- Australia

- /

- Specialty Stores

- /

- ASX:CTT

Cettire (ASX:CTT): Assessing Valuation After Earnings Reveal Swing to Net Loss

Reviewed by Simply Wall St

Cettire (ASX:CTT) just released its latest earnings, and the results are sparking debate among investors. After posting a profit last year, the company reported a modest net loss this time, even as sales remained steady. These numbers are already raising questions about Cettire’s next steps, particularly for those considering its turnaround potential compared to emerging risks.

This change in financial results coincides with a recent board shift, as Daniel Agostinelli stepped down as an Independent Non-Executive Director. Taking a broader perspective, Cettire’s share price has declined by more than 72% over the past year. Short-term momentum, however, tells a different story, with the stock rebounding 43% in the past month and 34% over the past three months, indicating renewed interest following a challenging period.

After such rapid moves in both directions, the question is whether Cettire is now trading at an attractive valuation with more growth ahead, or if investors are right to remain cautious about how the future is being priced in.

Most Popular Narrative: 37.7% Undervalued

The prevailing narrative suggests Cettire is trading well below its calculated fair value, driven by upbeat expectations for future growth and profitability improvements.

Ongoing investment in proprietary technology and platform capabilities (even as OpEx is optimized elsewhere) fosters enhanced user experience and operational efficiency. This enables improved conversion rates and scalable growth at higher operating leverage, potentially boosting net margins over time.

Is Cettire’s steep discount a once-in-a-cycle value play, or is there more beneath the surface? The most popular narrative hints at a bold roadmap anchored by robust projections. Curious about which critical financial levers this valuation is built on but not revealed here? Unlock the precise earnings, revenue, and margin targets backing this aggressive price view inside the full assessment.

Result: Fair Value of $0.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing luxury demand uncertainty and heavy reliance on global supply chains could quickly undermine the bullish case for Cettire’s sustained recovery.

Find out about the key risks to this Cettire narrative.Another View: What Does the SWS DCF Model Say?

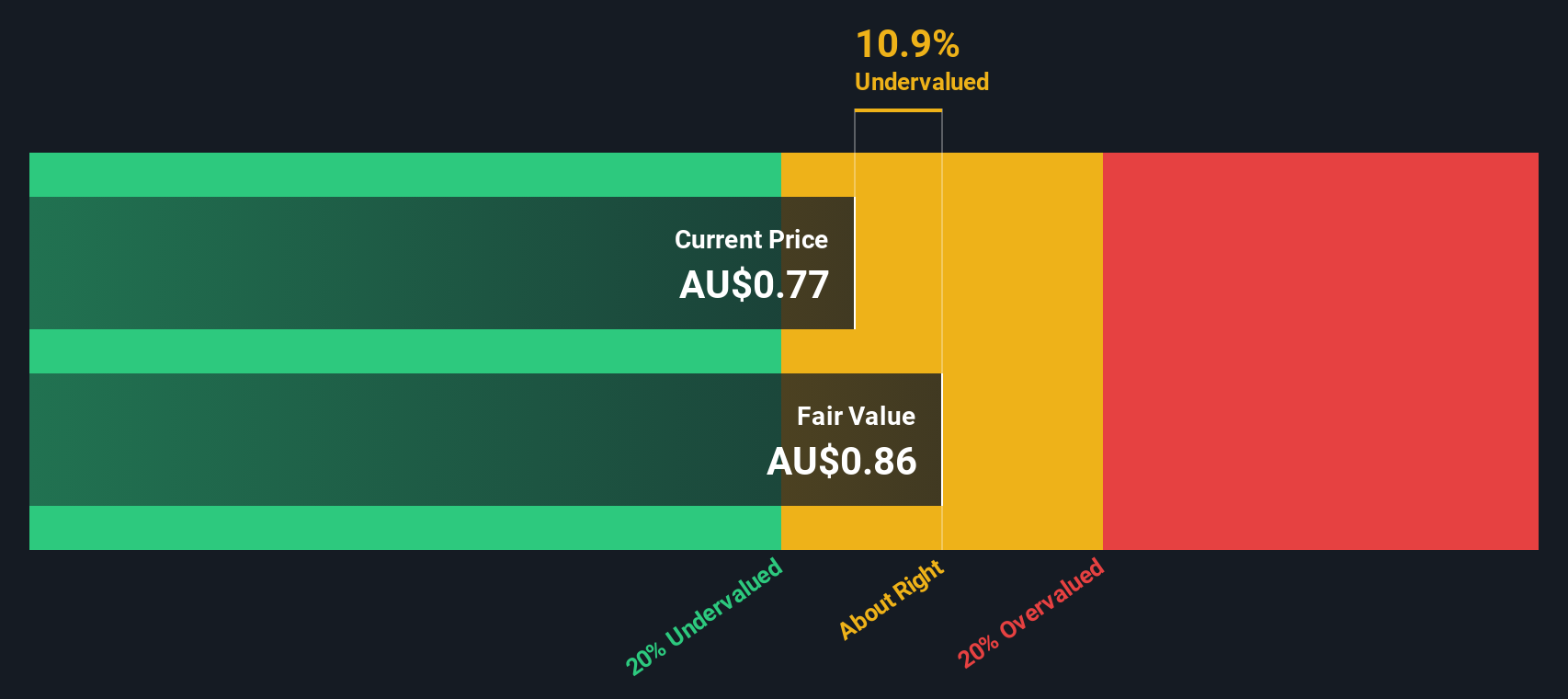

Looking through a different lens, the SWS DCF model also points to Cettire being undervalued based on its projected cash flows. Does this second method add more conviction, or does it raise new questions?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cettire Narrative

If you have a different perspective or prefer to dig into the numbers and craft your own outlook, you can build a fresh scenario in just minutes. Do it your way

A great starting point for your Cettire research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Unlock Even More Smart Investing Opportunities

Every market shift uncovers fresh opportunities. If you want a head start on tomorrow’s winners, don’t wait on the sidelines. Pinpoint hidden gems, emerging trends, and high-yield prospects before they hit the mainstream.

- Boost your potential with companies offering attractive dividend yields and build steady, compounding returns by checking out dividend stocks with yields > 3%.

- Tap into the promise of future innovation by targeting leaders in the quantum revolution. See which pioneers are redefining technology in quantum computing stocks.

- Nab bargains that the market has overlooked and strengthen your portfolio with shares trading below their intrinsic value by leveraging undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTT

Cettire

Engages in the online luxury goods retailing business in Australia, the United States, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives