- Australia

- /

- Oil and Gas

- /

- ASX:BRK

Brookside Energy And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 close up 0.34% at 8,285 points, with the IT sector leading gains while Utilities lagged behind. In such a fluctuating market landscape, identifying stocks with strong financials and growth potential becomes crucial for investors. Penny stocks, though often associated with smaller or newer companies, continue to offer intriguing opportunities when they demonstrate financial resilience and strategic positioning.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$65.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.53 | A$334.88M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.90 | A$109.9M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$340.29M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$238.78M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$226.38M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.295 | A$109.71M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.625 | A$823.33M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.99 | A$491.35M | ★★★★☆☆ |

Click here to see the full list of 1,050 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Brookside Energy (ASX:BRK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brookside Energy Limited, along with its subsidiaries, focuses on the exploration, production, and appraisal of oil and gas projects in the United States and has a market cap of A$47.25 million.

Operations: The company generates its revenue primarily from its Oil and Gas & Other US Entities segment, amounting to A$41.63 million, with a minor contribution from the Corporate segment at A$0.03 million.

Market Cap: A$47.25M

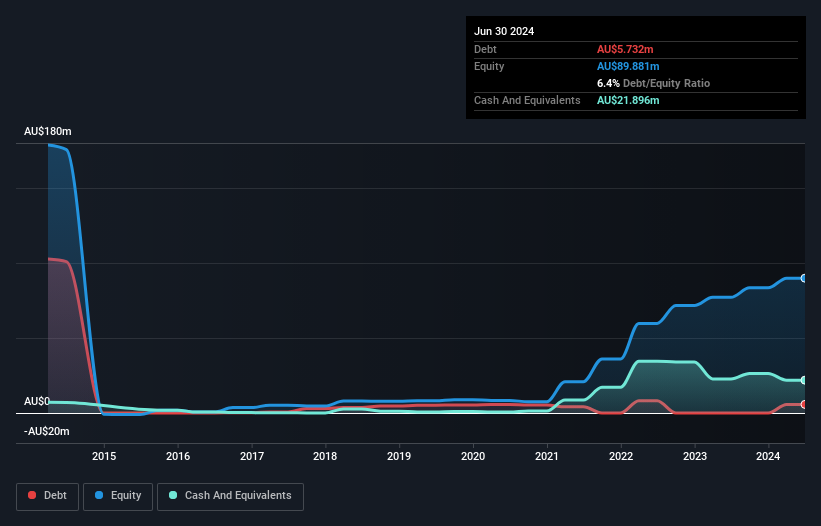

Brookside Energy Limited, with a market cap of A$47.25 million, has shown financial resilience by maintaining more cash than its total debt and covering short and long-term liabilities with short-term assets of A$24.3 million. Despite recent negative earnings growth, the company has achieved profitability over the past five years, growing earnings significantly per year. Its price-to-earnings ratio of 3.2x suggests it is trading at a good value relative to the broader Australian market average of 20x. However, Brookside's management team is relatively new and lacks experience compared to its seasoned board of directors.

- Unlock comprehensive insights into our analysis of Brookside Energy stock in this financial health report.

- Assess Brookside Energy's future earnings estimates with our detailed growth reports.

First Graphene (ASX:FGR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: First Graphene Limited is involved in the research, development, mining, exploration, manufacture, and sale of graphene products in Australia and the United Kingdom with a market cap of A$21.44 million.

Operations: The company's revenue is derived from two main segments: Graphene Production, which accounts for A$0.30 million, and Research & Development, contributing A$0.19 million.

