Harvey Norman Holdings And Two Other ASX Dividend Stocks To Consider

Reviewed by Simply Wall St

In the past year, the Australian market has seen a modest increase of 6.5%, despite a recent drop of 1.4% over the last seven days. In this dynamic environment, dividend stocks like Harvey Norman Holdings can offer investors potential stability and steady income, especially with earnings forecasted to grow by 13% annually.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Collins Foods (ASX:CKF) | 3.09% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 5.22% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.09% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 4.01% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 9.11% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 7.27% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.17% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.56% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.17% | ★★★★★☆ |

| Australian United Investment (ASX:AUI) | 3.59% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Harvey Norman Holdings (ASX:HVN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Harvey Norman Holdings Limited operates in integrated retail, franchise, property, and digital system sectors with a market capitalization of approximately A$5.26 billion.

Operations: Harvey Norman Holdings Limited generates revenue primarily through various retail segments, including A$982.46 million from New Zealand, A$204.83 million from Slovenia & Croatia, A$691.09 million from Singapore & Malaysia, A$237.17 million from non-franchised retail, and A$676.83 million from Ireland & Northern Ireland.

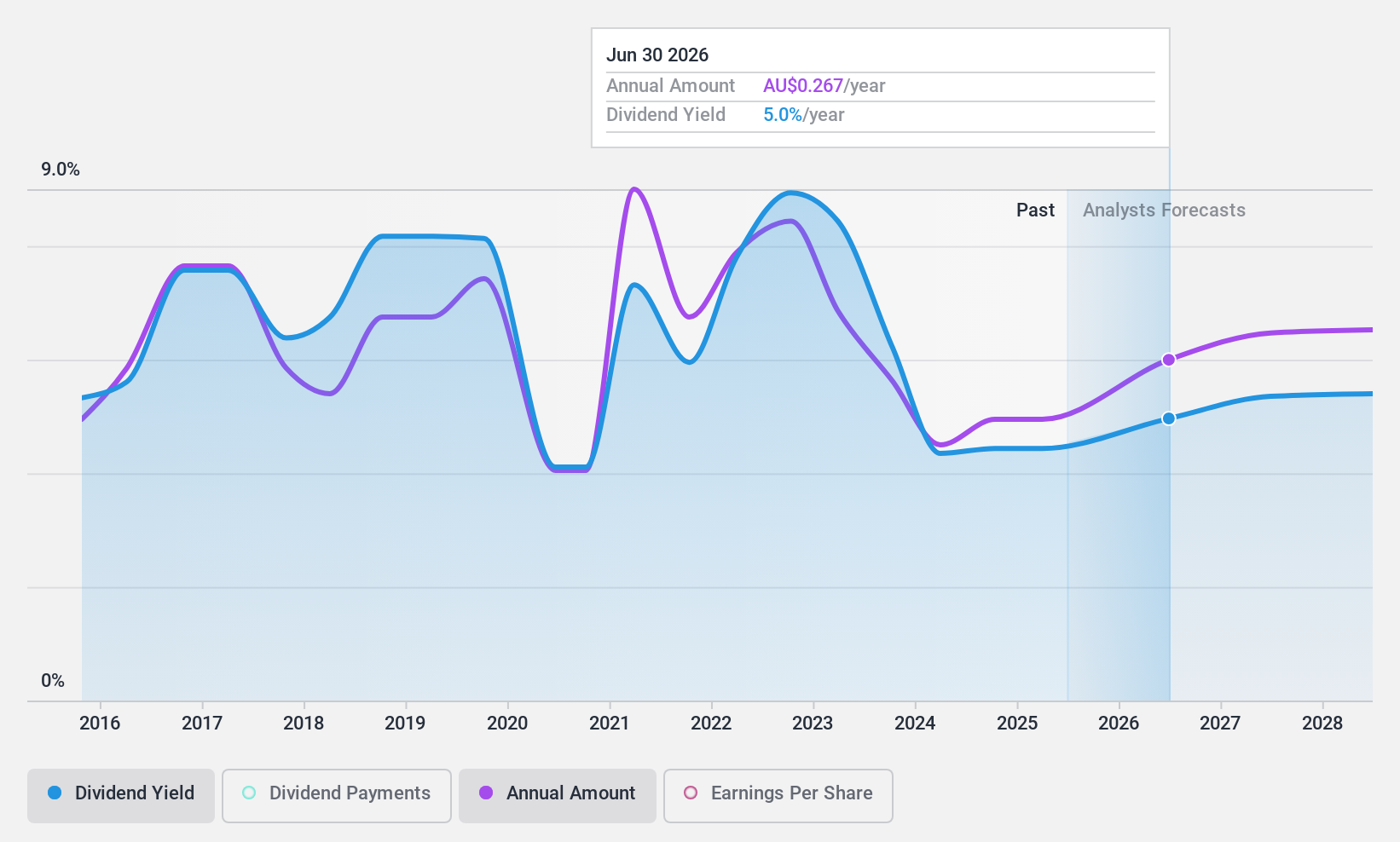

Dividend Yield: 4.7%

Harvey Norman Holdings (HVN) offers a dividend yield of 4.74%, which is below the top quartile in the Australian market. Despite this, its dividends are sustainably covered by earnings and cash flows, with payout ratios of 73.4% and 39.2% respectively. However, HVN has shown a volatile dividend history over the past decade and currently trades at a significant discount to estimated fair value, suggesting potential undervaluation relative to peers despite lower profit margins compared to last year.

- Take a closer look at Harvey Norman Holdings' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Harvey Norman Holdings shares in the market.

JB Hi-Fi (ASX:JBH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Hi-Fi Limited operates as a retailer of home consumer products, with a market capitalization of approximately A$6.69 billion.

Operations: JB Hi-Fi Limited generates revenue through its segments: The Good Guys at A$2.66 billion, JB Hi-Fi Australia at A$6.57 billion, and JB Hi-Fi New Zealand at A$0.28 billion.

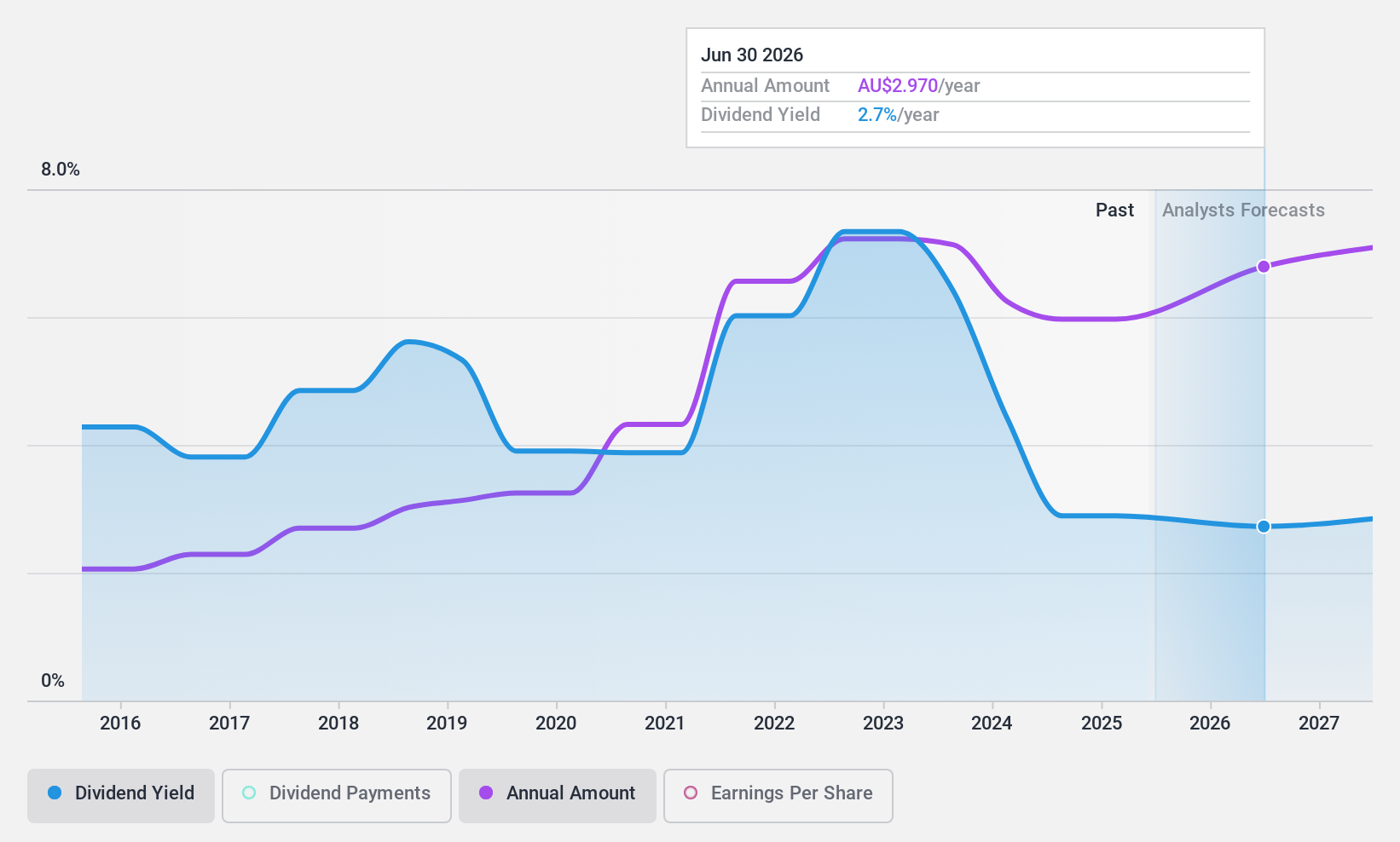

Dividend Yield: 4.5%

JB Hi-Fi's dividend yield at 4.46% falls below the top Australian dividend payers. While dividends have grown over the past decade, their stability has been questionable with significant fluctuations. Recent sales figures show mixed performance across regions, with JB Hi-Fi New Zealand showing strength. The dividends are well-supported by a 65% earnings payout ratio and a 46.7% cash flow payout ratio, indicating reasonable coverage despite forecasts of a slight earnings decline over the next three years.

- Get an in-depth perspective on JB Hi-Fi's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of JB Hi-Fi shares in the market.

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nib Holdings Limited operates as a provider of private health insurance for residents, international students, and visitors in Australia and New Zealand, with a market capitalization of approximately A$3.45 billion.

Operations: Nib Holdings Limited generates revenue through various segments, including Australian Residents Health Insurance at A$2.55 billion, New Zealand Insurance at A$351.90 million, NIB Travel at A$109.10 million, International (Inbound) Health Insurance at A$173.20 million, and Nib Thrive at A$38 million.

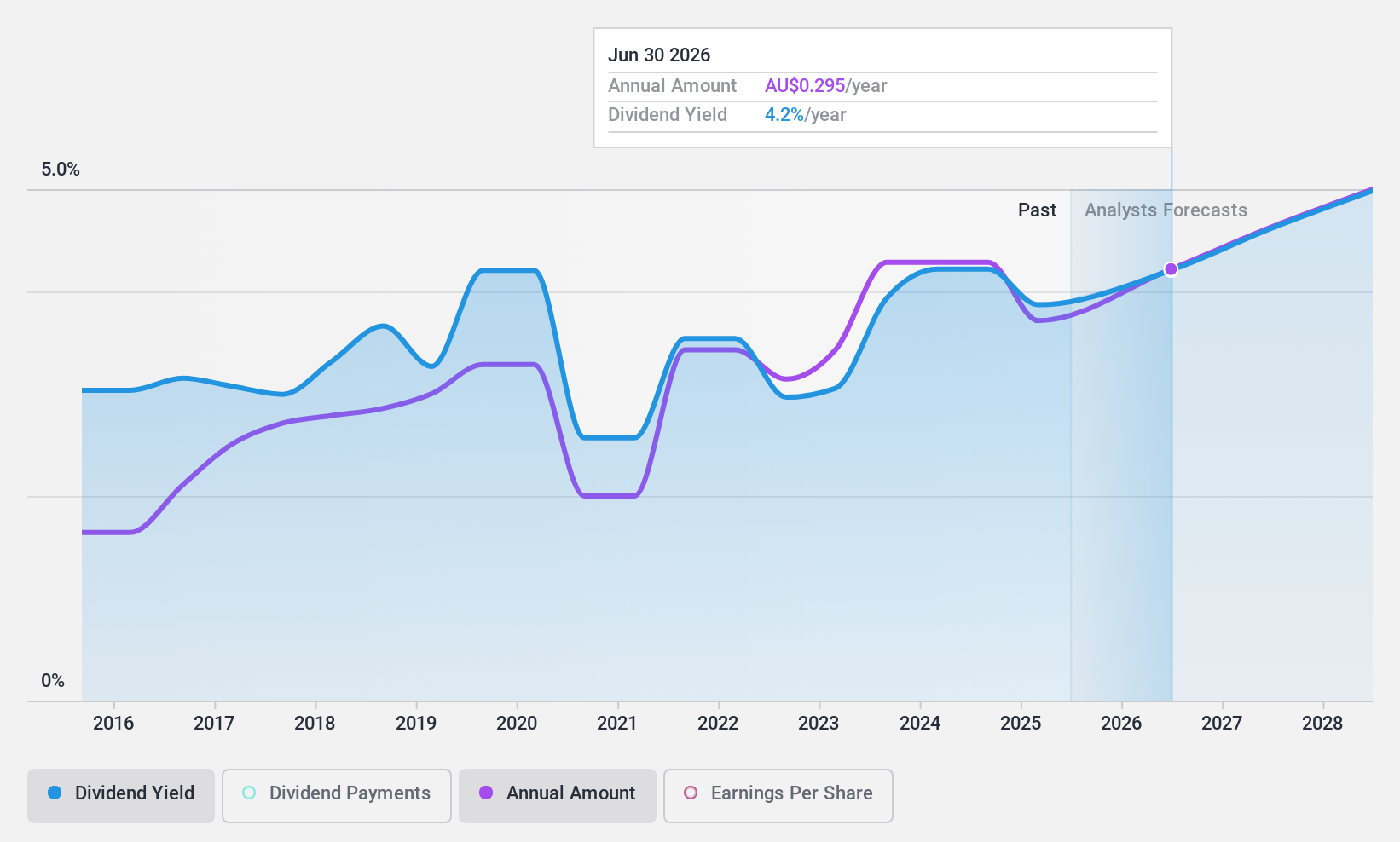

Dividend Yield: 4.2%

nib holdings' dividend yield of 4.22% is below the top Australian payers, and its history shows volatility over the past decade, reflecting unreliable growth. Despite this, dividends are reasonably covered by earnings and cash flows with payout ratios of 67.5% and 57.9%, respectively. The company's earnings are expected to grow at 3.79% annually, suggesting potential for future stability in dividend payments despite past inconsistencies.

- Dive into the specifics of nib holdings here with our thorough dividend report.

- Our valuation report here indicates nib holdings may be undervalued.

Summing It All Up

- Unlock more gems! Our Top ASX Dividend Stocks screener has unearthed 24 more companies for you to explore.Click here to unveil our expertly curated list of 27 Top ASX Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NHF

nib holdings

Engages in the underwriting and distribution of private health, life, and living insurance to residents, international students, and visitors in Australia and New Zealand.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives