Does Harvey Norman Holdings (ASX:HVN) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Harvey Norman Holdings (ASX:HVN). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Harvey Norman Holdings

How Quickly Is Harvey Norman Holdings Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Harvey Norman Holdings has managed to grow EPS by 18% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

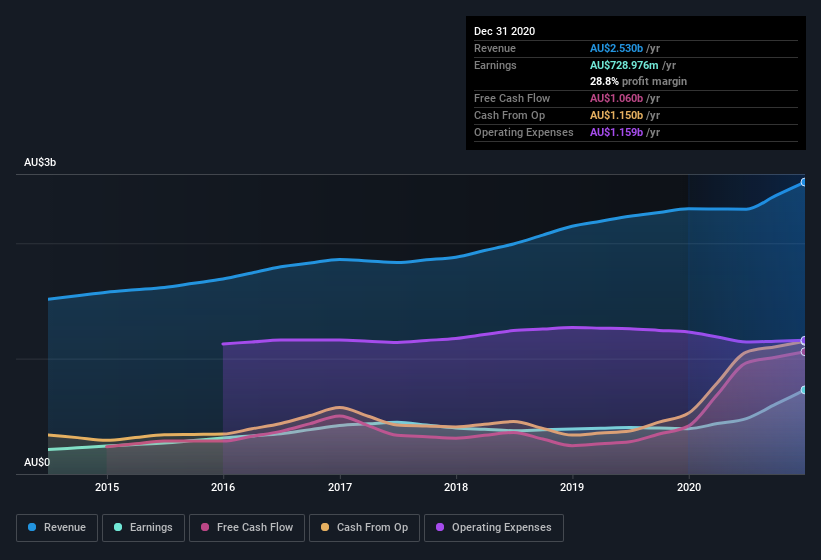

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Harvey Norman Holdings is growing revenues, and EBIT margins improved by 18.4 percentage points to 41%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Harvey Norman Holdings's forecast profits?

Are Harvey Norman Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that Harvey Norman Holdings insiders spent a whopping AU$1.0m on stock in just one year, and I didn't see any selling. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the Co-Founder, Gerald Harvey, who made the biggest single acquisition, paying AU$1.0m for shares at about AU$4.45 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Harvey Norman Holdings insiders own more than a third of the company. In fact, they own 41% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. And their holding is extremely valuable at the current share price, totalling AU$2.7b. That means they have plenty of their own capital riding on the performance of the business!

Does Harvey Norman Holdings Deserve A Spot On Your Watchlist?

You can't deny that Harvey Norman Holdings has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Still, you should learn about the 2 warning signs we've spotted with Harvey Norman Holdings (including 1 which can't be ignored) .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Harvey Norman Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Harvey Norman Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Harvey Norman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:HVN

Harvey Norman Holdings

Engages in the integrated retail, franchise, property, and digital system businesses.

Undervalued with excellent balance sheet and pays a dividend.