Market Cap: A$21.44M

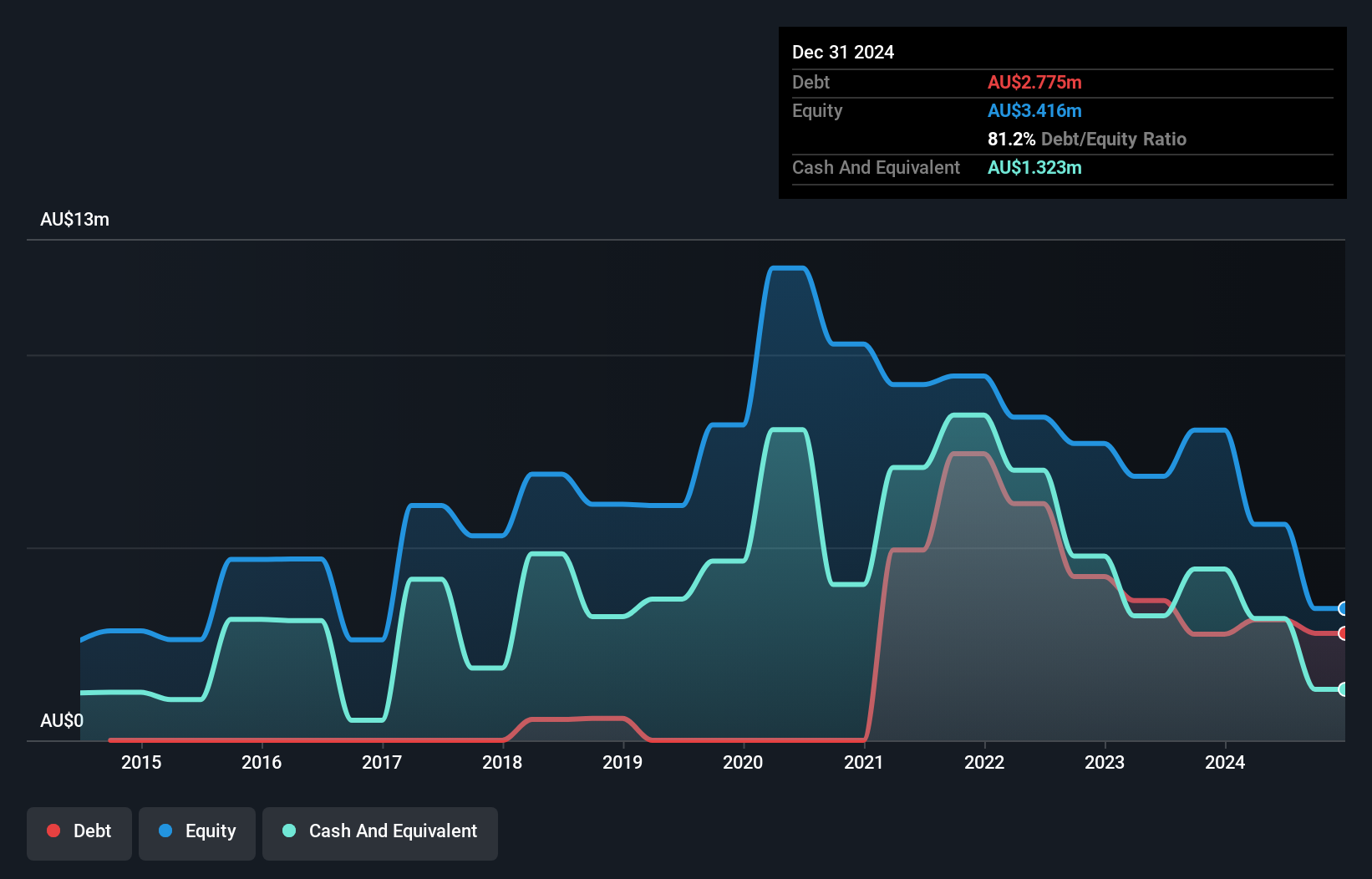

First Graphene Limited, with a market cap of A$21.44 million, is pre-revenue with total revenue under US$1m. The company has reduced its losses over the past five years by 3.4% annually despite remaining unprofitable and having a negative return on equity of -114.53%. Its debt to equity ratio has increased significantly over five years but it maintains more cash than total debt, providing some financial stability. Short-term assets of A$4.2 million cover both short-term and long-term liabilities comfortably. Shareholders have not faced meaningful dilution recently, though the company faces challenges with limited cash runway if growth continues at historical rates.

- Navigate through the intricacies of First Graphene with our comprehensive balance sheet health report here.

- Assess First Graphene's previous results with our detailed historical performance reports.

Peregrine Gold (ASX:PGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Peregrine Gold Limited is involved in mineral exploration in Australia and has a market capitalization of A$11.20 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: A$11.2M

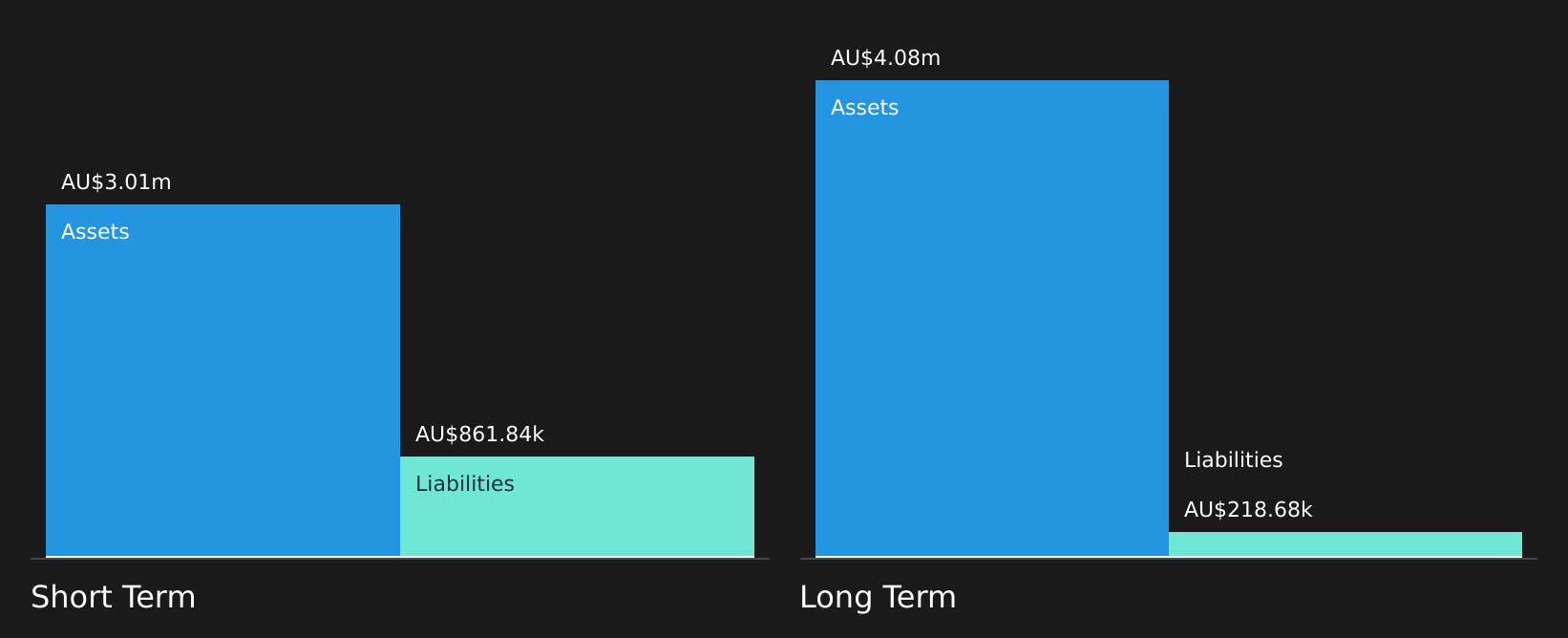

Peregrine Gold Limited, with a market cap of A$11.20 million, is pre-revenue and debt-free. Despite its unprofitability and negative return on equity (-65.5%), the company maintains financial stability with short-term assets (A$2.0M) exceeding both short-term (A$576.9K) and long-term liabilities (A$20.9K). The management team has an average tenure of 2.8 years, indicating experience in leadership roles, while the board averages 3.1 years in service. Recent developments include a follow-on equity offering raising A$2.55 million to potentially extend its cash runway beyond six months amidst high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Peregrine Gold.

- Learn about Peregrine Gold's historical performance here.

Turning Ideas Into Actions

- Take a closer look at our ASX Penny Stocks list of 1,050 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookside Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BRK

Brookside Energy

Engages in the exploration, production, and appraisal of oil and gas projects in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives