system businesses.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives