The Australian market has experienced a mix of fluctuations recently, declining by 2.0% over the last week but showing an overall growth of 6.1% over the past year with earnings expected to grow by 14% annually. In this dynamic environment, dividend stocks that offer stable yields can be particularly appealing to investors looking for consistent income streams.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 5.08% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.89% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.74% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.53% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.16% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.64% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 9.24% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.08% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 7.75% | ★★★★☆☆ |

| Macquarie Group (ASX:MQG) | 3.27% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Harvey Norman Holdings (ASX:HVN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Harvey Norman Holdings Limited operates in integrated retail, franchise, property, and digital system sectors with a market capitalization of approximately A$5.59 billion.

Operations: Harvey Norman Holdings Limited generates revenue through various geographical retail segments, including A$982.46 million from New Zealand, A$204.83 million from Slovenia & Croatia, A$691.09 million from Singapore & Malaysia, A$237.17 million from non-franchised retail operations, and A$676.83 million from Ireland & Northern Ireland.

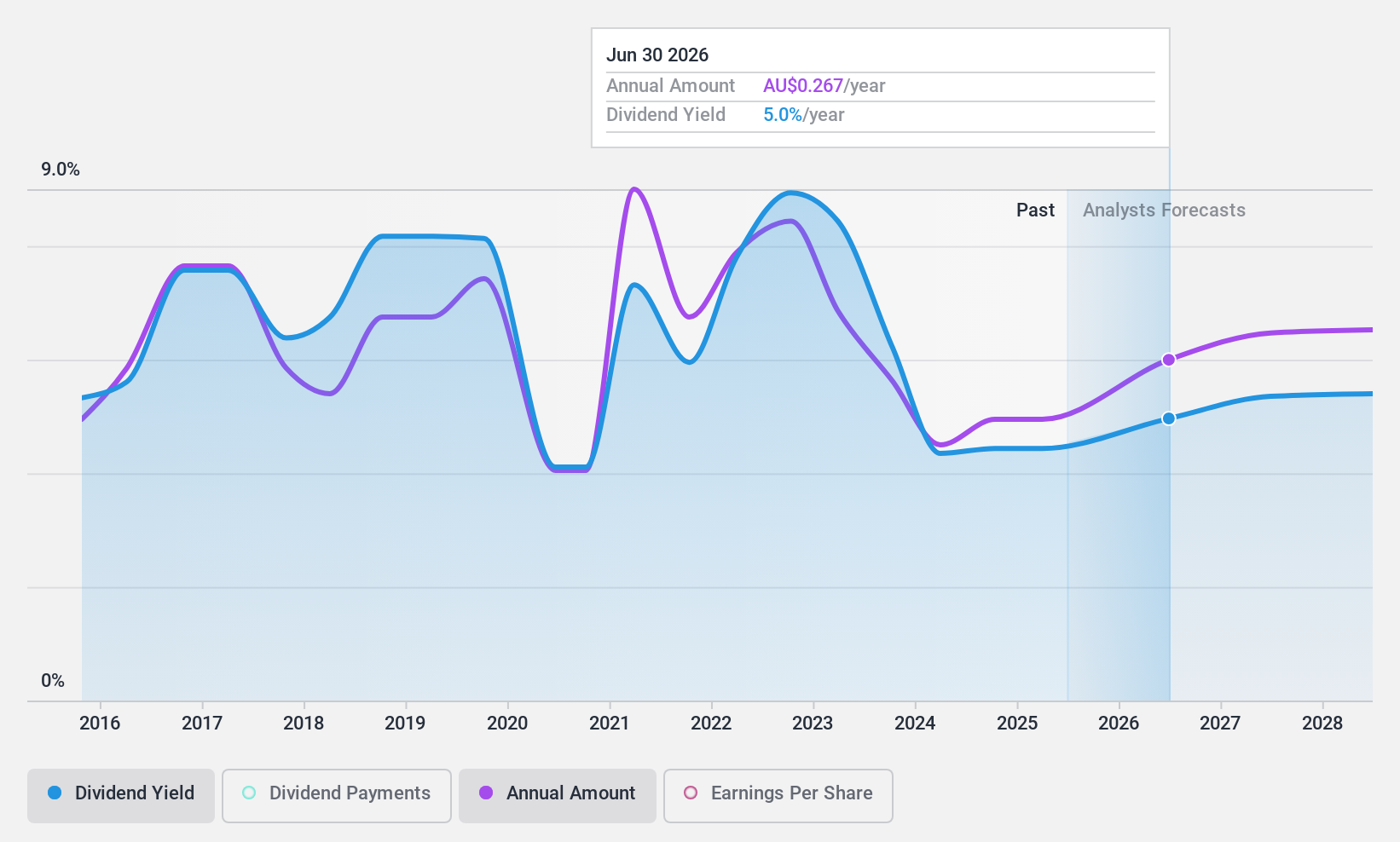

Dividend Yield: 4.5%

Harvey Norman Holdings has demonstrated a consistent increase in dividend payments over the past decade, supported by earnings and cash flows with a payout ratio of 73.4% and a cash payout ratio of 39.2%, respectively. However, its dividend yield of 4.45% trails behind the top quartile of Australian dividend stocks at 6.69%. Additionally, despite growing profits forecasted at 9.45% annually, its profit margins have declined from 26.6% to 13.4%, reflecting potential volatility in its financial stability.

- Delve into the full analysis dividend report here for a deeper understanding of Harvey Norman Holdings.

- Insights from our recent valuation report point to the potential undervaluation of Harvey Norman Holdings shares in the market.

JB Hi-Fi (ASX:JBH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Hi-Fi Limited operates as a retailer of home consumer products, with a market capitalization of approximately A$7.05 billion.

Operations: JB Hi-Fi Limited generates revenue through three primary segments: The Good Guys (TGG) with A$2.66 billion, JB Hi-Fi Australia (JB Aust) at A$6.57 billion, and JB Hi-Fi New Zealand (JB NZ) contributing A$0.28 billion.

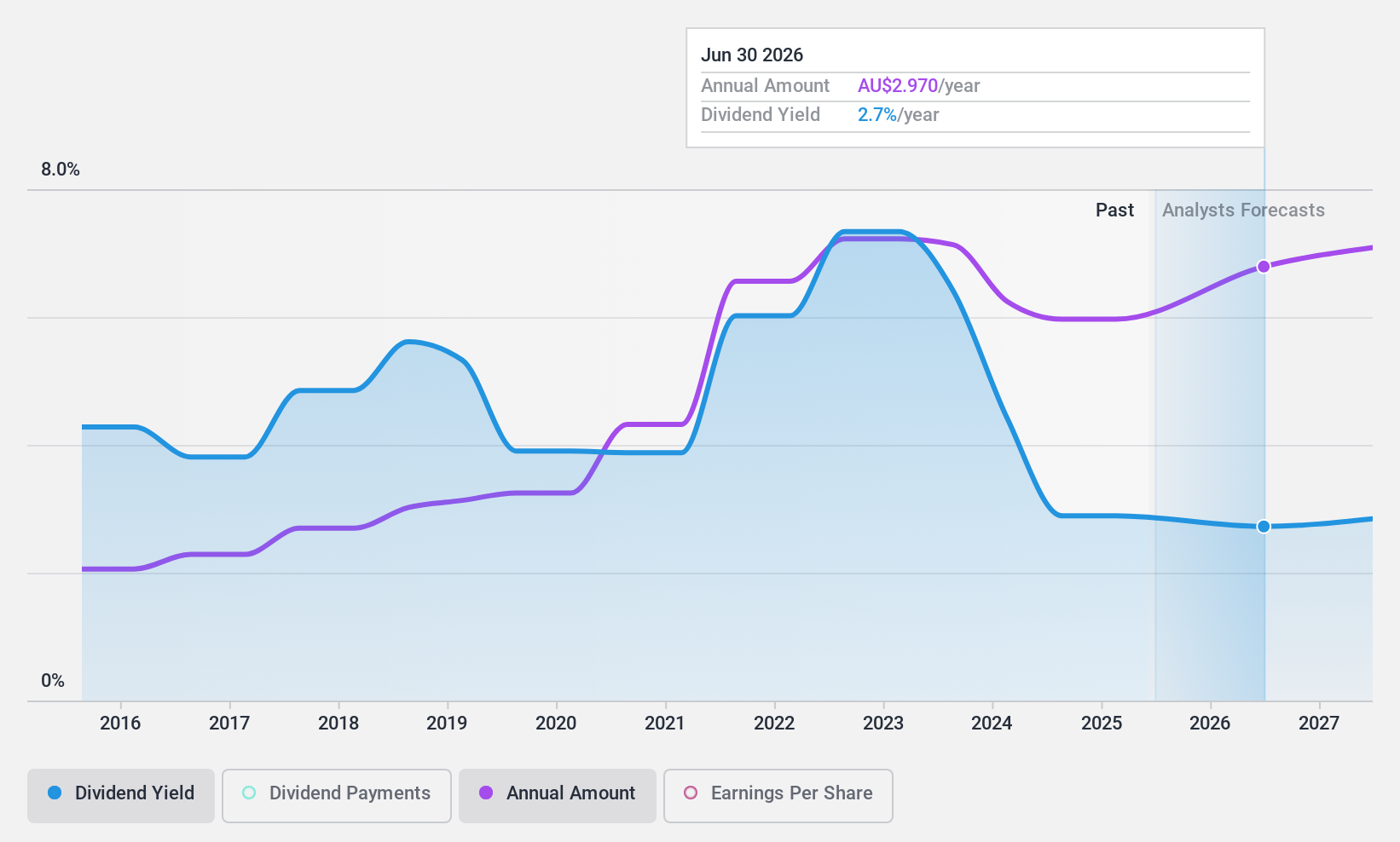

Dividend Yield: 4.2%

JB Hi-Fi's dividend yield of 4.23% sits below the top quartile in Australia, yet its dividends are reasonably secure with a 65% payout ratio and better coverage by cash flows at 46.7%. Despite this, dividends have shown volatility over the past decade and earnings are expected to drop by an average of 1.9% annually over the next three years. Recent sales figures indicate slight declines in JB HI-FI Australia and The Good Guys segments, contrasting with growth in JB HI-FI New Zealand.

- Take a closer look at JB Hi-Fi's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that JB Hi-Fi is priced higher than what may be justified by its financials.

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: nib holdings limited operates as a private health insurer, offering services to residents, international students, and visitors in Australia and New Zealand, with a market capitalization of approximately A$3.64 billion.

Operations: nib holdings limited generates revenue through various segments, including Australian Residents Health Insurance at A$2.55 billion, New Zealand Insurance at A$351.90 million, NIB Travel at A$109.10 million, International (Inbound) Health Insurance at A$173.20 million, and Nib Thrive at A$38 million.

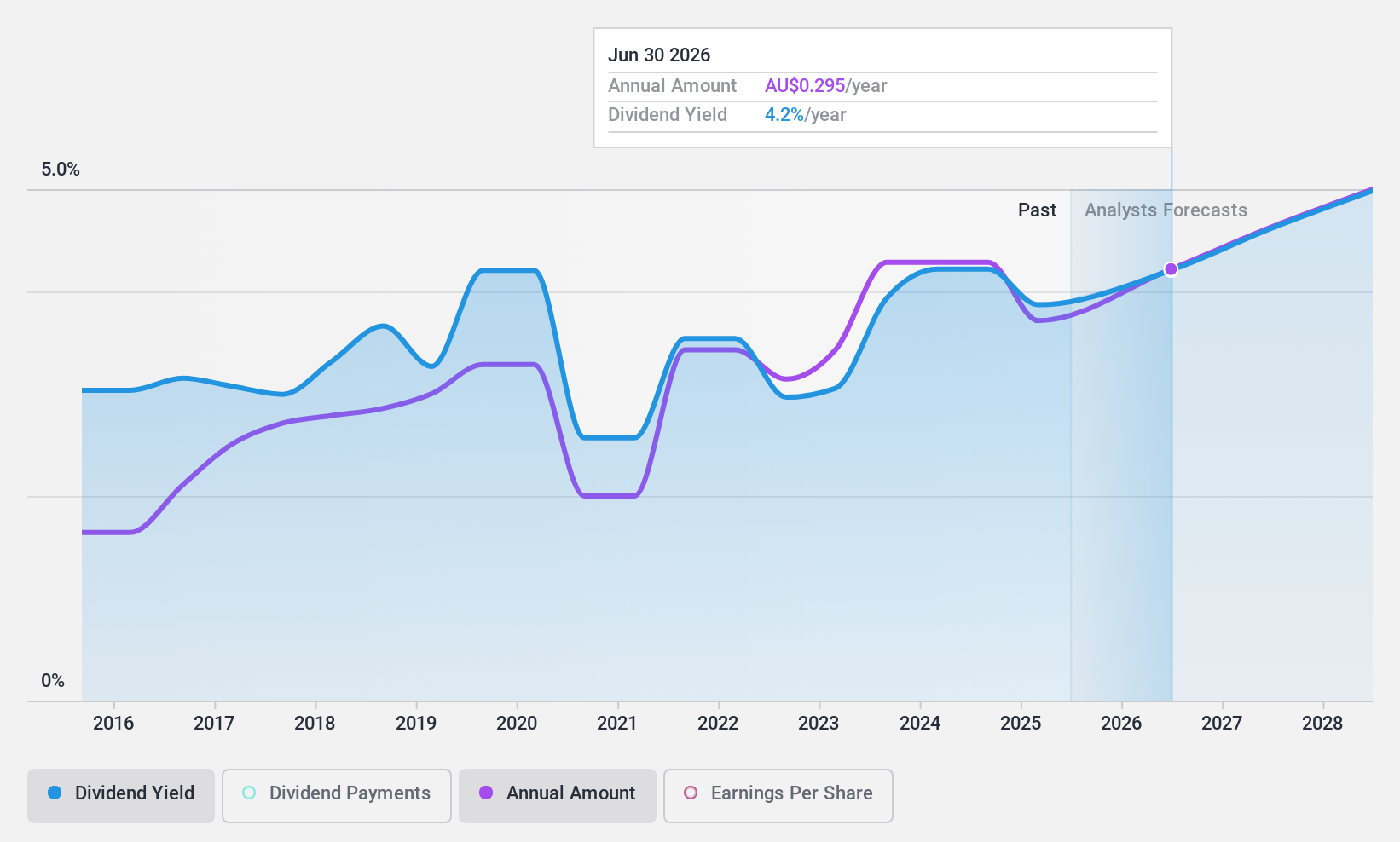

Dividend Yield: 4%

nib holdings' dividend yield of 3.98% is modest compared to Australia's top dividend payers. Despite a history of volatility in dividend payments over the past decade, both earnings and cash flow cover the current dividends with payout ratios at 67.5% and 57.9%, respectively. Earnings have grown by an average of 9.7% annually over the last five years, with a forecasted growth rate of 3.96% per year moving forward, suggesting potential for ongoing but moderate dividend support.

- Click here to discover the nuances of nib holdings with our detailed analytical dividend report.

- According our valuation report, there's an indication that nib holdings' share price might be on the cheaper side.

Summing It All Up

- Discover the full array of 27 Top ASX Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harvey Norman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HVN

Harvey Norman Holdings

Engages in the integrated retail, franchise, property, and digital system businesses.

Undervalued with excellent balance sheet and pays a dividend.