- Australia

- /

- Diversified Financial

- /

- ASX:OFX

3 ASX Penny Stocks With A$80M Market Cap

Reviewed by Simply Wall St

The ASX remains below the 8,000 points mark as Wall Street's uncertainty impacts sentiment in Australia, with energy leading gains and telecoms lagging behind. Despite these fluctuations, the concept of penny stocks continues to capture investor interest as they offer potential opportunities in smaller or newer companies. While the term "penny stock" may seem outdated, it still signifies a segment where solid financial foundations can lead to significant returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.69 | A$79.72M | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$3.00 | A$1.01B | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.34 | A$158.48M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.58 | A$113.9M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.43 | A$376.38M | ★★★★★☆ |

| CTI Logistics (ASX:CLX) | A$1.725 | A$134.57M | ★★★★☆☆ |

| West African Resources (ASX:WAF) | A$2.24 | A$2.55B | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.265 | A$1.18B | ★★★★★★ |

| NRW Holdings (ASX:NWH) | A$2.81 | A$1.28B | ★★★★★☆ |

| Accent Group (ASX:AX1) | A$1.865 | A$1.06B | ★★★★☆☆ |

Click here to see the full list of 1,011 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Baby Bunting Group (ASX:BBN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Baby Bunting Group Limited, with a market cap of A$254.32 million, operates in the retail sector providing maternity and baby goods across Australia and New Zealand.

Operations: The company's revenue is primarily generated from its Retail - Specialty segment, amounting to A$496.90 million.

Market Cap: A$254.32M

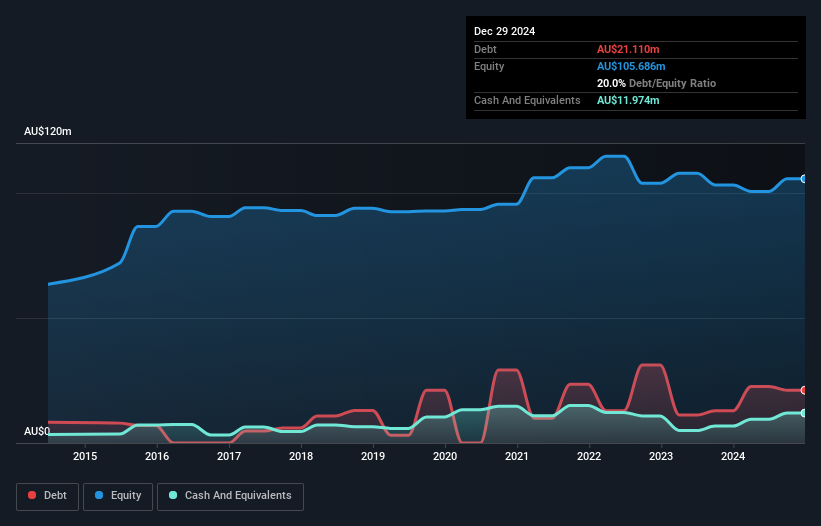

Baby Bunting Group Limited, with a market cap of A$254.32 million, operates in the retail sector and generates revenue primarily from its Retail - Specialty segment. The company has experienced management and board members, with average tenures of 10.1 and 4.9 years respectively. Despite stable weekly volatility at 6% over the past year, Baby Bunting faces challenges such as low return on equity (5.9%) and declining profit margins (1.2% from 2.4%). Recent earnings guidance suggests modest comparable store sales growth between 0% to 3%. The company plans to expand by refurbishing stores and opening new locations while suspending interim dividends to fund these initiatives.

- Click here to discover the nuances of Baby Bunting Group with our detailed analytical financial health report.

- Gain insights into Baby Bunting Group's outlook and expected performance with our report on the company's earnings estimates.

Mindax (ASX:MDX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mindax Limited is an Australian company focused on the exploration and development of mineral properties, with a market cap of A$88.10 million.

Operations: The company generates revenue from its iron ore segment, amounting to A$0.002994 million.

Market Cap: A$88.1M

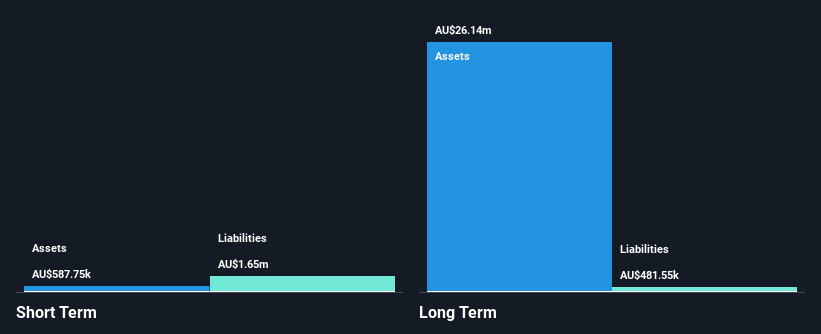

Mindax Limited, with a market cap of A$88.10 million, is pre-revenue and currently unprofitable, generating minimal income from its iron ore segment (A$3K). The company has no debt but faces liquidity challenges as its short-term assets (A$587.7K) do not cover short-term liabilities (A$1.6M). Mindax's recent follow-on equity offering raised A$0.3 million, providing some financial relief. Despite an experienced board with an average tenure of 4.9 years, the company's cash runway remains limited to three months based on free cash flow estimates unless additional capital is secured or expenditures are reduced further.

- Click here and access our complete financial health analysis report to understand the dynamics of Mindax.

- Gain insights into Mindax's historical outcomes by reviewing our past performance report.

OFX Group (ASX:OFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OFX Group Limited offers international payments and foreign exchange services across the Asia Pacific, North America, Europe, the Middle East, and Africa with a market cap of A$304.40 million.

Operations: The company's revenue is derived from its operations in the Asia Pacific (A$91.22 million), North America (A$88.75 million), and Europe (A$36.80 million).

Market Cap: A$304.4M

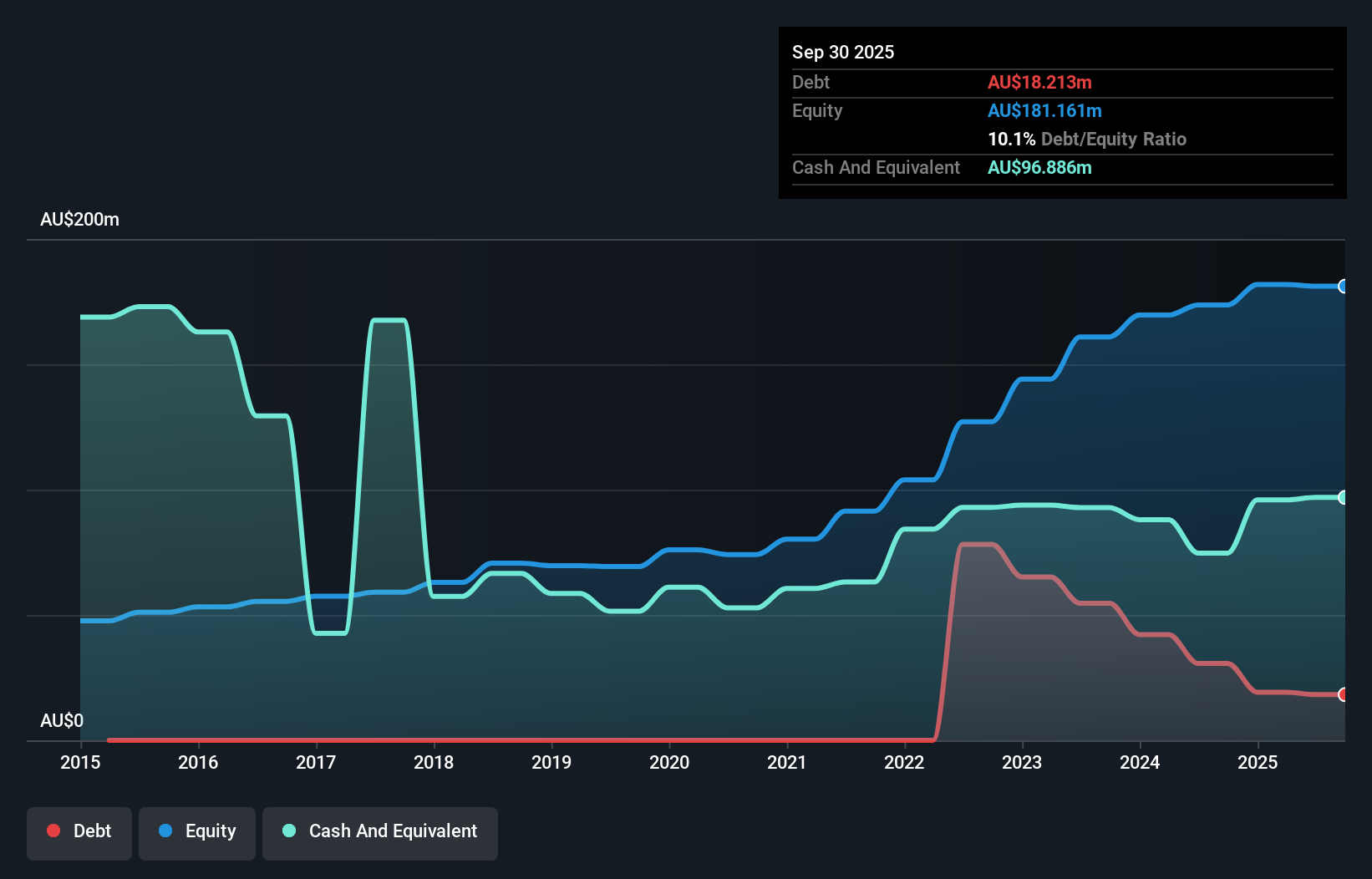

OFX Group, with a market cap of A$304.40 million, operates in international payments and foreign exchange across multiple regions. Despite trading 62.7% below its estimated fair value, the company has faced challenges with negative earnings growth over the past year and a low Return on Equity at 15.1%. However, its debt is well-covered by operating cash flow (148.1%), and short-term assets exceed both short- and long-term liabilities significantly. Although recent profit margins have declined from 13.5% to 11%, OFX's management team is experienced, contributing to stable weekly volatility at 5%.

- Click to explore a detailed breakdown of our findings in OFX Group's financial health report.

- Review our growth performance report to gain insights into OFX Group's future.

Where To Now?

- Navigate through the entire inventory of 1,011 ASX Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OFX

OFX Group

Provides international payments and foreign exchange services in the Asia Pacific, North America, Europe, the Middle East, and Africa.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026